Motif Investing Review Enjoy Free EFT Motifs

Post on: 30 Июнь, 2015 No Comment

I decided to update my Motif Investing review as I have been on the platform for a few months. I still like the idea of the company and think you should try it out. I dont not have all of my money invested in my account as I use it to create additional income streams, not save for retirement.

Motif Investing is my current favorite investing platform. I learned about this new approach from some other investing bloggers. As I have been on a massive investing kick lately, I knew I had to give it a try. Motif Investing is a new kid on the block, but they offer features which many other online brokerages do not. I will explain what I mean soon as I go through my Motif Investing review for those looking for another alternative for their investing money.

Who is Motif Investing?

Motif Investing was created by two friends who wanted to allow everyday investors to follow their ideas. Instead of just following specific stocks, they allow you to create stock portfolios around ideas, whether they be economic, political, or any other theme. They did this on top of offering low cost trading options for their customers. Motif Investing is entirely unique and I have had a great time funding and learning more about the service. I decided to do this Motif Investing review to show you how you can setup an account and start trading with their easy to use platform.

Motif is trying to do for thematic investing what discount brokerage companies did for stock-buying by making it available on a larger scale and for lower fees.

Paul Sullivan, New York Times

How Motif Investing Works

Their service is built entirely on what they call Motifs. They are essentially buckets of up to 30 stocks or ETFs. Motif has created quite a few pre-made Motifs to allow beginner investors to pick a theme. As of this writing, there are 150 professionally created Motifs.You can pick high performing dividends if you want to earn passive income. If you love the rental market, then you can pick the renter nation motif. Whatever idea or theme you want to pursue, you can find it on Motif Investing. They provide a lot of good data around their Motifs, so you can learn more about the stocks which make them up. I have been impressed on what I could learn just by looking through each Motif.

Low Trade Fees When you see that Motif charges $9.95 per trade, you might turn your face to it. It is a little high compared to the likes of Scottrade or others. What that fee doesnt tell you is you are paying $9.95 to purchase a Motif. This bucket of 30 equities only costs you one fee. It is not $9.95 per stock trade like the other sites, it is like getting 30 stocks for the price of one. This makes Motif Investing highly competitive with their pricing. If you want to trade a stock in your motif, then you can do so for $4.95.

Diversity Diversity is key in investing and Motif allows you to create diversity in your porfolio. You can buy multiple motifs in different areas, themes, or ideas. Since you shouldnt stick all of your money in one industry, it is recommended to go with a few different Motifs to create diversity.

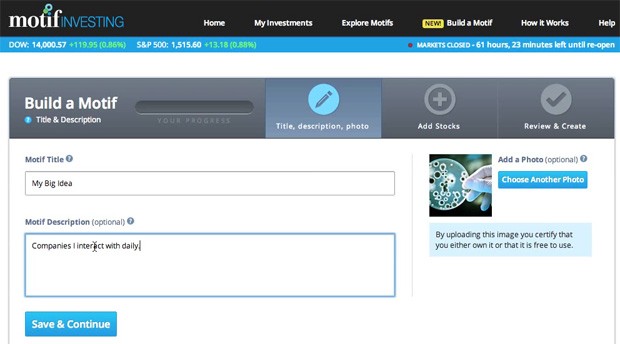

Motif Customization Motif Investing allows you to purchase their pre-made Motifs without any changes. This can get you started quickly and easily. One of the great features is you dont have to stick with the stocks in that Motif. If you dont like a particular stock, you can remove it from the Motif and add another one. This doesnt cost you any extra besides the original purchase fee. If you dont have anything you like, then you can create your own Motif. You can fill it with up to 30 equities and build it around what you are comfortable with.

Motif Investing is Social I thought this was really cool. When Motif customers create their own Motifs, they can allow others to add those buckets to their portfolio. If you like what another customer has created, then you can buy that Motif. You can read customer comments on said Motifs and get feedback on whether others feel about the Motif. They can be either Bullish or Bearish. Currently, Motif customers have created over 55,000 motifs based on certain themes.

Offering No Fee Motifs Motif Investing created what they call New Horizon Motifs which comprise of low-cost ETFs. The best part is there is no charge for these motifs and they are based on specific asset classes and are still customizable. Motif offers 9 benchmark horizon motifs which have no commissions and no monthly fees. These benchmarks are based on your risk tolerance.

Motif Investing Pros

I am really happy that I setup a Motif Investing account. I wanted to add another investing element to my new found focus. Motif Investing has allowed me to do this with every little cost. Here are some of the pros of Motif Investing and hopefully you find them good as well.

- Theme/Idea Focused What I really like is how their Motifs are focused on specific themes or ideas. You can get a great group of stocks with one low cost all revolving around a theme you want to deal with. My current focus is on dividends and they have a few good dividend Motifs. They best part is the community has either created some better ones or enhanced the ones Motif pre-made. This gives me many options to grab some awesome stocks. As the world changes, so do Motif. They constantly come out with new Motifs based on evolving themes. They just created a Motif with companies who fight infectious diseases.

- Simple Fees I like simple fees. We have all heard how easy it is for fees to cut into your profits. While Motif charges $9.95 per Motif trade, you are dealing with up to 30 stocks at a time. If you want to remove or add a stock, then it is only $4.95. I have not found any other fees, so they dont appear to be hiding them.

- You Can Buy Fractional Shares While this might not be pro for some, it is cool with me. When you put money into a Motif, you are essentially purchasing fractional shares. This means you dont have to put enough money in to get full shares. While you wont get the full return with fractional shares, it enables you to get started with less money. Motif Investing allows you to get started with as little as $250 .

- Active Community The social aspect of Motif Investing keeps me interested and engaged. You can interact with other community members and they can provide their feedback on your Motifs. The great part is you can purchase motifs created by other members and that is something not offered in other places.

- Great Customer Service I had a little issue with my account in the beginning, but they were super responsive. I even had a personal call after I signed up thanking me for becoming a member and wanted to answer any questions I had. That was a nice surprise and welcomed.

Motif Investing Cons

Though I am a Motif Investing fanboy, there are some cons with the service. You do have to be careful with the amount of trading you do as the cost can add up. That is the nature of investing I guess. Here are some cons of Motif Investing.

- No DRIP Motif Investing does not offers a dividend reinvestment plan. This was a big one for me as I really wanted a DRIP, but they just dont have one. When you receive a dividend payment from a stock, it just goes into your account as cash. The money is not reinvested back into the stock, so these are taxable events unless you have one of their tax-deferred accounts, such as an IRA.

- Tax Ramifications Investing can be hard on your taxes. What I love about ETFs, especially with my Betterment account is my tax paperwork is small. When I buy more, then it is only dealing with one transaction. This is not the case with Motif Investing. When you sell a Motif or rebalance it, all of the stocks in there are counted as multiples. You will have mounds of paperwork for tax time if you like to buy and sell or rebalance all of the time.

- Fees can add up The straight forward pricing was a pro for me, but it is also a con. When you add or remove a stock from a motif, it will cost $4.95. When you rebalance a Motif, it will cost you $9.95. If you are very active and like to tweak your motifs on a constant basis or rebalance more than you should, the fees will add up over time.

Why Motif Investing is My New Favorite Tool

I already have a Betterment account and a Scottrade account. These are for specific needs, but I wanted to try something different. I am really glad I found Motif Investing. I think their platform is super easy to use and you can find information about all of their services quick an easy. Motifs bucket strategy is one I really enjoy. I have heard a few people say you cant diversify that way, but I disagree. You can easily customize a Motif before you buy it or create your own. This really puts the power in your hands and enables you to diversify to your hearts content.

I hope to be a Motif investor for some time have been with them for a few months and think their service will continue to grow as people learn about the benefits. I also hope my Motif Investing review helped you learn more about them and give you an idea about what they focus on and how they work. I have really enjoyed the ease of use of the system and the social aspect to learn about different motifs.