Is Internal Rate of Return or Net Present Value Better

Post on: 1 Июнь, 2015 No Comment

Is Internal Rate of Return or Net Present Value Better?

You can opt-out at any time.

Financial managers and business owners usually like performance measures expressed in percentages instead of dollars. As a result, they tend to like capital budgeting decisions expressed as a percentage, like internal rate of return (IRR) instead of in a dollar amount, like net present value (NPV). However, there is a problem. Even though internal rate of return is usually a reliable method of determining whether or not a capital investment project is a good investment for a business firm. there are conditions under which it is not reliable but net present value is .

What is Internal Rate of Return

In the language of finance, internal rate of return is the discount rate (or the firm’s cost of capital. that forces the present value of the cash inflows of the project to equal the initial investment which is equivalent to forcing the net present value of the project to equal $0. Pretty confusing. I can also say that internal rate of return is an estimate of the rate of return on the project.

Clearly, internal rate of return is a more difficult metric to calculate than net present value. With an Excel spreadsheet. it is a simple function. In the past, financial managers had to calculate it using trial and error which was a long and complex calculation. Here is an online calculator that you can use to calculate IRR anytime you need it.

First, in English, what is internal rate of return? It is a way of expressing the value of a project in a percentage instead of in a dollar amount. It is usually correct, except there are some exceptions that will make it wrong.

Decision Rules for Internal Rate of Return

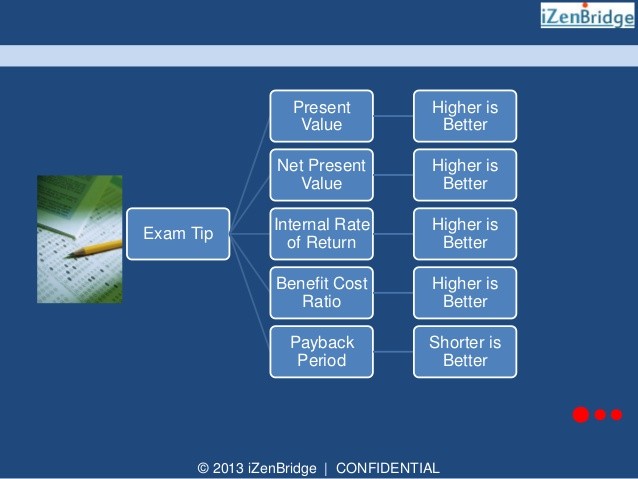

If the IRR of a project is greater than or equal to the project’s cost of capital, accept the project. However, if the IRR is less than the project’s cost of capital, reject the project. The rationale is that you never want to take on a project for your company that returns less money than you pay than you pay to borrow money (cost of capital ).

Just like for net present value, you have to consider whether you are looking at independent or mutually exclusive project. For independent projects, if the IRR is greater than the cost of capital, then you accept as many projects as your budget allows. For mutually exclusive projects, if the IRR is greater than the cost of capital, you accept the project. If it is less than the cost of capital. then you reject the project.

An Example of Internal Rate of Return and Why Net Present Value is Better

Let’s take a look at an example in this article on net present value. First, take a look at Project S. You can see that, when you calculate net present value. and since these are mutually exclusive projects, Project S loses. It has a lower net present value than Project L, so the firm would choose Project L over Project S. However, if you use the online calculator and plug the cash flows for the two projects into it, the internal rate of return for Project S is 14.489%.

Now, let’s look at Project L. Project L is the project you would choose under the net present value criteria as its net present value is $1,004.03 as compared to Project S’s net present value of $788.20. Again, if you use the online calculator and plus Project L’s cash flows into it, you will get an IRR for Project L of 13.549%. Under the IRR decision criteria, Project L has a lower IRR and the firm would choose Project S.

Why do the decision criteria of internal rate of return and net present value give different answers in a capital budgeting analysis? Here lies one of the problems with internal rate of return in capital budgeting. If a firm is analyzing mutually exclusive projects, IRR and NPV may give conflicting decisions. This will also happen if any of the cash flows from a project are negative except the initial investment .

Summary

Everything points to the net present value decision method being superior to the internal rate of return decision method. One last issue that business owners have to consider is reinvestment rate assumption. IRR is sometimes wrong because it assumes cash flows from the project are reinvested at the project’s IRR. However, net present value assumes cash flows from the project are reinvested at the firm’s cost of capital which is correct.