How to Create Your Own Target Date Fund for Retirement

Post on: 30 Июнь, 2015 No Comment

Hemera | Thinkstock

One spring day a few years back, I was whining to a friend that I didnt have the time to figure out which mutual fund, or funds, to buy for my IRA. The April 15 deadline to make a contribution was fast approaching. In a fit of frustration, I announced to my friend who happens to be a smart money manager that Id probably be better off just investing in a target-date retirement fund and be done with it.

She laughed and said, You know, you could put together your own target fund.

So I did. And you might want to do the same.

Set It and Forget It

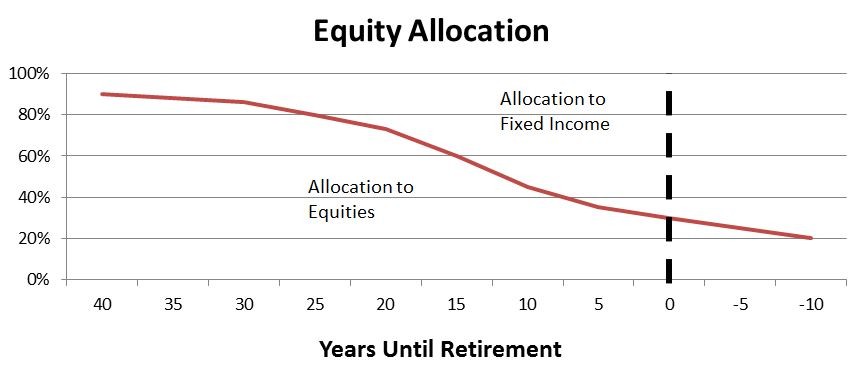

Many people who invest in target-date mutual funds do it because they can adopt a set-it-and-forget-it strategy for their retirement planning. With a target-date fund, you select the year youd like to retire and buy a mutual fund with that year in its name (like Target 2020). The fund manager then divvies up investors cash among stocks and bonds, shifting that allocation to a more conservative mix as the target date approaches, or soon after. Typically, the fund is doing this by buying multiple other funds from the same investment company.

As Next Avenue has explained. target-date funds can be a smart way to save for retirement if you dont have the knowledge, time or desire to actively choose and monitor your investments. Many people use target-date funds when investing in their 401(k) plans.

But that doesnt really describe my approach to managing my retirement savings. Im not the type to hand over my money and passively forget about it for the next 15 years or so.

Setting Up a DIY Target-Date Fund

So I took my friends advice and set up my own DIY target-date retirement fund in a self-directed IRA at a no-load mutual fund company.

Actually, its four stock and bond mutual funds that together work like one target-date fund. As I make my regular annual contribution to my retirement savings, I pick which of these funds to juice up. Some years Ive added only to the bond portion; in other years, Ive doled a portion to the equity side, too.

I see my DIY target fund as a way to invest in mutual funds that have been vetted by pros and strike the balance that I want between owning stable bonds and stocks that can provide some oomph. This tactic gives me a sense that Im in control of my own portfolio, but its a little like bowling with the bumpers up. Im relatively secure in the knowledge that Im not going to roll a gutter ball. Thats empowering for me.

If you think this approach might suit you, follow these steps to create your own personal target-date fund:

Select your target date the year you expect to retire. I hope to retire in 2025, when I turn 65, or within a few years of that. Since Im self-employed with no employer pension waiting, I figure Ill probably wind up working longer. But the 2025 target gives me a bulls-eye for planning purposes.

Research target-date fund families to find a fund with the date you want. The biggest target-date fund families are Fidelity, T. Rowe Price, and Vanguard, though most financial institutions offer them, too. I picked Vanguard for a few reasons. Im a big believer in no-load index funds, which Vanguard is known for, and my husband and I already had accounts there. Plus, Vanguard was the only fund company I found specializing in index funds for its target-date funds.

Aim for low expenses. Actively-managed target-date funds tend to have the highest annual expenses on average, above .70 percent, according to Morningstar. Many Exchange Traded Funds or ETFs charge less than 0.30 percent. Vanguard has an average charge of 0.18 percent for its target funds.

Check out the funds holdings. Find the target fund on its companys website and see what percentage of the fund is in stocks, bonds and cash, and which particular mutual funds the target-date fund invests in.

I discovered that Vanguards 2025 fund, for example, invests in three Vanguard index funds, now holding approximately 70 percent of assets in equities through a Total Stock Market Index Fund and a Total International Stock Index Fund. The remaining 30 percent of the Vanguard 2025 fund is invested in bonds. Truthfully, thats a little tame for me.

Within seven years after 2025, the Vanguard funds asset allocation gets more conservative. At that point, the fund is expected to hold around 70 percent of assets in bonds and cash, and about 30 percent in U.S. and international stocks.

Fidelity Freedom 2025, by contrast, is currently more conservative than Vanguards 2025. Its equity portion is 68 percent. T. Rowe Price is a tad more aggressive, with around 77 percent in stocks.

Build it yourself. Mimic your chosen target funds asset allocation model by dividing your investment dollars among the same funds the target fund holds, using its stock/bond/cash percentages as a guide. You can then tweak the weighting of stocks and bonds in your DIY target-date fund to suit your comfort level. You might want to also buy another fund or two from the company if you want to own investments the target fund doesnt hold.

For the most part, I opted for Vanguards index fund strategy then tossed some dough into a Vanguard emerging markets index fund as well. As a result, my 2025 target fund skews more toward equities than Vanguards, but not radically so.

Rebalance your holdings when necessary. Once a year say, at tax time youll want to check in on the funds within the target-date fund youre imitating. Then, if your overall portfolio balance has changed because one of the funds is way up or way down, you can tweak your DIY holdings to get back to the level you want by selling some shares of the fund that is pumped up and buying shares of the one that isnt as big a percentage as you originally targeted.

So far, Ive only rebalanced once to give a little more weight to bonds. At the time, the stock market was jittery from the fallout of the debt crisis in European markets and I was feeling a little rattled. That made me glad I had my DIY target-date retirement program, so I could make the adjustment and sleep better at night.