How to Calculate Return on Investment

Post on: 1 Июнь, 2015 No Comment

Many people use the return on investment calculation to determine how well their investments are performing. The benefit of the return on investment (ROI) calculation is that it is very simple to understand and to complete. It is also beneficial because it gives meaning when someone tells you they earned $5,000 on an investment. But there is a downside to the return on investment calculation as well. Before we get to all of the benefits and downsides, we first need to see what the return on investment calculation looks like.

Photo Credit: Stuart Miles

Return on Investment Calculation

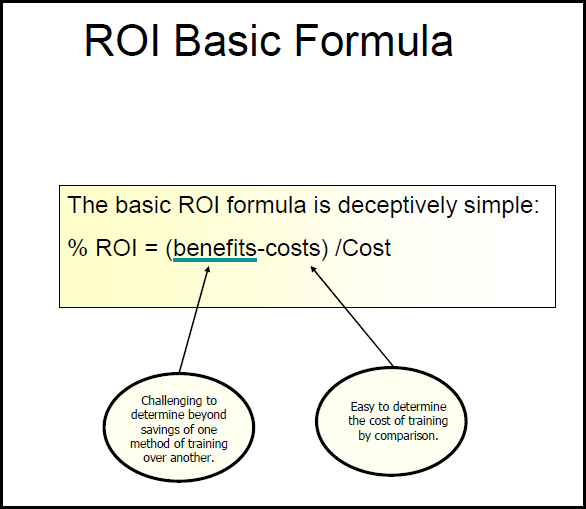

The equation for return on investment is straightforward. You simply take the gain from your investment, subtract the cost of the investment and divide that answer by the cost of the investment. Here is how it looks graphically:

ROI = (Gain From Investment – Cost Of Investment)/Cost Of Investment

For example, let’s say we bought a mutual fund for $5,000 and we sold it for $10,000. The equation would be:

ROI = ($10,000 $5,000)/$5,000

The return on investment is 100%. This is clear since we doubled our money. But what if we bought $5,000 of a mutual fund, and then bought another $10,000, earned a $250 dividend and sold everything for $17,000? Here is how this would look:

ROI = ($17,250 $15,000)/$15,000

In this case, the return on investment is 15%. Note that the gain from your dividend needs to be accounted for. Without accounting for it, you are underestimating your return on investment.

Pitfalls To Watch For

The biggest pitfall with the return on investment calculation is that many times people omit important information, which therefore gives them an incorrect answer. The dividend example about is just one of these pitfalls. Others include:

Transaction Costs: If you are being charged to buy a stock by an online broker. that charge needs to be included in your costs.

Dividends & Capital Gains: I mentioned dividends above, but don’t forget about capital gains as well. Both of these need to be added to your gain when computing return on investment.

Home ownership Costs: Many times, whether it is homeowners or rental property owners, people forget to include ongoing costs associated with the house which include insurance, taxes, upgrades, etc. All of these need to be included in the cost of the home. It would be inaccurate if you sold your house for $250,000 which included the appreciation of your remodeled kitchen but you never included the cost of the remodeled kitchen in your costs.

Benefits Of Return on Investment

The greatest benefit from return on investment is that it tells us exactly how profitable an investment was. For example, let’s say you have two friends, Bill and Sarah and Bill tells you he just made $5,000 selling his collectibles and Sarah tells you she just made $1,000 on a stock. Just looking at these numbers, you would think that Bill’s investment in collectibles is a better one because he earned more cash. The problem is that we don’t know the costs associated with each.

When we look at the return on investment, we see that Bill sold his collectibles for $60,000 but his cost was $55,000. He made $5,000 and his return on investment was 9%. But Sarah sold her stock for $10,000 after buying it for $9,000 making her return on investment 11%. Even though Bill has more cash on hand, Sarah’s investment was the better investment in terms of return on investment.

Downside Of Return on Investment

In the beginning of this post I mentioned that the return on investment calculation has a downside. That downside is time. The return on investment calculation does not take into account time. This makes a big difference. For example, assume Bill and Sarah are back and they have a hot new investment for you take part in. Bill’s will return 100% and Sarah’s will return 65%. On the surface, Bill’s looks like the winner. But what if you have to wait 10 years to earn Bill’s return and Sarah’s investment will pay you back in 3 years? Here, Sarah’s investment is superior.