How to Manage a Windfall Successfully

Post on: 20 Февраль, 2017 No Comment

Published on October 19th, 2006

This entry is part of JLPs October project a month-long, cross-blog review of the book The Bogleheads Guide to Investing. Some of what follows is taken directly from the book.

You have won $50,000! So, what do you do now?

Every day I give advice on following the slow, sure path to wealth. But what happens if you do manage to get rich quickly? What happens if you win the lottery, or hit the jackpot in Vegas, or inherit a million bucks from your Great Aunt Tilley?

The Bogleheads Guide to Investing notes that many people receive windfalls at some point in their lives. Most windfalls arent of the million-dollar variety most are on the order of tens of thousands of dollars. Its possible to receive large lump sum payments from:

- Inheritance

- Divorce settlement

- Insurance settlement

- Lawsuit settlement

- Real-estate sale

- An income bonus

- The sale of a business

- Retirement

- Etc.

What if you inherit $25,000? First, its important to understand that windfalls involve more than money. Sudden wealth involves strong emotion, values, and personal psychology. How you cope with fortune depends on who you are. Its not uncommon for a person who strikes it rich to feel guilt or fear. And, more often than not, the wealth is squandered quickly. According to The Bogleheads Guide to Investing :

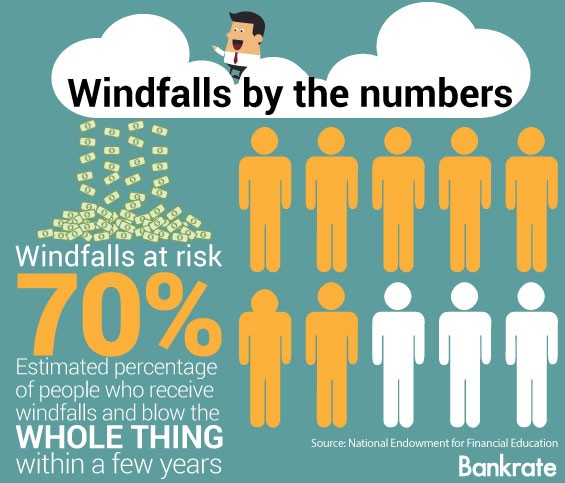

Most financial practitioners agree that well over 50 percent [of windfalls] are lost in a relatively short period of time. NBC News reported that more than 70 percent of lottery winners exhaust their fortunes within three years.

What should you do if you suddenly find yourself with a lot of money? Surprisingly, few personal finance books tackle the subject. Only one other book in my library addresses the issue. The Only Investment Guide Youll Ever Need includes a chapter entitled What To Do If You Inherit a Million Dollars; What To Do Otherwise. If you strike it rich, the book advises:

- Go out for a very nice dinner.

- Put about one year of living expenses into a savings account.

- Put the rest in diversified investments.

- Be sure your will is in order.

Andrew Tobias is a witty writer, and The Only Investment Guide Youll Ever Need is filled with great advice, but I think his recommendation for coping with windfalls is too mechanical. It fails to consider human nature. It assumes that everyone has the patience and wisdom to make the right choice. The advice in The Bogleheads Guide to Investing is more practical. Because of the emotional and psychological issues involved, the authors recommend caution and the following course of action :

- Pay any taxes due.

- Take one or two percent to treat yourself and your family. If you receive a windfall, by all means do something special. But do it modestly. How much is 1-2%? Its $10-$20 on a $1,000 windfall. Its $100-$200 on a $10,000 windfall. Its $1000-$2000 on a $100,000 windfall.

- Use some or all of the money to pay off debt. As unglamorous as this sounds, its the best course of action. If you have existing debt, use your windfall to get rid of it. This will free up cash flow, and youll essentially be able to enjoy a prolonged time-release windfall.

- Deposit the rest of the money in a safe account. Put it someplace that will earn you interest while you decide what to do with it.

- Do not touch the money for several months. Allow the initial emotion to pass. Get over the initial urge to spend the money on a big house or a fancy car. Live your life as you has before.

- Make a wish list. Spend time learning how much the windfall can buy. Most people have unrealistic expectations about how much $10,000 or $100,000 or $1,000,000 can buy. Resist all temptations to use the money now, but run the numbers to see what it could buy.

- Get professional help. Do not obtain advice from somebody who might profit from your money, such as a commissioned broker. Find a good CPA who does not sell investment products.

The Bogleheads advice is sound. If you follow these steps, youll enjoy prolonged benefit from your windfall. Like the other reviewers before me. I think that The Bogleheads Guide to Investing is filled with excellent, down-to-earth investment advice. Its not a comprehensive personal finance book, but its advice on investing is spot-on. Its certainly worth borrowing from your public library, and perhaps even worth purchasing.

(While researching this entry, I found this Liz Pulliam Weston article. which contains similar advice.)

GRS is committed to helping our readers save and achieve their financial goals. Savings interest rates may be low, but that is all the more reason to shop for the best rate. Find the highest savings interest rates and CD rates from Synchrony Bank. Ally Bank. GE Capital Bank. and more.