Inverse and Leveraged ETFs

Post on: 21 Март, 2016 No Comment

The popularity of exchange-traded funds (ETFs) has led to the spin-off of second-order ETFs that are designed to provide investors with downside/bearish (often referred to as inverse) exposure and/or leveraged (sometimes referred to as ultra) returns. To construct these ETFs, complex financial instruments such as options, swaps and futures are arranged and embedded into the ETFs portfolio. While this may sound onerous and foreboding, these ETFs can be effective tools if you fully understand what they do, how to use them, and the risks involved. The purpose of this article is to help you understand what leveraged and inverse ETFs are designed to do, while detailing some of their risks and potential benefits.

It’s important to note that these instruments are not for the average investor: They involve a great deal of risk and don’t always work as intended. Furthermore, although an ETF may be designed to provide investment returns that correspond inversely to, and/or by multiples of, the performance of an underlying index, due to expenses, potential tracking error, market supply-and-demand conditions and other factors, there can be no guarantee that exact correlation will be achieved.

Let’s use the S&P 500 (SPX) as the basis for examples in this discussion. However, I’d be remiss to not mention that inverse and leveraged ETFs are available for many popular indexes and sectors such as the Nasdaq, the Dow Jones industrial average, the MSCI EAFE, commodities (such as gold), financials, and oil and gas.

Inverse ETFs: The class of inverse ETFs may be the most difficult to envision, because a common way to gain a short or bearish exposure to a stock or index is to short-sell a security. Short sales must be transacted in a margin account. However, with inverse ETFs, to take a bearish position, you buy the ETFs rather than sell them short. In the case of the S&P 500, an inverse ETF would be designed to increase in value on a percentage basis in relation to the decrease in value of the SPX. For example, if you purchased the inverse ETF for $100 and the SPX declined by 1%, then your ETF should typically increase by 1%, or $1, to $101. Conversely, if the SPX increased by 1%, then your inverse ETF should decline by 1%, or $1, to $99. These relationships exist on a day-to-day basis only, and may not necessarily track perfectly, as the supply/demand dynamics of the trading markets may result in a less than perfect correlation.

Leveraged ETFs: These ETFs (whether bullish or bearish) are typically designed to return twice (double) the daily performance (or inverse performance) of the index they seek to track. Recently, triple-leveraged ETFs have been introduced into the market, but for the purposes of this discussion I will review only the double-leveraged varieties.

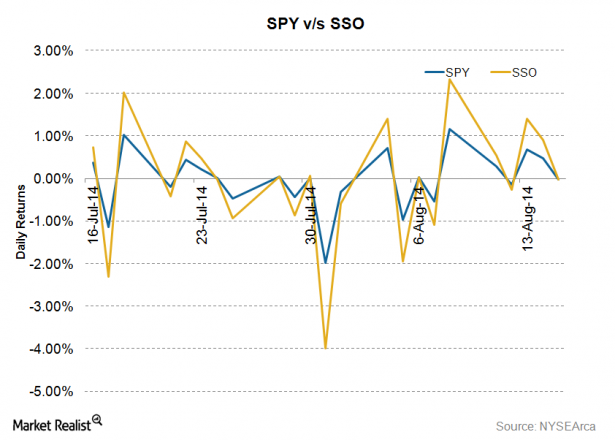

Here’s an example: If you purchased the leveraged version of the basic unlevered ETF that tracks the SPX ETF (SSO), you would expect that investment to move positively, twice, in relation to the SPX on any given day. For example, should you purchase the leveraged ETF for $100 and the SPX increases by 1% the following day, your ETF should typically increase by 2%, to $102. On the other hand, if the SPX declines by 1%, then your leveraged ETF should typically decline by 2%, to $98. As with the inverse ETF, these are day-to-day movements and are unlikely to be perfectly correlated.

Inverse-leveraged ETFs: These ETFs are transacted exactly like inverse ETFs in the sense that you buy the instrument. If you sought leveraged bearish exposure and bought an inverse-leveraged ETF for $100, should the SPX decline by 1%, your ETF should increase in value by 2%, to $102. Alternatively, if the SPX increases by 1%, your inverse-leveraged ETF should decline by 2%, to $98. Once again, the ETF is designed to approximate the leveraged performance of the underlying index on a daily basis only, and correlations may not be perfect.

Red flags for leveraged ETFs

We cannot jump blindly into the arena of leveraged and inverse-leveraged ETFs without accepting some risks and warnings. Here are a few worth noting:

Greater risk: These are leveraged instruments. As such, you risk losing more on a percentage basis than the decline in the underlying index. Leverage cuts both ways, and can work against an investor. For example, if the market declines by 5%, you could lose much more than 5%.

Interest/tax charges: There are interest charges embedded in the leveraged ETFs. As a result, the price of the ETF will reflect these implicit expenses (in the case of a long leveraged ETF) and the benefit of interest income (in the case of the inverse-leveraged ETFs). Furthermore, an inverse ETF (leveraged or not) will be liable for short dividends. These expenses will also be reflected in the price of the inverse ETF. Because these funds need to constantly re-hedge their exposure with derivative instruments, they can generate gains or losses, which may lead to big capital gains distributions in some cases. As distributions from these ETFs can receive disadvantageous tax treatment, you should consult with your tax advisor before investing in leveraged ETFs. Furthermore, distributions (which may appear as dividends) could take the form of ordinary income or capital gains. This varies from ETF to ETF.

Won’t always work as intended: The most important caveat to consider when dealing in leveraged ETFs is the nature of the leverage. As I have mentioned, these ETFs are designed to achieve performance that is equal to a multiple of the performance of the underlying index on a given day. The index value upon which the ETF’s performance goal is based changes every day (unless the index remains flat). This can lead to big differences between the performance you expect and that which is actually achieved by a leveraged ETF. The longer the holding period, the more likely it is that the leverage you assume you will be earning will not be correlated to the actual performance of the underlying index. Therefore, you should consider these instruments on a short-term basis and should not use them for intermediate- and long-term investment purposes.

For example, you could wind up losing money on a leveraged ETF based on the path dependency of the targeted index, even if the index itself had appreciated or was flat at the end of the same time horizon. Assume that the index dropped 1% (on an absolute basis) every day for 50 consecutive days from 1,000 to 500, and then rose in one day from 500 back to 1,000. Furthermore, assume that you paid $100 for the long leveraged ETF when the index was first at 1,000. Given the path that it took, when the index returned to 1,000 you would be left with a leveraged ETF that was worth less than the original $100 purchase price.

How to put ETFs to work

Once you fully understand leveraged and inverse-leveraged ETFs, they can be powerful tools for your portfolio. Here are some practical examples: Allocating idle cash: Say you have some idle cash that you want to use to gain short-term market exposure, but you want the potential for leveraged returns and are willing to accept the risks. By using a leveraged ETF, you may be able to obtain your desired result with less cash. For example, let’s say you have a 20% cash allocation that you want to temporarily expose to the performance of the market. Rather than investing all 20% back into the market, you could keep 10% in cash and invest 10% in a leveraged ETF designed to return twice the performance of the broad market. Theoretically, you’d initially have an additional 20% exposure to the market’s performance, but you would still have 10% in cash. Because the ETF is designed to approximate twice the performance of the underlying index for the day only, your additional exposure to market performance after the first day would depend on the volatility of the underlying index. Increasing your exposure: You can use leveraged ETFs to try to obtain exposure in excess of 100% to the overall market. You can do this without accessing the features of a margin account. In the prior example, say you deployed the entire 20% cash balance into a leveraged ETF. Initially, you would have 80% of your portfolio in stocks and another 40% market exposure via the ETF, as the 20% investment in the leveraged ETF provides initial two-to-one market exposure. Now you have 120% exposure to the market and could potentially gain or benefit at a leveraged rate of return. Reducing risk or hedging: While leveraged and inverse-leveraged ETFs can be extremely risky and speculative when used on their own, they can also be used to reduce or hedge risk when combined with a complete portfolio. You might be 100% invested in the market, but concerned about a short-term market drop and yearning to get more defensive. Selling off 10% of your holdings would bring your exposure down to 90% of your capital. You could use the 10% to purchase an inverse-leveraged ETF to approximate a 20% short hedge against the portfolio, bringing your total exposure down to about 70%. Thus, you could theoretically turn a 100%-at-risk portfolio into a 70%-at-risk portfolio by executing a 10% liquidation and commensurate purchase of an inverse-leveraged ETF. Note that over longer periods, the hedging power can be lost. As we have discussed, this is because the index value upon which the ETF’s performance is based changes every day. If the rest of your portfolio is different from the ETF’s underlying index, the hedge will be imperfect.

Important Disclosures

Exchange-traded funds are subject to risks similar to those of stocks. Investment returns will fluctuate and are subject to market volatility, so that an investor’s shares, when redeemed or sold, may be worth more or less than their original cost. For more complete information, including expenses, investment objectives and potential risks, on a specific exchange-traded fund, please call your Schwab investment professional at 800-435-9050 for a prospectus. Please read the prospectus carefully before you invest.

Since an ETF designed to track an index or basket of commodities is not diversified and focuses its investments entirely in a single commodity or commodity basket, the fund will involve a greater degree of risk than an investment in other diversified fund types.

Neither Mr. Rothbort nor TheStreet.com is affiliated with Charles Schwab & Co. Inc. The views expressed here are those of Mr. Rothbort, and do not necessarily reflect the views of Charles Schwab & Co. Inc. They are presented as a service to Schwab Active Trading clients. Schwab makes no judgment or warranty with respect to the accuracy, timeliness, completeness or suitability of the information presented. The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. Past performance is no guarantee of future results.

Commissions, taxes and transaction costs are not included in this discussion, but can affect final outcome and should be considered. Please contact a tax advisor for the tax implications involved in these strategies.

Short selling is an advanced trading strategy involving potentially unlimited risks, and must be done in a margin account.

Inverse ETFs are designed to increase (or decrease) in value on a percentage basis in relation to the decrease (or increase) in value of a target sector or index. Leveraged ETFs can be used to help bolster portfolios in many ways, such as by obtaining exposure in excess of 100% to the overall market. These instruments do have disadvantages, including potentially high volatility, and should be considered for short-term investment purposes only.