How to Calculate Return on Invested Capital

Post on: 1 Июнь, 2015 No Comment

Return on Invested Capital (ROIC) is a measure of financial performance expressed as a percentage that is a very useful metric for assessing how much profit a company is generating for every dollar that is invested in it. When compared to simply looking at a company’s profit margin, ROIC gives you a better picture of how efficiently a company is using the capital that has been invested in it to generate income. This is of course important to any prospective investor who is considering investing in an organization.

The general formula for calculating ROIC is:

ROIC = Net Income after Tax ÷ Invested Capital

Invested Capital represents the investment in the company, be it funded through debt or equity, that has is being used to generate income. The basic method for arriving at Invested Capital is:

How Useful is calculating Return on Invested Capital?

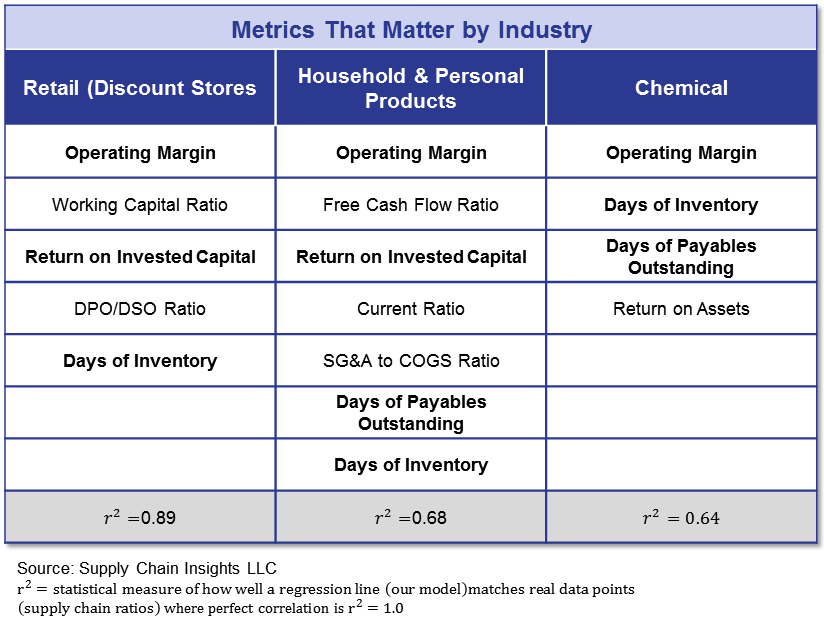

The importance of looking at a company’s year over year ROIC varies depending on the type of company in consideration, as is the case with many other profitability metrics. For industries that tend to make large capital investments, such as Oil & Gas, Manufacturing, and even large retail chains, calculating ROIC is especially informative. For service based entities that require only small investments in capital in order to generate revenue ROIC is less useful.

When looking at ROIC it is also important to consider what the cost of capital (borrowing rate) is for the company that you are looking at. If year over year the company’s cost of capital exceeds the return on capital the company is actually losing value for every additional dollar invested in it. This is a serious problem for any company in the long run. That said, in cases where management is actively improving the return on invested capital, whether through divesting low performing assets or other business plans, a company can still be a good investment target even if the ROIC is lower than its cost of capital.

Additional Considerations when Looking at ROIC

It is important to note that some institutions calculate ROIC in a slightly different manner. This can make direct comparisons misleading if you do not make sure that the underlying method is consistent.

- Using Net Income after Dividends as the numerator instead of Net Income after Tax

- Deducting excess cash from the value for Invested Capital, as some feel that excess cash is value in the company that should not be considered Invested Capital for generating income. This adds a degree of subjectivity as calculating excess cash, or cash not required for regular operations, can vary based on individual opinion.

- Using average Long Term Debt and Shareholder Equity to approximate the actual invested capital over the year.