Mobile Home Investing 2014 Safe Act and Dodd Frank Act

Post on: 1 Апрель, 2015 No Comment

Welcome back,

Thanks for visiting. In this discussion we are going to briefly outline the Safe Act and Dodd Frank Act, and discuss how you may choose to safely move forward with your mobile home investing business in easy to understand language. Please read this post in full and all subsequent disclaimers.

In short: The sky is not falling, but you do need to protect yourself.

The reasons for this article are to inform, pose questions, and bring clarity to your mobile home investing business with regards to the new and pre-existing rules concerning reselling mobile homes to end-user buyers with seller held financing.

Seller Held Financing:

A real estate agreement where financing provided by the seller is included in the purchase price. It is also known as a purchase-money mortgage. Seller financing is a mortgage given to the seller as part of the buyers consideration for the purchase of the property and is delivered at the same time that the property is transferred as a simultaneous part of the transaction.

The advice given below is not to be considered legal advice. This article has been compiled from discussions with multiple States Banking Relating Organizations, Manufactured Home Departments nationwide, conducting simple online searches, discussions with real estate attorneys and others that know much more than I do about these new laws. Please preform your own diligence before proceeding forward.

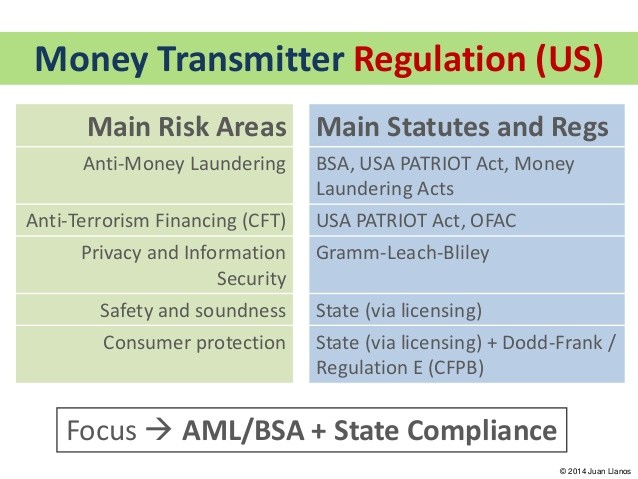

Let us first have a basic understanding of these new Acts as they apply to your mobile home investing business. I say as they apply to your mobile home investing business because these Acts encompass many changes including; seller financing, conventional financing, lending, banking regulations, reporting, home ownership, screening buyers, derivatives, commodities, automobile financing, and much more.

- Seller financing restrictions do not apply to commercial real estate sales.

- Seller financing restrictions do not apply to investment property that is sold to another investor not living in the home.

- Seller financing restrictions do not apply to properties with more than 4 units, such as multifamily properties.

- Concerning the Safe Act: Most states have set a diminimus provision that will allow for up to 3 owner financed sales per 12 month period that may be preformed by you without a loan originator. There is strict criteria that the home and buyer must meet for the financing to be legal. If you are not an investor and selling your own mobile home proceed as instructed here .

- Concerning the Dodd Frank Act: Most states have set a diminimus provision that will allow for up to 5 self-underwritten owner financed sales per 12 month period. These loans must follow the 8 criteria found here (see pages 14-15).

- Using an approved loan originator is a strategy that is legal to negotiate, underwrite, and create your notes and secured mortgages. This may cost between $99-$2,000 or more per sale.

- Fines if caught selling homes illegally with secured Notes and Mortgages/Deeds of Trust will be a full refund of the past 3 years of payments received from this tenant-buyer.

- These new laws took affect January 10th, 2014. Notes created prior to this date do not apply.

- All Notes and Mortgages/Deeds of Trusts that hold the subject property as the collateral of the debt fall under the scope of the Safe Act and Dodd Frank.

- Personal remark: Attorneys will be looking to work with and help all unhappy owner-financed owners. Please protect yourself and only sell homes through legal methods.

Please realize that these Acts are written on thousands of sheets of paper.The below words only skim the very surface of these rulings. For a complete understanding I encourage you to read the Acts yourself.

The Safe Act:

An Act intended to provide uniform licensing standards nationwide, as these licensing standards had been non-uniform from state to state for the past 20+ years. It was also designed to create a comprehensive licensing database so that all relevant information on Mortgage Loan Originators (MLO) will be centralized and publicly available.

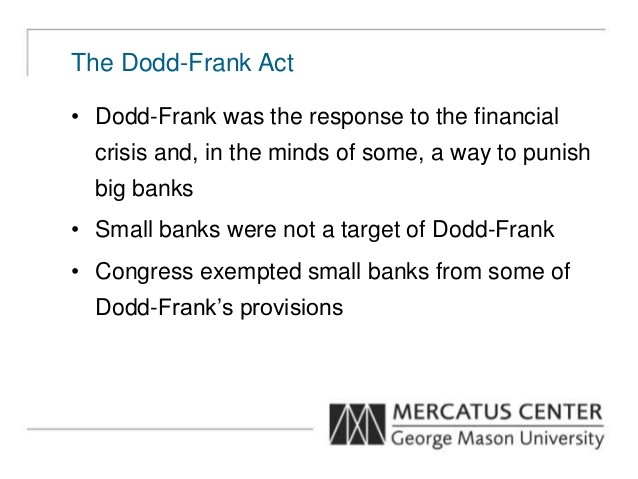

The Dodd Frank Act:

An Act to promote the financial stability of the United States by improving accountability and transparency in the financial system, to end too big to fail, to protect the American taxpayer by ending bailouts, to protect consumers from abusive financial services practices, and for other purposes.

Now that we have an extremely brief understanding of the general reasoning for the Acts and what purposes they were created we can begin to discuss what these acts mean for us as successful mobile home investors, what these laws prohibit, and how to proceed.

Let us first discuss you buying an investment mobile home with monthly payments from your seller:

This is perfectly legal and is not affected by the acts as you will not be living in the investment home yourself. Proceed as usual.

Let us next discuss you selling your investment mobile home to an end-user via monthly payments inside of a mobile home park:

Selling a mobile home inside a park through monthly payments to an end-user that will be living in the mobile home is acceptable with very-very specific conditions, these conditions require you do not fall within the scope of the Acts. When it comes to selling a mobile home inside a park with payments it is going to be vitally important to not have the subject mobile home as collateral for the loan. The Acts pertain to secured notes only, for now. Not creating a mortgage or deed of trust to secure the home with the financing will leave you with an Unsecured Note. By not having collateral and therefore no recourse to foreclose it may seem as the investor is taking near 100% of the risk. For this reason it is very important we use Personal Property Trusts. Land Trusts, and specific additional supporting agreements.

Is it possible to use a Mortgage Loan Originator when reselling your mobile homes in a community? A licensed and Safe Act approved Residential Mortgage Loan Originator (RMLO) can negotiate, approve, underwrite, and help create your secured Notes, Mortgages, and/or Deeds of Trusts to secured your interest. The cost associated with this depends on your area and each specific RMLO. Costs I have seen range from $99 to $2,000+ depending on the services offered. After the 3 owner financed sales per 12 months sold to end-users with secured notes you should only proceed if you are licensed. If you are unlicensed and proceed with more the 3 transactions this may result in fines if caught, this is relatively new and untested.

Is it possible to have your seller create a note/mortgage to your buyer and then you purchase the note/mortgage for the sales price of the home? Does this make sense? If not see the example below. This technique is not advised by me or this website. While this would seemingly not violate the Acts as the homeowner is the one originating the note/mortgage this method is impracticable in real life. If this was the case the seller would often undercut you and sell directly to the tenant-buyer, also the tenant-buyer would now know your purchase price. In addition we often times find our buyers days or weeks after the original sale of the home. This impracticable method would restrict us from purchasing the home with seller held financing. Additionally the end-user buyer will need to meet strict criteria to ensure they have been verified that they can pay back the entire note. If the tenant-buyer can not pay back the loan you may be held liable for holding a risky loan and subject to fines.

Example: The seller and you agree to a purchase price of $5,000 cash for the sellers mobile home in a park. You find a tenant-buyer that is willing to pay $15,000 with $2,000 today and monthly payments of $300.00. The seller then creates a Note and Mortgage for the tenant-buyer and all parties agree. Once the paperwork is signed you purchase the $15,00o Note from the buyer for the agreed upon $3,000.00 cash. In short this method is very impracticable.

Can I just simply Rent or resell my used investment mobile home for all cash or bank financing?

Good thinking. However it depends. Many mobile home parks will not allow subleasing or renting within their walls. In addition many buyers will not have $10,000-$40,000 to purchase your used mobile home all-cash. Many banks have strict requirements for lending on mobile homes inside parks and attached to private land.

Let us next discuss you selling your investment mobile home to an end-user via monthly payments while the mobile home is attached to land you also own (AKA not in a mobile home park):

In this situation an approved residential loan originator should always be used to negotiate, underwrite, and help create these loans and secured mortgages/deeds of trust. It is crucial to have a secured loan because you will always wish to have the conventional ability to foreclose on the tenant-buyer should they not pay your Note. It is my suggestion that you almost always use a Lease Option before you sell your mobile home on land with owner financing to ensure your buyer is a low-risk buyer that pays on-time. After a predetermined time you may now utilize the help of your Residential Loan Originator to negotiate, underwrite, and help create the loan and secured mortgage/deed of trust.

Audio below: May not be available on tablets, listen on your PC.

John Fedro and Bill Walston discussing the Dodd Frank and Safe Acts

Conclusion:

Know the laws of your state. Do your own research and do not fall within the scope of these Acts jurisdiction. In addition make sure you understand how to properly screen your tenant-buyers to verify that they do have the ability to pay your desired home payments.

Mobile Home Investing: 2014 Safe Act and Dodd Frank Act

Do not hesitate to ask any follow up questions. I will be happy to answer what I can.

Love what you do daily,

John Fedro

support@mobilehomeinvesting.net

Online Sources:

Updated Disclaimer: I have received a few emails asking for free forms associated with selling your mobile home safely from a personal property trust like I mention above. In the article above we mainly discuss reselling your investment mobile home as an unlicensed RMLO investor to an end-user buyer who plans on living in your mobile home. While I covered a number of thoughts for selling and buying mobile homes safely with payments I did not discuss all the paperwork I use on a weekly basis to convey ownership and protect my investment homes. These undisclosed forms are legally very important to the transactions. These forms are located in the Mobile Home Formula online training program. Todays article is not a sales pitch for this product. Because members have invested for these documents I will not be making these forms and agreements available for free. I hope this make sense and is fair too all.

Updated Disclaimer: This website and the Mobile Home Formula training website strives to bring you the most relevant and up-to-date information concerning your mobile home investing business. The statement that only Notes with secured debts apply to these rules may not always be true. In reality overtime the Consumer Financial Protection Bureau that is in charge of these acts may change or update these laws to reflect unsecured notes. We here will keep you posted if this happens and suggest alternative legal avenues to sell your investment mobile homes with monthly payments.

This site is dedicated to providing the most up to date information. If you have additional information about these acts or see changes that you feel are inaccurate please comment below. We are all here to learn and grow together.

Related videos: