How to use ETFs in your investment strategies

Post on: 20 Октябрь, 2015 No Comment

Article utilities

Investors can use exchange-traded funds to tilt or change a core investments focus, including sector focus or just spicing up a strategy or even to park cash. We describe how to use ETFs in five key investment strategies.

Core and satellite

This entails surrounding a core of market-matching investments with small investments in a series of market-beating, or satellite, investments.

Exchange-traded funds can feature in this strategy in one of two ways.

One way is to fill a portfolios core with ETFs covering broad market indices such as the S&P/ASX 200 or, further afield, the S&P Global 100. Investors can then add to this core the fund of a preferred manager, the shares of a pet company and other assets.

Alternatively, narrower ETFs covering a sector or country can spice up a core of, say, blue-chip shares, residential property and managed funds.

Sector tilting

With a sector ETF, investors can lean or tilt their portfolios towards a favoured sector.

Domestically, providers are already tracking energy, financials, industrials, resources and property. Internationally, iShares has three funds covering consumer staples, healthcare and telecommunications.

Investors and self-managed superannuation funds taking a view that the resource sector will outperform over the short- to medium-term can tilt their portfolio and, with just one trade, have an interest in the top 60 or so mining and resource stocks listed on the ASX, says Australian Index Investments chief executive Annmaree Varelas.

The view behind, say, a resources-sector tilt can be strategic and based on a secular trend such as the industrialisation of China and other emerging economies. But it can also be tactical and based on a singular event such as, for example, a Chinese government economic stimulus package.

But independent ETF analyst Zac Wallis of Morningstar warns the ease of buying and selling ETFs is a double-edged sword for investors.

Investors trying to add value through sector rotation should note that macroeconomic calls are very difficult to get right consistently over time, he says.

It also pays to drill down into the index on which an ETF is based as not all indices are very diversified. Speculative resources stocks now make up a significant part of the Small Ordinaries Index, so a bet on it is a big bet on resources.

Cash equitisation

This is a baffling name for the straightforward idea of parking cash in an ETF until something better comes along. Institutions use cash equitisation for new money coming into their funds, says State Street Global Advisers Asia Pacific ETF head Frank Henze.

For example, if a funds performance benchmark is the S&P/ASX 200, the manager will buy an ETF over that index.

They keep exposure to the core benchmark while making decisions about where to allocate inflows, Henze says.

The starring role given to ETFs in sector tilting, cash equitisation and other tactical strategies shouldnt discourage patient investors from using them.

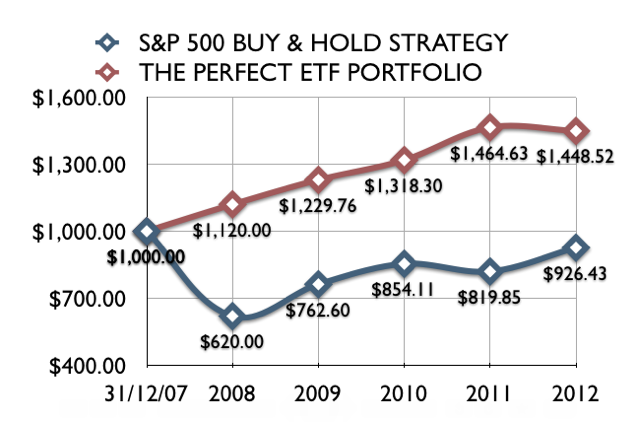

Buy and hold

ETFs are appropriate for a long-term buy-and-hold strategy as long as investors rebalance periodically, says Wallis. With a few easy trades, an investor can build a truly diversified equities portfolio at a very low cost.

ETFs can also be used to create set-and-forget wealth for the next generation, says AIIs Varelas. They are great, low-cost investments for children and grandchildren, as you have the ability to implement a dividend reinvestment plan, which assists in growing long-term wealth.

But parents and grandparents wanting to make regular contributions to a descendants future fund should look elsewhere, Wallis says.

At this stage, ETFs are not suitable for investors looking to use regular contribution strategies, as the trading costs will erode the cost benefits over time.

At present, investing in Australias resources-heavy sharemarket is an easy way for investors to profit indirectly from the rise of China and other rapidly industrialising economies.

Global diversification

But industrialisation and the demand for iron ore and other resources it generates is only one, time-limited aspect of Chinas rise. In future, profiting from emerging economies may require investing directly and indirectly in their companies. ETFs are available to make buying shares in China-listed companies as easy as in Australian ones.

For example, iShares has ETFs for individual countries (China, Japan, Singapore and South Korea), groups of countries (emerging markets, BRIC) and regions (Europe, Australasia and the Far East).

As well as globalising a portfolio, ETFs can put investors into sectors only weakly represented on the ASX. Take iShares global healthcare ETF.

A typical investor is unlikely to have a meaningful allocation to the healthcare sector given it is a relatively small component of the ASX, says Wallis. Adding this exposure to the portfolio will increase diversification.

Note most ETFs that invest in global markets are not hedged for currency risk so any rise in the Australian dollar will erode gains. A fall in the currency, however, would boost them.