Investment Objectives The Investment Policy Statement

Post on: 16 Март, 2015 No Comment

You may have financial goals such as a luxury retirement or a second home. Its your objectives that help you reach those financial goals. Goals are the result, objectives are the path that gets you to your results. Financial goals may be grey areas (i.e. retire comfortably), yet the investment objectives should be as clearly defined as possible.

What Are Your Investment Objectives?

If the first step in this process is describing who you are as an investor, the second step is defining your investment objectives. While your financial goals may be grey, you still need a reasonable starting point in order to reach your end goals.

Most investors define their investment objectives as “I want my money to grow”, or “I want $3,000 per month for the rest of my life” and leave it at that. There’s more too your investment objectives than that.

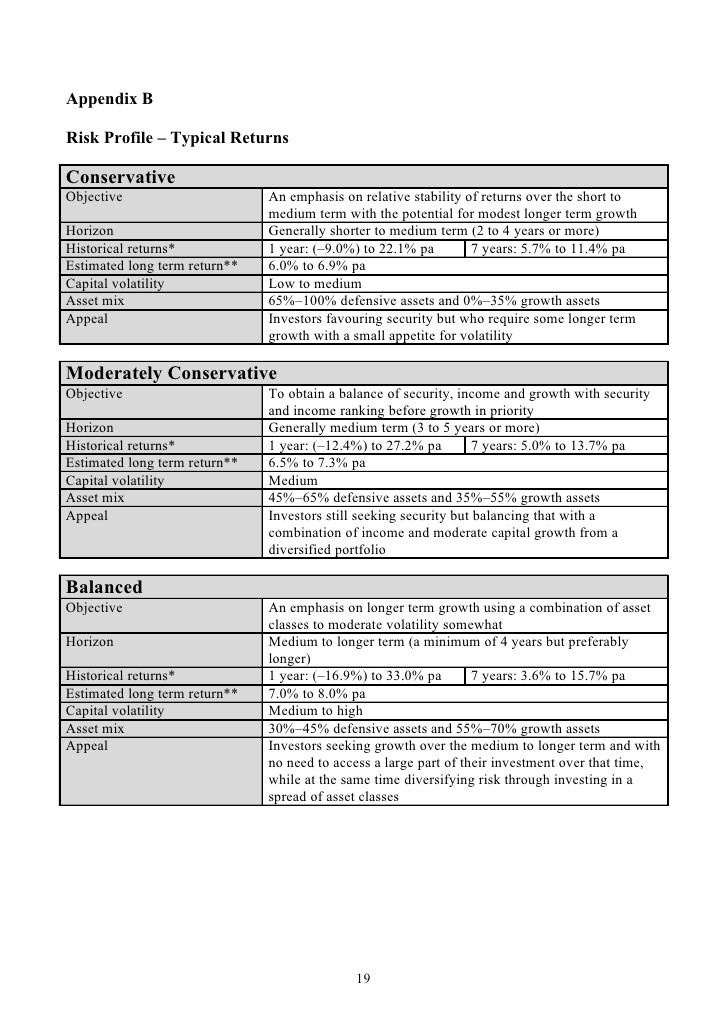

Many investors want principle growth, some investors want investment income, and most investors want a mix of both growth and income. Other investors want XX% investment return over XX years.

Some investors need to average 8% per year to accomplish their goals. Others only need 5% per year. Some still will need 10% or more to accomplish their lofty goals.

A word of caution here. Labeling your investment objectives as “growth” or “XX% return” can create holes in your investment plan. Small holes can lead to big leaks. While your investment objectives may be grey, your investment plan should be as clear cut as possible.

Investing for Growth & Income

In terms of “growth” or “income”, most every investment portfolio is going to have components of both growth and income. It’s hard to avoid in fact. Every diversified investment portfolio will have investments which generate capital gains, investment income from dividends and interest payments and variations of total return.

For the overwhelming majority of investors defining the investment objectives as “growth and income” is satisfactory (whether they realize it or not).

Investment Rate Of Return

“XX%” rate of return over time can be very misleading. Take for example 10% rate of return over the rest of your life expectancy which is 20 years or more (for example). 10% may be an outrageous investment objective. Yet even if you attained it you may not be keeping pace with goals from your financial plan.

The real rate of investment return is what matters most to you! What you actually earn after all fees, expenses, taxes and inflationary pressure is taken out is your real rate of investment return.

Most financial advisors will quote investment returns after fees, yet not every financial advisor does. Some financial advisors will “sugar coat” your returns and gloss over the important stuff.

Other financial advisors will overlook the taxes due on your investment income and even capital gains. Worse yet, taxation of retirement plan distributions are oftentimes overlooked as well.

If you average a 10% rate of investment return (which I’d caution never to assume, even in a 100% equity portfolio) over the next 20 years it may look great on the surface. Who wouldn’t want a 10% annualized rate of return right? However inflation has averaged nearly 4.5% per year for over 40 years now.

That 4.5% eats away at your 10% return. Taxes will eat away at the 10% return. Fees and commissions will eat away your 10% return. That leaves you with less than 5.5% in real investment return.

Overly (and devastatingly) simplistic financial calculations don’t take the fees, expenses, taxes and inflationary factors into account. Rather the average investor sees a million dollar portfolio generating $100,000 per year from total return and thinks they’re set for life! This isn’t always the case.

Worse yet, there are periods in time when inflation will be above 4.5% average per year. What happens in extended stretches of time when inflation is 5.5% or greater for example? Your investment returns shrink to 3.5% or less.

When 10% Investment Return Isnt Good Enough!

The point is not to rain on your parade. The point is there are many factors tied to your investment objectives. While targeting a specific rate of return is interesting in practice, you must regularly evaluate your progress towards your financial goals carefully benchmarking your progress.

I do this with clients during our annual review. Together we update client objectives and finances, and discuss our progress towards their investment objectives.

During the process clients see clearly that they’re either on track or “not so much”. If they’re “not so much” on track (earning too little, spending too much, etc.) adjustments need to be made.

Investing is like flying. You need a pre-flight checklist to get your financial game plan in order. But once the pre-flight checklist is done you power off and hit cruising altitude. Headwinds, storms and jet streams will push you off course once in a while. What’s important is making the necessary corrections to land on target.

Your investment plan is no different. It must be checked against your financial plan and corrections must be made when necessary. Straying too far off target can lead to a crash landing.