Moody s Power transmission REITs may be on the horizon

Post on: 8 Февраль, 2016 No Comment

New York, October 30, 2014 — Large US power transmission utilities are actively exploring the feasibility of using the real estate investment trust structure as a financing vehicle, says Moody’s Investors Service. It is plausible that utility REITs might emerge as early as late next year.

Many US utilities are taking a look at their transmission assets to assess whether utilizing a REIT structure makes sense, given the abundance of these types of assets that produce steady cash flows, says Moody’s Associate Managing Director Jim Hempstead in the report US Utility Transmission Assets: Power Transmission REITs Poised to be Sector’s Next Phase of Financial Engeneering.

Utilities have been pursuing financial engineering structures such as Yieldcos and Master Limited Partnerships because yield-hungry investors assign premium valuations to vehicles with steady dividend growth trajectories, says Moody’s.

Potential REIT candidates in the utility sector include Texas-based transmission and distribution utilities and large transmission-only companies. At the top of the list, says Moody’s, is Dallas-based Oncor Electric Delivery Company LLC (Baa1 positive), whose parent will soon be auctioned to the highest bidder in a bankruptcy court administered sales proceeding.

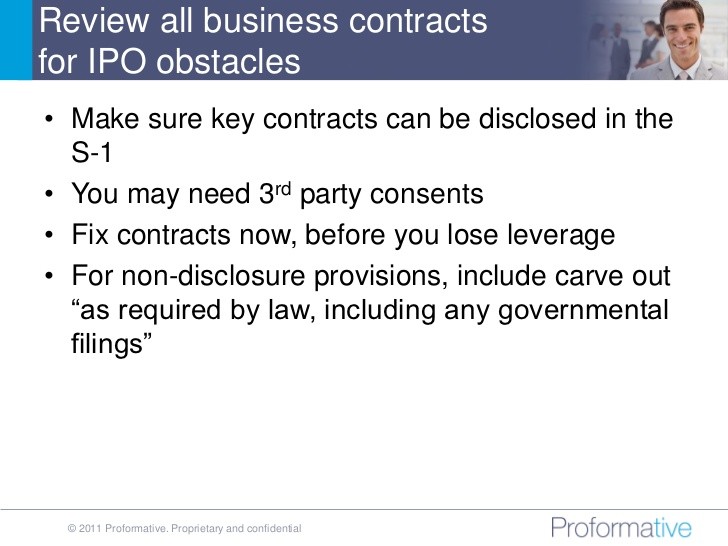

By itself, a REIT structure should not weaken a utility’s credit profile, says Moody’s. The structure would involve three principal credit considerations: the impact on the state and local regulatory relationship, the impact on discretionary cash flow and the complexity of the capital structure.

The credit quality of any potential utility REIT would probably be closely linked to that of the existing utility sponsor, says Moody’s.

In 2014, the US Internal Revenue Service clarified existing rules that define what constitutes real estate. As a result, the REIT sector has grown as companies look to spin off their assets into new companies that are effectively exempted from corporate taxes as long as they operate within REIT guidelines.

These clarifications have helped open the REIT structure to non-traditional sectors, such as fiber optic and copper networks for telecommunications companies, or electric transmission for utility companies.

www.moodys.com/viewresearchdoc.aspx?docid=PBC_176168.

***

NOTE TO JOURNALISTS ONLY: For more information, please call one of our global press information hotlines: New York +1-212-553-0376, London +44-20-7772-5456, Tokyo +813-5408-4110, Hong Kong +852-3758-1350, Sydney +61-2-9270-8141, Mexico City 001-888-779-5833, So Paulo 0800-891-2518, or Buenos Aires 0800-666-3506. You can also email us at mediarelations@moodys.com or visit our web site at www.moodys.com.

This publication does not announce a credit rating action. For any credit ratings referenced in this publication, please see the ratings tab on the issuer/entity page on www.moodys.com for the most updated credit rating action information and rating history.

James Hempstead

Associate Managing Director