Money Market Accounts Definition Pros and Cons

Post on: 3 Октябрь, 2015 No Comment

Courtney Keating / E+ / Getty Images

A money market account is an account that offers two attractive features: interest on your deposits, and easy access to your money.

Money market accounts combine the best features of checking accounts and savings accounts, but there are pros and cons to every type of account. Let’s review what you get (and what you have to give up) when you use these accounts.

Earnings and Access

Money market accounts, like savings accounts, pay interest. They’re a safe place to store cash because they’re FDIC insured (or, if you use a credit union, NCUSIF insured ). Interest rates are often better than you’ll get from a traditional savings account – especially with larger account balances – so they’re usually somewhere between a CD and a savings account when it comes to earning potential.

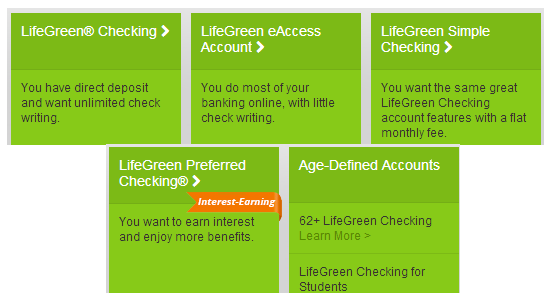

Like checking accounts, money market accounts make it easy to spend your money. Most accounts allow you to write checks or withdraw cash, and some offer a debit card that can be used to make purchases. This easy access, combined with a competitive interest rate, is what traditionally made money market accounts unique. In recent years, reward checking, interest checking accounts. and online banks have become more popular and offer the same benefits, but sometimes you’ll get a better deal from a money market account.

The Fine Print

Money market accounts are great, but there are a few things you should be aware of before opening an account.

Minimum balances: money market accounts usually require a relatively large minimum balance. You can generally open a savings account (especially an online savings account) with a small deposit, but money market accounts might only be available if you’ve got several thousand dollars or more. If your account balance falls below the minimum, expect to pay fees (which of course eat into your return).

Transaction limits: you have access to cash in a money market account, but there are limits. You won’t be able to make payments with your checkbook or debit card more than six times per month (by law), and some banks only allow three payments per month. You can withdraw cash as often as you like, but these accounts aren’t as flexible as your checking account when it comes to everyday use.

The right choice? Money market accounts are a great tool. But they might not be the right tool for your needs. Could you earn more by using CDs? If you use a CD ladder you can earn decent returns while keeping some of your money liquid (and more of it will become liquid soon) and minimizing early withdrawal penalties. If you’re investing for the long-term, talk with a financial planner about what mix of investments can best help you reach your goals.

Is it safe? If you want safety, make sure you use a money market account from a bank or credit union. Money market funds have their place, but they are not the same thing.

What they’re Best For

Money market accounts are great for money that you will (or might ) need in the relatively near future. They allow you to earn a small return while keeping the funds safe and accessible. They’re especially useful for large, infrequent expenses such as:

- Emergency funds

- Budgeting for quarterly tax payments

- Tuition

Again, this isn’t the best place to keep funds for regular expenses because there are limits on how many payments you can make. That said, you could keep funds for a few of your largest monthly expenses (such as your mortgage) in a money market account to earn a bit more interest.