International Accounting Standards

Post on: 5 Апрель, 2015 No Comment

17 CFR PARTS 230 and 240

[RELEASE NOS. 33-7801, 34-42430; INTERNATIONAL SERIES NO. 1215]

FILE NO. S7-04-00

[RIN: 3235-AH65]

INTERNATIONAL ACCOUNTING STANDARDS

AGENCY: Securities and Exchange Commission.

ACTION: Concept release; request for comment.

SUMMARY: With the activities and interests of investors, lenders and companies becoming increasingly global, the Commission is increasing its involvement in a number of forums to develop a globally accepted, high quality financial reporting framework. Our efforts, at both a domestic and international level, consistently have been based on the view that the only way to achieve fair, liquid and efficient capital markets worldwide is by providing investors with information that is comparable, transparent and reliable. That is why we have pursued a dual objective of upholding the quality of financial reporting domestically, while encouraging convergence towards a high quality global financial reporting framework internationally. In this release, we are seeking comment on the necessary elements of such a framework, as well as on ways to achieve this objective. One aspect of this is seeking input to determine under what conditions we should accept financial statements of foreign private issuers that are prepared using the standards promulgated by the International Accounting Standards Committee.

DATES: Comments should be received on or before May 23, 2000.

ADDRESSES: Please send three copies of your comments to Jonathan G. Katz, Secretary, Securities and Exchange Commission, 450 Fifth Street, N.W. Washington, D.C. 20549-0609. You also may submit your comments electronically at the following e-mail address: rule-comments@sec.gov. All comment letters should refer to File No. S7-04-00; you should include this file number in the subject line if e-mail is used. Comment letters can be inspected and copied in our public reference room at 450 Fifth Street, N.W. Washington, D.C. 20549-0102. We will post electronically submitted comments on our Internet Web site at .

FOR FURTHER INFORMATION CONTACT: Sandra Folsom Kinsey, Senior International Counsel, Division of Corporation Finance at (202) 942-2990, or D.J. Gannon, Professional Accounting Fellow, Office of the Chief Accountant at (202) 942 4400.

SUPPLEMENTARY INFORMATION

I. INTRODUCTION AND PURPOSE OF THIS RELEASE

Over the last two decades, the global financial landscape has undergone a significant transformation. These developments have been attributable, in part, to dramatic changes in the business and political climates, increasing global competition, the development of more market-based economies, and rapid technological improvements. At the same time, the world’s financial centers have grown increasingly interconnected.

Corporations and borrowers look beyond their home country’s borders for capital. An increasing number of foreign companies routinely raise or borrow capital in U.S. financial markets, and U.S. investors have shown great interest in investing in foreign enterprises. This globalization of the securities markets has challenged securities regulators around the world to adapt to meet the needs of market participants while maintaining the current high levels of investor protection and market integrity.

Our efforts to develop a global financial reporting framework have been guided by the cornerstone principle underlying our system of regulation — pursuing our mandate of investor protection by promoting informed investment decisions through full and fair disclosure. Financial markets and investors, regardless of geographic location, depend on high quality information in order to function effectively. Markets allocate capital best and maintain the confidence of the providers of capital when the participants can make judgments about the merits of investments and comparable investments and have confidence in the reliability of the information provided.

Because of increasing cross-border capital flows, we and other securities regulators around the world have an interest in ensuring that high quality, comprehensive information is available to investors in all markets. We stated this view in 1988, when we issued a policy statement that noted that all securities regulators should work together diligently to create sound international regulatory frameworks that will enhance the vitality of capital markets. 1 We have applied this approach in a number of instances, including our recent adoption of the International Disclosure Standards developed by the International Organization of Securities Commissions (IOSCO) for non-financial statement information. 2 Our decision to adopt the International Disclosure Standards was based on our conclusion that the standards were of high quality and that their adoption would provide information comparable to the amount and quality of information that U.S. investors receive today.

Currently, issuers wishing to access capital markets in different jurisdictions must comply with the requirements of each jurisdiction, which differ in many respects. We recognize that different listing and reporting requirements may increase the costs of accessing multiple capital markets and create inefficiencies in cross-border capital flows. Therefore, we are working with other securities regulators around the world to reduce these differences. To encourage the development of accounting standards to be considered for use in cross-border filings, we have been working primarily through IOSCO, and focusing on the work of the International Accounting Standards Committee (IASC). Throughout this effort, we have been steadfast in advocating that capital markets operate most efficiently when investors have access to high quality financial information.

However, ensuring that high quality financial information is provided to capital markets does not depend solely on the body of accounting standards used. An effective financial reporting structure begins with a reporting company’s management, which is responsible for implementing and properly applying generally accepted accounting standards. Auditors then have the responsibility to test and opine on whether the financial statements are fairly presented in accordance with those accounting standards. If these responsibilities are not met, accounting standards, regardless of their quality, may not be properly applied, resulting in a lack of transparent, comparable, consistent financial information.

Accordingly, while the accounting standards used must be high quality, they also must be supported by an infrastructure that ensures that the standards are rigorously interpreted and applied, and that issues and problematic practices are identified and resolved in a timely fashion. Elements of this infrastructure include:

In this release, we discuss a number of issues related to the infrastructure for high quality financial reporting. We solicit views on the elements necessary for developing a high quality, global financial reporting framework for use in cross-border filings. We believe these issues should be considered in the development of any proposals to modify current requirements for enterprises that report using IASC standards because our decisions should be based on the way the standards actually are interpreted and applied in practice.

We recognize that each of the elements of the infrastructure may be at different stages of development and that decisions and progress on some of these infrastructure issues may be independent of the body of accounting standards used.

II. ELEMENTS OF A HIGH QUALITY GLOBAL FINANCIAL REPORTING STRUCTURE

A. High Quality Accounting Standards

High quality accounting standards are critical to the development of a high quality global financial reporting structure. Different accounting traditions have developed around the world in response to varying needs of users for whom the financial information is prepared. In some countries, for example, accounting standards have been shaped primarily by the needs of private creditors, while in other countries the needs of tax authorities or central planners have been the predominant influence. In the United States, accounting standards have been developed to meet the needs of participants in the capital markets.

U.S. accounting standards provide a framework for reporting that seeks to deliver transparent, consistent, comparable, relevant and reliable financial information. Establishing and maintaining high quality accounting standards are critical to the U.S. approach to regulation of capital markets, which depends on providing high quality information to facilitate informed investment decisions.

High quality accounting standards consist of a comprehensive set of neutral principles that require consistent, comparable, relevant and reliable information that is useful for investors, lenders and creditors, and others who make capital allocation decisions. High quality accounting standards are essential to the efficient functioning of a market economy because decisions about the allocation of capital rely heavily on credible and understandable financial information.

When issuers prepare financial statements using more than one set of accounting standards, they may find it difficult to explain to investors the accuracy of both sets of financial statements if significantly different operating results, financial positions or cash flow classifications are reported under different standards for the same period. Questions about the credibility of an entity’s financial reporting are likely where the differences highlight how one approach masks poor financial performance, lack of profitability, or deteriorating asset quality.

The efficiency of cross-border listings would be increased for issuers if preparation of multiple sets of financial information was not required. However, the efficiency of capital allocation by investors would be reduced without consistent, comparable, relevant and reliable information regarding the financial condition and operating performance of potential investments. Therefore, consistent with our investor protection mandate, we are trying to increase the efficiency of cross-border capital flows by seeking to have high quality, reliable information provided to capital market participants.

B. High Quality Auditing Standards

The audit is an important element of the financial reporting structure because it subjects information in the financial statements to independent and objective scrutiny, increasing the reliability of those financial statements. Trustworthy and effective audits are essential to the efficient allocation of resources in a capital market environment, where investors are dependent on reliable information.

Quality audits begin with high quality auditing standards. Recent events in the United States have highlighted the importance of high quality auditing standards and, at the same time, have raised questions about the effectiveness of today’s audits and the audit process. 3 We are concerned about whether the training, expertise and resources employed in today’s audits are adequate.

Audit requirements may not be sufficiently developed in some countries to provide the level of enhanced reliability that investors in U.S. capital markets expect. Nonetheless, audit firms should have a responsibility to adhere to the highest quality auditing practices — on a world-wide basis — to ensure that they are performing effective audits of global companies participating in the international capital markets. To that end, we believe all member or affiliated firms performing audit work on a global audit client should follow the same body of high quality auditing practices even if adherence to these higher practices is not required by local laws. 4 Others have expressed similar concerns. 5

C. Audit Firms with Effective Quality Controls

Accounting and auditing standards, while necessary, cannot by themselves ensure high quality financial reporting. Audit firms with effective quality controls are a critical piece of the financial reporting infrastructure. Independent auditors must earn and maintain the confidence of the investing public by strict adherence to high quality standards of professional conduct that assure the public that auditors are truly independent and perform their responsibilities with integrity and objectivity. As the U.S. Supreme Court has stated: It is not enough that financial statements be accurate; the public must also perceive them as being accurate. Public faith in the reliability of a corporation’s financial statements depends upon the public perception of the outside auditor as an independent professional. 6 In addition, audit firms must ensure that their personnel comply with all relevant professional standards.

The quality control policies and procedures applicable to a firm’s accounting and auditing practice should include elements such as: 7

A firm’s system of quality control should provide the firm and investors with reasonable assurance that the firm’s partners and staff are complying with the applicable professional standards and the firm’s standards of quality.

Historically, audit firms have developed internal quality control systems based on their domestic operations. However, as clients of audit firms have shifted their focus to global operations, audit firms have followed suit and now operate on a world-wide basis. Therefore, quality controls within audit firms that rely on separate national systems may not be effective in a global operating environment. We are concerned that audit firms may not have developed and maintained adequate internal quality control systems at a global level. 8

D. Profession-Wide Quality Assurance

The accounting profession should have a system to ensure quality in the performance of auditing engagements by its members. Necessary elements of the system include:

In some jurisdictions the local accounting profession may have a system of quality assurance. However, structures focused on national organizations and geographic borders do not seem to be effective in an environment where firms are using a number of affiliates to audit enterprises in an increasingly integrated global environment.

E. Active Regulatory Oversight

The U.S. financial reporting structure has a number of separate but interdependent elements, including active regulatory oversight of many of these elements, such as registrants’ financial reporting, private sector standard-setting processes and self-regulatory activities undertaken by the accounting profession. Each of these elements is essential to the success of a high quality financial reporting framework. This oversight reinforces the development of high quality accounting and auditing standards and focuses them on the needs of investors. It provides unbiased third party scrutiny of self-regulatory activities. Regulatory oversight also reinforces the application of accounting standards by registrants and their auditors in a rigorous and consistent manner and assists in ensuring a high quality audit function.

III. BACKGROUND ON EFFORTS TO REDUCE BARRIERS TO CROSS- BORDER CAPITAL FLOWS

A. Foreign Private Issuers — The Current Requirements

The Securities Act of 1933 9 and the Securities Exchange Act of 1934 10 establish the disclosure requirements for public companies in the United States. The form and content requirements for financial statements filed with the Commission are set forth in Regulation S-X. 11 This framework establishes the initial and continuing disclosures that companies must make if they wish to offer securities in the United States or have their securities traded publicly on an exchange or quoted on the Nasdaq stock market. 12

Our current financial statement requirements for foreign private issuers parallel those for U.S. domestic issuers, except that foreign private issuers may prepare financial statements in accordance with either U.S. generally accepted accounting principles (U.S. GAAP) or with another comprehensive body of accounting standards (including IASC standards). A foreign private issuer using accounting standards other than U.S. GAAP must provide an audited reconciliation to U.S. GAAP. 13

There are some exceptions to this reconciliation requirement. For example, we have amended our requirements for financial statements of foreign private issuers to permit use of certain IASC standards without reconciliation to U.S. GAAP. 14 These are:

By requiring a U.S. GAAP reconciliation, with the exceptions noted above, we do not seek to establish a higher or lower disclosure standard for foreign companies than for domestic companies. Rather, the objective of this approach is to protect the interests of U.S. investors by requiring that all companies accessing U.S. public markets provide high quality financial reporting that satisfies the informational needs of investors, without requiring use of U.S. standards in the presentation of that information. 15

The U.S. GAAP reconciliation requirement requires foreign issuers to supplement their home country financial statements. The total number of foreign reporting companies increased from 434 in 1990 to approximately 1,200 currently.

B. Towards Convergence of Accounting Standards in a Global Environment

In the past, different views of the role of financial reporting made it difficult to encourage convergence of accounting standards. Now, however, there appears to be a growing international consensus that financial reporting should provide high quality financial information that is comparable, consistent and transparent, in order to serve the needs of investors. Over the last few years, we have witnessed an increasing convergence of accounting practices around the world. A number of factors have contributed to this convergence. First, large multinational corporations have begun to apply their home country standards, which may permit more than one approach to an accounting issue, in a manner consistent with other bodies of standards such as IASC standards or U.S. GAAP. Second, the IASC has been encouraged to develop standards that provide transparent reporting and can be applied in a consistent and comparable fashion worldwide. Finally, securities regulators and national accounting standard-setters are increasingly seeking approaches in their standard-setting processes that are consistent with those of other standard-setters. 16 Some national standard-setters are participating in multinational projects, such as those on accounting for business combinations, in order to draw on a broader range of comment about an issue.

If convergence of disclosure and accounting standards contributes to an increase in the number of foreign companies that publicly offer or list securities in the U.S. capital markets, investors in the United States would benefit from increased investment opportunities and U.S. exchanges would benefit from attracting a greater number of foreign listings. Although the U.S. markets have benefited greatly from the high quality financial reporting that U.S. GAAP requires, current disparities in accounting practices may be a reason foreign companies do not list their securities on U.S. exchanges. As Congress has recognized,

[E]stablishment of a high quality comprehensive set of generally accepted international accounting standards would greatly facilitate international financing activities and, most importantly, would enhance the ability of foreign corporations to access and list in the United States markets. 17

These concerns are offset by significant benefits realized by companies reporting under U.S. GAAP, as a result of improvements in the quality of information available to both management and shareholders as a result of reporting under U.S. GAAP. 18 It is important that convergence does not sacrifice key elements of high quality financial reporting that U.S. investors enjoy currently. Investors benefit when they have the ability to compare the performance of similar companies regardless of where those companies are domiciled or the country or region in which they operate.

Over the years, we have realized that foreign companies make their decisions about whether to offer or list securities in the United States for a variety of economic, financial, political, cultural and other reasons. Many of these reasons are unrelated to U.S. regulatory requirements. 19 However, some foreign companies cite, among other reasons, a reluctance to adopt U.S. accounting practices as a reason for not listing in the United States. These companies have indicated that they have forgone listing in the United States rather than follow accounting standards that they have not helped formulate. Therefore, accepting financial statements prepared using IASC standards without requiring a reconciliation to U.S. GAAP could be an inducement to cross-border offerings and listings in the United States.

On the other hand, other factors could continue to deter foreign access to the U.S. markets. For example, some foreign companies have expressed concern with the litigation exposure and certain public disclosure requirements that may accompany entrance into the U.S. markets. 20 Foreign companies also may be subject to domestic pressure to maintain primary listings on home country stock exchanges.

C. Development of the Core Standards Project

After studying issues relating to international equity flows, IOSCO noted that development of a single disclosure document for use in cross-border offerings and listings would be facilitated by the development of internationally accepted accounting standards. Rather than attempt to develop those standards itself, IOSCO focused on the efforts of the IASC. In 1993, IOSCO identified for the IASC what IOSCO believed to be the necessary components of a core set of standards that would comprise a comprehensive body of accounting principles for enterprises making cross-border securities offerings. IOSCO later identified a number of issues relating to the then-current IASC standards. The IASC then prepared a work plan designed to address the most significant issues identified by IOSCO — the core standards work program. In 1995, IOSCO and the IASC announced agreement on this work program, and IOSCO stated that if the resulting core standards were acceptable to IOSCO’s Technical Committee, that group would recommend endorsement of the IASC standards. The focus of IOSCO’s involvement in the core standards project is on use of IASC standards by large, multinational companies for cross-border capital-raising and listing. 21

IV. MAJOR ISSUES TO BE ADDRESSED IN OUR ASSESSMENT OF THE IASC STANDARDS

A. Criteria for Assessment of the IASC Standards

In an April 1996 statement regarding the IASC core standards project, we indicated that, once the IASC completed its project, we would consider allowing use of the resulting standards in cross-border filings by foreign issuers offering securities in the United States. 22 The three criteria set forth in that statement remain the criteria that will guide our assessment of the IASC standards. We request your views on whether the IASC standards:

1. constitute a comprehensive, generally accepted basis of accounting;

2. are of high quality; and

3. can be rigorously interpreted and applied.

In responding to the requests for comment set forth below, please be specific in your response, explaining in detail your experience, if any, in applying IASC standards, and the factors you considered in forming your opinion. Please consider both our mandate for investor protection and the expected effect on market liquidity, competition, efficiency and capital formation.

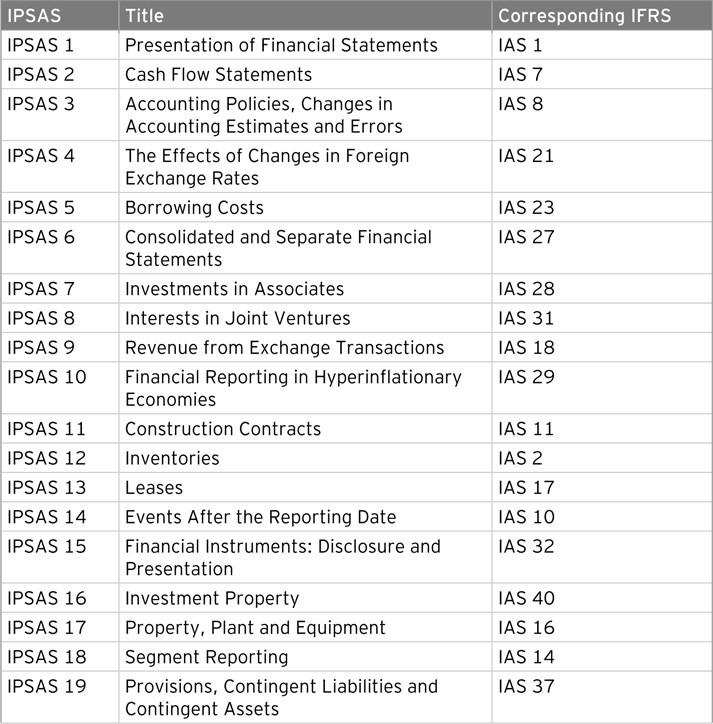

IASC standards are published and copyrighted by the IASC, and we can not reproduce those standards as part of this release. However, copies of the standards have been placed in our public reference rooms. The IASC also has summaries of each standard available on its website at . A listing of the IASC standards and their effective dates is included as Appendix B. For your convenience, a listing of questions 1-26 is included as Appendix A.

1. Are the Core Standards Sufficiently Comprehensive?

The goal of the core standards project was to address the necessary components of a reasonably complete set of accounting standards that would comprise a comprehensive body of principles for enterprises undertaking cross-border offerings and listings. In developing the work program for the core standards project, IOSCO specified the minimum components of a set of core standards and identified issues to be addressed by the IASC. 23 For topics outside the core standards, such as industry-specific accounting standards, it was agreed that IOSCO members either would accept home country treatment or require specific host country treatment or equivalent disclosure.

Q.1 Do the core standards provide a sufficiently comprehensive accounting framework to provide a basis to address the fundamental accounting issues that are encountered in a broad range of industries and a variety of transactions without the need to look to other accounting regimes? Why or why not?

Q.2 Should we require use of U.S. GAAP for specialized industry issues in the primary financial statements or permit use of home country standards with reconciliation to U.S. GAAP? Which approach would produce the most meaningful primary financial statements? Is the approach of having the host country specify treatment for topics not addressed by the core standards a workable approach? Is there a better approach?

Q.3 Are there any additional topics that need to be addressed in order to provide a comprehensive set of standards?

2. Are the IASC Standards of Sufficiently High Quality? Why or Why Not?

When we refer to the need for high quality accounting standards, we mean that the standards must result in relevant, reliable information that is useful for investors, lenders, creditors and others who make capital allocation decisions. To that end, the standards must (i) result in a consistent application that will allow investors to make a meaningful comparison of performance across time periods and among companies; (ii) provide for transparency, so that the nature and the accounting treatment of the underlying transactions are apparent to the user; and (iii) provide full disclosure, which includes information that supplements the basic financial statements, puts the presented information in context and facilitates an understanding of the accounting practices applied. Such standards should:

In assessing the quality of the IASC standards, we are applying these criteria on a standard-by-standard basis, as well as to the IASC standards as a whole. In comment letters submitted to the IASC, the SEC staff has raised concerns including, but not limited to:

You may wish to review the SEC staff and IOSCO comment letters for a further discussion of these and other issues. 24 We, of course, welcome comments on other issues posed by specific approaches taken in the IASC standards, regardless of whether they were raised in IOSCO or SEC staff comment letters.

Indeed, we are seeking advice on any technical issues arising with respect to the IASC standards. In general, we are seeking to determine whether preparers, auditors and users of financial statements have identified particular issues based on their experience with the IASC standards and whether they have developed strategies for addressing those issues. We also would benefit from the public’s views regarding whether any of the standards represent a significant improvement over U.S. accounting practices. 25

A critical issue in assessing the quality of the IASC standards will be whether they would produce the same level of transparency and comparability that generally is provided to U.S. investors under U.S. GAAP. The focus of the staff’s comments to the IASC has not been on the differences between the proposed standards and U.S. GAAP; rather, the staff focused on the quality of the proposed standards. An analysis of the differences, however, could serve as a useful tool for highlighting what differing information might be provided in financial statements prepared using IASC standards compared with U.S. GAAP financial statements. 26 If the differences between the IASC standards and U.S. GAAP are significant, the financial position and operating results reported under the IASC standards may be difficult to compare with results reported under U.S. GAAP. The ability to make such a comparison is important for an investor making capital allocation decisions between U.S. and non-U.S. enterprises, especially within the same industry.

Q.4 Are the IASC standards of sufficiently high quality to be used without reconciliation to U.S. GAAP in cross-border filings in the United States? Why or why not? Please provide us with your experience in using, auditing or analyzing the application of such standards. In addressing this issue, please analyze the quality of the standard(s) in terms of the criteria we established in the 1996 press release. If you considered additional criteria, please identify them. 27

Q.5 What are the important differences between U.S. GAAP and the IASC standards? We are particularly interested in investors’ and analysts’ experience with the IASC standards. Will any of these differences affect the usefulness of a foreign issuer’s financial information reporting package? If so, which ones?

Q.6 Would acceptance of some or all of the IASC standards without a requirement to reconcile to U.S. GAAP put U.S. companies required to apply U.S. GAAP at a competitive disadvantage to foreign companies with respect to recognition, measurement or disclosure requirements?

Q.7 Based on your experience, are there specific aspects of any IASC standards that you believe result in better or poorer financial reporting (recognition, measurement or disclosure) than financial reporting prepared using U.S. GAAP? If so, what are the specific aspects and reason(s) for your conclusion?

3. Can the IASC Standards be Rigorously Interpreted and Applied?

(a) The Experience to Date

High quality financial reporting cannot be guaranteed solely by developing accounting standards with the strongest theoretical bases; financial reporting may be weak if conceptually sound standards are not rigorously interpreted and applied. If accounting standards are to satisfy the objective of having similar transactions and events accounted for in similar ways, preparers must recognize their responsibility to apply these standards in a way that is faithful to both the requirements and intent of the standards, and auditors and regulators around the world must insist on rigorous interpretation and application of those standards. Otherwise, the comparability and transparency that are the objectives of common standards will be eroded.

In this respect, it is difficult to evaluate the effectiveness of certain of the IASC standards at this stage. First, there is little direct use of IASC standards in developed capital markets. Second, even where IASC standards are used directly in those markets, a number of the new or revised standards may not have been implemented yet. 28 For that reason, financial statements currently prepared using IASC standards may not reflect the improvements achieved by the IASC in the core standards project. Therefore, preparers, users and regulators may not have significant implementation experience with respect to those standards to assist us in our evaluation of the quality of the standards as they are applied.

In order for any body of standards to be able to be rigorously interpreted and applied, there must be a sufficient level of implementation guidance. The IASC standards frequently provide less implementation guidance than U.S. GAAP. Instead, they concentrate on statements of principles, an approach that is similar to some national standards outside the United States. Also, the IASC has formatted its standards by using bold (`black’) lettering to emphasize basic requirements of the standards while placing explanatory text in normal (`gray’) lettering. We believe that the requirements of an IASC standard are not limited to the black lettered sections and that compliance with both black and gray letter sections of IASC standards should be regarded as necessary. Additionally, the IASC has published a basis for conclusions for only two of its standards. The basis for conclusion in U.S. standards often is useful in promoting consistent understanding of the standard setter’s reasoning and conclusions.

Comparability may be achieved with respect to less detailed standards through common interpretation and practice by companies and auditors who are familiar with the standards. Earlier standard-setting organizations in the United States, such as the Accounting Principles Board, followed this approach and developed less detailed standards. Our experience with that approach was not favorable, however, and led to the current organization and approach to standard-setting under the FASB. 29

Q.8 Is the level of guidance provided in IASC standards sufficient to result in a rigorous and consistent application? Do the IASC standards provide sufficient guidance to ensure consistent, comparable and transparent reporting of similar transactions by different enterprises? Why or why not?

Q.9 Are there mechanisms or structures in place that will promote consistent interpretations of the IASC standards where those standards do not provide explicit implementation guidance? Please provide specific examples.

Q.10 In your experience with current IASC standards, what application and interpretation practice issues have you identified? Are these issues that have been addressed by new or revised standards issued in the core standards project?

Q.11 Is there significant variation in the way enterprises apply the current IASC standards? If so, in what areas does this occur?

(b) The Need for a Financial Reporting Infrastructure

Effective financial reporting begins with management, which is responsible for implementing and applying properly a comprehensive body of accounting principles. Rigorous and consistent application of accounting standards also depends on implementation efforts of the standard-setter, auditors and regulators. There are concerns that current IASC standards may not be rigorously and consistently applied. For example, a recent study authored by the former IASC secretary-general identifies non-compliance with IASC standards by a number of the 125 companies surveyed. It also cites examples of auditors who failed to identify properly a lack of compliance with IASC requirements in their reports on an issuer’s financial statements. 30

In addition, the SEC staff has noted inconsistent applications of IAS 22, Business Combinations . The staff has received a number of requests to accept characterizations of business combinations as unitings of interests despite IAS 22’s clear intention that uniting of interest accounting be used only in rare and limited circumstances. In addition, the SEC staff, based on its review of filings involving foreign private issuers using IASC standards, has identified a number of situations involving not only inconsistent application of the standards but also misapplication of the standards. 31 In these circumstances, the SEC staff has required adjustments to the financial statements in order to comply with IASC standards.

Q.12 After considering the issues discussed in (i) through (iv) below, what do you believe are the essential elements of an effective financial reporting infrastructure? Do you believe that an effective infrastructure exists to ensure consistent application of the IASC standards? If so, why? If not, what key elements of that infrastructure are missing? Who should be responsible for development of those elements? What is your estimate of how long it may take to develop each element?

(i) The Interpretive Role of the Standard-Setter

In order for a set of accounting standards to be fully operational, the standard-setter must support reasonably consistent application of its standards. A standard-setter’s responsibility for ensuring consistent application of its standards includes providing an effective mechanism for identifying and addressing interpretive questions in an expeditious fashion.

The IASC began addressing interpretive issues in 1997 with the creation of its Standing Interpretations Committee (SIC) to provide resolution of interpretive issues arising in the application of the IASC standards that are likely to receive divergent or unacceptable treatment in the absence of authoritative guidance.

Q.13 What has your experience been with the effectiveness of the SIC in reducing inconsistent interpretations and applications of IASC standards? Has the SIC been effective at identifying areas where interpretive guidance is necessary? Has the SIC provided useful interpretations in a timely fashion? Are there any additional steps the IASC should take in this respect? If so, what are they?

(ii) The Restructuring of the IASC

The IASC has published a restructuring plan which is expected to result in an independent Board whose members are selected based on technical expertise, with oversight provided by an independent set of Trustees. The restructuring also is expected to integrate the roles of the IASC and those of national standard-setters. 32

At this time, we do not anticipate adopting a process-oriented approach (like our approach to the FASB 33 ) to IASC standards. Instead, we expect to continue a product-oriented approach, assessing each IASC standard after its completion. Nonetheless, the quality of the standard-setter has relevance to our consideration of the IASC standards, particularly with respect to implementation and interpretation questions. Since many of the IASC standards are new or relatively new, application issues may arise that require the response of an effective and high quality standard setter. Additionally, the quality of the standard-setter has critical implications for the development and acceptance of future standards. 34

An effective high quality standard-setter is characterized by:

Q.14 Do you believe that we should condition acceptance of the IASC standards on the ability of the IASC to restructure itself successfully based on the above characteristics? Why or why not?

(iii) The Role of the Auditor in the Application of the Standards

High quality accounting standards and an effective interpretive process are not the only requirements for effective financial reporting. Without competent, independent audit firms and high quality auditing procedures to support the application of accounting standards, there is no assurance that the accounting standards will be applied appropriately and consistently. As discussed in the introduction to this release, increasing globalization of business and integration of capital markets raise challenging questions of how to provide oversight of audit professionals on a world-wide basis to ensure consistent high quality and ethical audit and accounting practices.

In the United States, implementation and application of U.S. GAAP are supported through professional quality control practices and professional and governmental (state and federal) oversight and enforcement activities. National technical offices of U.S. accounting firms serve an important role in ensuring an appropriate and consistent interpretation and application of U.S. GAAP and U.S. auditing standards.

Q.15 What are the specific practice guidelines and quality control standards accounting firms use to ensure full compliance with non-U.S. accounting standards? Will those practice guidelines and quality control standards ensure application of the IASC standards in a consistent fashion worldwide? Do they include (a) internal working paper inspection programs and (b) external peer reviews for audit work? If not, are there other ways we can ensure the rigorous implementation of IASC standards for cross-border filings in the United States? If so, what are they?

Q.16 Should acceptance of financial statements prepared using the IASC standards be conditioned on certification by the auditors that they are subject to quality control requirements comparable to those imposed on U.S. auditors by the AICPA SEC Practice Section, such as peer review and mandatory rotation of audit partners? 35 Why or why not? If not, should there be disclosure that the audit firm is not subject to such standards?

In many jurisdictions, including the United States, accountants and auditors are trained and tested in their domestic accounting standards, but do not receive training in IASC standards. For that reason, accountants and auditors around the world will need to develop expertise with IASC standards to support rigorous interpretation and application of these standards.

Q.17 Is there, at this time, enough expertise globally with IASC standards to support rigorous interpretation and application of those standards? What training have audit firms conducted with respect to the IASC standards on a worldwide basis? What training with respect to the IASC standards is required of, or available to, preparers of financial statements or auditors certifying financial statements using those standards?

(iv) The Role of the Regulator in the Interpretation and Enforcement of Accounting Standards

While the Commission has the authority to establish accounting standards, 36 historically we have looked to the private sector for leadership in establishing and improving accounting standards to be used by public companies. 37 As a result, the Commission has recognized the FASB as the private sector body whose standards it considers to have substantial authoritative support. This partnership with the private sector facilitates input into the accounting standard-setting process from all stakeholders in U.S. capital markets, including financial statement preparers, auditors and users, as well as regulators. Our willingness to look to the private sector, however, has been with the understanding that we will, as necessary, supplement, override or otherwise amend private sector accounting standards.

The SEC staff is involved with the application of accounting standards on a daily basis through its review and comment process. This review process, administered by the Division of Corporation Finance, allows the staff to review and comment on a company’s application of GAAP and related SEC disclosure requirements. The SEC staff would have the same significant interpretive and enforcement role in the application of the IASC standards when those standards are used to prepare financial statements included in SEC filings. 38 To perform that role, our staff would need to develop expertise regarding the IASC standards. 39

However, other jurisdictions accepting IASC standards may develop conflicting interpretations or may accept applications of IASC standards that would not be acceptable in the United States and other jurisdictions, in part, because of lack of expertise, resources, or even the authority to question a company’s application of accounting standards. We are seeking to identify ways to reduce the development of diverging interpretations of IASC standards.

Q.18 Is there significant variation in the interpretation and application of IASC standards permitted or required by different regulators? How can the risk of any conflicting practices and interpretations in the application of the IASC standards and the resulting need for preparers and users to adjust for those differences be mitigated without affecting the rigorous implementation of the standards?

In considering changes in our current financial reporting requirements, we will consider the effects of possible changes on the ability of our enforcement program to provide an effective deterrent against financial reporting violations by foreign issuers, their corporate officials and their auditors.

Q.19 Would further recognition of the IASC standards impair or enhance our ability to take effective enforcement action against financial reporting violations and fraud involving foreign companies and their auditors? If so, how?

To facilitate its investigations of possible securities law violations, the SEC staff may need to obtain access to a non-U.S. auditor’s working papers, as well as testimony, in connection with audit work done outside the United States. 40 In some prior investigations, we have obtained access to information through the voluntary cooperation of the company or its foreign auditors. We also have the potential of using domestic compulsory mechanisms or enforcement tools such as memoranda of understanding and other arrangements with non-U.S. regulators. However, these approaches for obtaining information about an auditor’s work can cause delays in investigations, and may still not permit obtaining access to working papers and testimony that are needed to assess information the issuer has provided to its auditors and to investigate the adequacy of the work supporting the auditor’s report. The circumstances in which we need this information have grown, due to the expanded multinational activities of U.S. companies and the increasing number of foreign issuers that are listed on U.S. exchanges. Greater acceptance of the IASC standards may increase further the instances in which an issuer’s auditor is not based in the United States.

Q.20 We request comment with respect to ways to assure access to foreign working papers and testimony of auditors who are located outside the United States. For example, should we amend Regulation S-X to require a representation by the auditor that, to the extent it relied on auditors, working papers, or information from outside the United States, the auditor will make the working papers and testimony available through an agent appointed for service of process? If not, should we require that the lack of access to auditors’ workpapers be disclosed to investors? Is there another mechanism for enhancing our access to audit working papers and witnesses outside the United States?

B. Possible Approaches to Recognition of the IASC Standards for Cross-Border Offerings and Listings

As discussed, IOSCO and Commission recognition of the IASC standards will depend on the outcome of the current assessment work. The assessment work has two aspects: (1) considering the quality of each of the IASC standards individually and (2) evaluating whether the body of standards operates effectively as a whole.

The goal of the core standards project has been to develop a high quality set of generally accepted international accounting standards that ultimately would reduce or eliminate the need for reconciliation to national standards. Any Commission action could take several forms, including, for example:

There may be other approaches, or combinations of approaches, that would be appropriate. In determining what approach to take we will consider outstanding substantive issues noted by IOSCO in its report, the underlying work assessing the IASC standards performed by the SEC staff and other members of IOSCO, as well as responses we receive to this release. In addition, the approach we adopt initially may change in light of future modifications of the IASC standards or further development of the related infrastructure elements.

Q.21 What has been your experience with the quality and usefulness of the information included in U.S. GAAP reconciliations? Please explain, from your viewpoint as a preparer, user, or auditor of non-U.S. GAAP financial statements, whether the reconciliation process has enhanced the usefulness or reliability of the financial information and how you have used the information provided by the reconciliation. Please identify any consequences, including quantification of any decrease or increase in costs or benefits, that could result from reducing or eliminating the reconciliation requirement.

Q.22 Should any requirements for reconciliation differ based on the type of transaction (e.g.. listing, debt or equity financing, rights offering, or acquisition) or the type of security (e.g.. ordinary shares, convertible securities, investment grade or high yield debt)? Are there any other appropriate bases for distinction?

Q.23 If the current reconciliation requirements are reduced further, do you believe that reconciliation of a bottom line figure would still be relevant (e.g.. presenting net income and total equity in accordance with U.S. GAAP)?

Q.24 Should any continuing need for reconciliation be assessed periodically, based on an assessment of the quality of the IASC standards?

Q.25 The IASC standards finalized as part of the core standards project include prospective adoption dates. Most standards are not required to be applied until fiscal years beginning on or after January 1, 1998, at the earliest. Should we retain existing reconciliation requirements with respect to the reporting of any fiscal year results that were not prepared in accordance with the revised standards or simply require retroactive application of all revised standards regardless of their effective dates? If not, why not?

The current reconciliation requirements are designed to make financial statements prepared under non-U.S. GAAP more comparable to those prepared under U.S. GAAP. Additionally, there may be indirect benefits realized from those requirements. For example, some multinational accounting firms have stated that the reconciliation process has served as a quality control mechanism with respect to audit work performed by their local offices with respect to foreign companies. On the other hand, the SEC staff, based on its review of filings involving foreign private issuers using non-U.S. GAAP, has noted a number of situations involving the inclusion of reconciling items that appear to be the result of non-compliance with home country GAAP rather than a difference between the home country (or IASC) basis of accounting and U.S. GAAP. As such, there should not be a reconciling item. This may be indicative of not enough focus on the accuracy of the primary financial statements.

Q.26 Does the existence of a reconciliation requirement change the way in which auditors approach financial statements of foreign private issuers? Also, will other procedures develop to ensure that auditors fully versed in U.S. auditing requirements, as well as the IASC standards, are provided an opportunity to review the financial reporting practices for consistency with those standards? If so, please describe these procedures. Alternatively, will the quality of the audit and the consistency of the application of the IASC standards depend on the skill and expertise of the local office of the affiliate of the accounting firm that conducts the audit?

V. CONCLUSION

Following receipt and review of comments, we will determine whether rulemaking or other further action is appropriate. In addition to responding to the specific questions we have presented in this release, we encourage commenters to provide any information to supplement the information and assumptions contained in this release regarding the role of accounting standards in the capital-raising process, the information needs of investors and capital markets, and the other matters discussed. We also invite commenters to provide views and data as to the costs and benefits associated with the possible changes discussed in this release in comparison to the costs and benefits of the existing regulatory framework. In order for us to assess the impact of changes that could affect capital formation, market efficiency and the protection of investors, we solicit comment from the point of view of a variety of groups, including, without limitation, foreign and domestic issuers, underwriters, broker-dealers, analysts, investors, accountants and attorneys involved in the registration process and other interested parties.

By the Commission.

Jonathan G. Katz

Secretary

February 16, 2000

APPENDIX A

LISTING OF QUESTIONS IN THE CONCEPT RELEASE

Criteria for Assessment of the IASC Standards

Are the Core Standards Sufficiently Comprehensive?

Q.1 Do the core standards provide a sufficiently comprehensive accounting framework to provide a basis to address the fundamental accounting issues that are encountered in a broad range of industries and a variety of transactions without the need to look to other accounting regimes? Why or why not?

Q.2 Should we require use of U.S. GAAP for specialized industry issues in the primary financial statements or permit use of home country standards with reconciliation to U.S. GAAP? Which approach would produce the most meaningful primary financial statements? Is the approach of having the host country specify treatment for topics not addressed by the core standards a workable approach? Is there a better approach?

Q.3 Are there any additional topics that need to be addressed in order to provide a comprehensive set of standards?

Are the IASC Standards of Sufficiently High Quality? Why or Why Not?

Q.4 Are the IASC standards of sufficiently high quality to be used without reconciliation to U.S. GAAP in cross-border filings in the United States? Why or why not? Please provide us with your experience in using, auditing or analyzing the application of such standards. In addressing this issue, please analyze the quality of the standard(s) in terms of the criteria we established in the 1996 press release. If you considered additional criteria, please identify them.

Q.5 What are the important differences between U.S. GAAP and the IASC standards? We are particularly interested in investors’ and analysts’ experience with the IASC standards. Will any of these differences affect the usefulness of a foreign issuer’s financial information reporting package? If so, which ones?

Q.6 Would acceptance of some or all of the IASC standards without a requirement to reconcile to U.S. GAAP put U.S. companies required to apply U.S. GAAP at a competitive disadvantage to foreign companies with respect to recognition, measurement or disclosure requirements?

Q.7 Based on your experience, are there specific aspects of any IASC standards that you believe result in better or poorer financial reporting (recognition, measurement or disclosure) than financial reporting prepared using U.S. GAAP? If so, what are the specific aspects and reason(s) for your conclusion?

Can the IASC Standards be Rigorously Interpreted and Applied?

The Experience to Date

Q.8 Is the level of guidance provided in IASC standards sufficient to result in a rigorous and consistent application? Do the IASC standards provide sufficient guidance to ensure consistent, comparable and transparent reporting of similar transactions by different enterprises? Why or why not?

Q.9 Are there mechanisms or structures in place that will promote consistent interpretations of the IASC standards where those standards do not provide explicit implementation guidance? Please provide specific examples.

Q.10 In your experience with current IASC standards, what application and interpretation practice issues have you identified? Are these issues that have been addressed by new or revised standards issued in the core standards project?

Q.11 Is there significant variation in the way enterprises apply the current IASC standards? If so, in what areas does this occur?

The Need for a Financial Reporting Infrastructure

Q.12 After considering the issues discussed in (i) through (iv) below, what do you believe are the essential elements of an effective financial reporting infrastructure? Do you believe that an effective infrastructure exists to ensure consistent application of the IASC standards? If so, why? If not, what key elements of that infrastructure are missing? Who should be responsible for development of those elements? What is your estimate of how long it may take to develop each element?

The Interpretive Role of the Standard-Setter

Q.13 What has your experience been with the effectiveness of the SIC in reducing inconsistent interpretations and applications of IASC standards? Has the SIC been effective at identifying areas where interpretive guidance is necessary? Has the SIC provided useful interpretations in a timely fashion? Are there any additional steps the IASC should take in this respect? If so, what are they?

Q.14 Do you believe that we should condition acceptance of the IASC standards on the ability of the IASC to restructure itself successfully based on the above characteristics? Why or why not?

The Role of the Auditor in the Application of the Standards

Q.15 What are the specific practice guidelines and quality control standards accounting firms use to ensure full compliance with non-U.S. accounting standards? Will those practice guidelines and quality control standards ensure application of the IASC standards in a consistent fashion worldwide? Do they include (a) internal working paper inspection programs and (b) external peer reviews for audit work? If not, are there other ways we can ensure the rigorous implementation of IASC standards for cross-border filings in the United States? If so, what are they?

Q.16 Should acceptance of financial statements prepared using the IASC standards be conditioned on certification by the auditors that they are subject to quality control requirements comparable to those imposed on U.S. auditors by the AICPA SEC Practice Section, such as peer review and mandatory rotation of audit partners? Why or why not? Why or why not? If not, should there be disclosure that the audit firm is not subject to such standards?

Q.17 Is there, at this time, enough expertise globally with IASC standards to support rigorous interpretation and application of those standards? What training have audit firms conducted with respect to the IASC standards on a worldwide basis? What training with respect to the IASC standards is required of, or available to, preparers of financial statements or auditors certifying financial statements using those standards?

The Role of the Regulator in the Interpretation and Enforcement of Accounting Standards

Q.18 Is there significant variation in the interpretation and application of IASC standards permitted or required by different regulators? How can the risk of any conflicting practices and interpretations in the application of the IASC standards and the resulting need for preparers and users to adjust for those differences be mitigated without affecting the rigorous implementation of the standards?

Q.19 Would further recognition of the IASC standards impair or enhance our ability to take effective enforcement action against financial reporting violations and fraud involving foreign companies and their auditors? If so, how?

Q.20 We request comment with respect to ways to assure access to foreign working papers and testimony of auditors who are located outside the United States. For example, should we amend Regulation S-X to require a representation by the auditor that, to the extent it relied on auditors, working papers, or information from outside the United States, the auditor will make the working papers and testimony available through an agent appointed for service of process? If not, should we require that the lack of access to auditors’ workpapers be disclosed to investors? Is there another mechanism for enhancing our access to audit working papers?

Possible Approaches to Recognition of the IASC Standards for Cross-Border Offerings and Listings

Q.21 What has been your experience with the quality and usefulness of the information included in U.S. GAAP reconciliations? Please explain, from your viewpoint as a preparer, user, or auditor of non-U.S. GAAP financial statements, whether the reconciliation process has enhanced the usefulness or reliability of the financial information and how you have used the information provided by the reconciliation. Please identify any consequences, including quantification of any decrease or increase in costs or benefits, that could result from reducing or eliminating the reconciliation requirement.

Q.22 Should any requirements for reconciliation differ based on the type of transaction (e.g.. listing, debt or equity financing, rights offering, or acquisition) or the type of security (e.g.. ordinary shares, convertible securities, investment grade or high yield debt)? Are there any other appropriate bases for distinction?

Q.23 If the current reconciliation requirements are reduced further, do you believe that reconciliation of a bottom line figure would still be relevant (e.g.. presenting net income and total equity in accordance with U.S. GAAP)?

Q.24 Should any continuing need for reconciliation be assessed periodically, based on an assessment of the quality of the IASC standards?

Q.25 The IASC standards finalized as part of the core standards project include prospective adoption dates. Most standards are not required to be applied until fiscal years beginning on or after January 1, 1998, at the earliest. Should we retain existing reconciliation requirements with respect to the reporting of any fiscal year results that were not prepared in accordance with the revised standards or simply require retroactive application of all revised standards regardless of their effective dates? If not, why not?

Q.26 Does the existence of a reconciliation requirement change the way in which auditors approach financial statements of foreign private issuers? Also, will other procedures develop to ensure that auditors fully versed in U.S. auditing requirements, as well as the IASC standards, are provided an opportunity to review the financial reporting practices for consistency with those standards? If so, please describe these procedures. Alternatively, will the quality of the audit and the consistency of the application of the IASC standards depend on the skill and expertise of the local office of the affiliate of the accounting firm that conducts the audit?

APPENDIX B

LIST OF CORE STANDARDS AND EACH

STANDARD’S EFFECTIVE DATE