Investing in Stocks and The Stop Loss

Post on: 16 Октябрь, 2015 No Comment

Ive promised some Dry articles for you, and not being one to forget about promises I’ve put this one together for the fans of my “Dry” posts. This is the next post in my series on investing. Its dedicated to the Stop Loss. Personally, I think the stop loss is one of the most powerful, yet underused tools available to any investor, whether new or experienced. Theres a place for the stop loss in any investing or trading strategy. Consider it a safety net to help you with the risk management perspective of your investment strategy.I also think that with the current markets potential for a correction, the stop loss may be something that prudent investors should be considering. Many online brokerages, like Etrade . make it fairly simple to place these trades. If youve never heard of them before or need help placing the trade, make sure to call your online brokerage as they should be able to walk you through place a trade such as this.

Why The Stop Loss?

For a long term investor, the stop loss can be an important risk management tool, a way to protect gains or minimize losses. Ill get into sticky territory with this one since a long term investor should be willing to accept a temporary paper loss. But if part of your long term strategy is to minimize a loss at a certain pre-defined level, then the stop loss order is a good tool to help do that.

I use the trailing stop loss in my accounts that have a long term outlook. When a position hits a level that Im comfortable with in terms of profit, Ill usually put a trailing stop loss on it in the range of 5 to 15% percent as the trail. Ill do that if I think theres still upward potential for that issue and the percentage of trail will vary based on market conditions and the stocks beta (volatility) amongst other factors. If that position goes up, the trailing stop loss will follow it along. If it loses then it should (more on that later) sell out at the predetermined level you set for it.

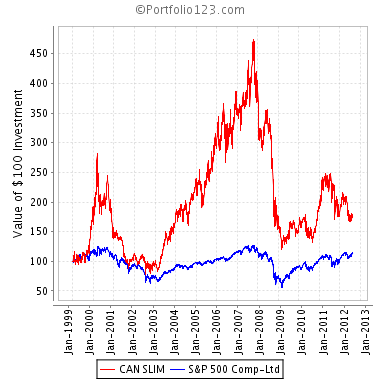

One great use of the stop loss is when you know youll be away for an extended period of time without accessing or having access to your accounts. Should a serious market correction occur during that period, you may return to find that your 40 or 50% less well off then you were before you left. Can you imagine what you would have felt like if you had taken a vacation to a remote location in the late September, early October time frame of 2008? The market opened at $11,139 on September 29, 2008 and closed at $ $8451 a week later on October 06, 2008. With stop losses in place, you would have mitigated your losses and had a cash position to start bottom fishing. Without a stop loss the situation would have been just plain ugly.

The Stop Loss Explained

Before I go into too much detail I want to explain two different ways that you can place an order to buy or sell for a stock. When buying or selling a stock you can place a limit order or a market order . A limit order lets you specify at exactly what price you want that trade executed. A market order fills your order at the best available price but is a bit more volatile. My preference is to use market orders. Ive been kept out of a good trade by using limit orders in the past whereas market orders get executed almost immediately and close to the last traded prices (although not always). Its important to understand the difference between the two, when you place a stop loss order you can specify how you want it placed, as a market or a limit.

The basic stop loss is a fairly simple order. You can specify a specific dollar amount, or the Stop Price you want to sell at, if the price of that stock drops to the price you set, your sell order will be triggered. An alternative to the plain stop loss order is a trailing stop loss order. This type of order is a little more complex but its my preferred way of entering a stop loss order. The trailing stop will follow a stock up, either as a percent of the stock or as a dollar amount that you set when entering the order. So for example, if you have 100 shares of Gadgetron Inc, and its selling at $50.00 a share you might enter a trailing stop at 10%. When you enter the order, the stop price will be $45.00 Should Gadegetron go up to $60 a share, the stop price will follow but will now be $54 a share, 60-(60*.10). If you had originally entered the trailing stop loss as a dollar amount, lets say $5 in this case, your original stop price would have been the same, $45. But when the stock when up, your new stop price would have been $55, 60-5.

A trailing stop loss order requires a bit more information on your part. When entering an order for a trailing spot youll have three options on how you want the stop to be triggered. You will have to make a selection between Last , Ask or Bid to trigger the order. If it sounds complex, dont fret, its not. The Ask option will trigger your order when the ask price of a stock matches your stop. Similarly, the Bid option will trigger your order when a bid is place on a stock that matches your stop. Personally, I dont like to use either of these since the stock doesnt actually have to trade at your stop price to have your order entered. The Last option is my preference when placing a trialing stop loss order. The stock has to actually trade at (or below) the stop price you set to trigger the order.

There is another option youll see when placing a stop loss order. The Stop Loss Limit order combines a stop loss order with a limit order. What that means is that once a stock drops low enough trip the stop order, a limit order goes into effect. This gives you a significant amount of control over what price your stop loss gets executed at, but it also carries the risk of your order not getting executed. Personally, Im not a big fan of limit orders and am especially wary of a limit order in conjunction with a stop loss.

The Ugly Side of the Stop Loss

Stop Losses are not all flowers and sunshine. Theres a dark side to the stop loss and that is that there are risks in using these orders. One common school of thought is that trading floors can see your stop loss order. Stories abound of traders pushing a stock price down to trigger your order and then letting the market correct the price upwards. Im not sure how true this is, especially as it applies to small quantities, but there are enough stories around to at least make you believe that the possibility exists.

Another risk is that a stock that is getting sacrificed to the gods of fear may slide significantly below your stop and get executed at a very low price. Lets go back to the fictional company I reference earlier, Gadetron Inc. You have 100 shares of Gadgetron and its been doing well and is currently at the $60.00 level. You decided that you wanted to protect your initial investment of $50 a share so you entered a trailing stop loss order at $10.00 below the Last. One bright day, theres a news item that spreads throughout the Financial community like wildfire; Mr. Amfullabrains, the chief scientist and researcher of Gadgetron, has left the country and rumor has it that he has taken the all of the companies intellectual property with him. The price of the company’s stock takes a drastic plunge and you get stopped out. Not at the $50 a share you were looking for but at $35 a share. Is it possible? Yes it is, although the analogy is corny, the possibility exists. Just look at Enrons price history and that will give you an idea of just how quickly a company’s stock price can plummet on bad news.

So is the stock loss order the right tool for you. Its up to you to make that decision but it should be evaluated and considered as part of any investment strategy, especially when it comes to risk managment.

Tell us about your experiences with stop losses.

Are there times when theyve saved your portfolio?

How about times that theyve worked against you?