How Farm Subsidies Harm Taxpayers Consumers and Farmers Too

Post on: 28 Март, 2016 No Comment

How Farm Subsidies Harm Taxpayers, Consumers, and Farmers, Too

This year’s expiration of federal agriculture policies gives Congress an important opportunity to take a fresh look at the $25 billion spent annually on farm subsidies. Current farm policies are so poorly designed that they actually worsen the conditions they claim to solve. For example:

- Farm subsidies are intended to alleviate farmer poverty, but the majority of subsidies go to commercial farms with average incomes of $200,000 and net worths of nearly $2 million.

Lawmakers would be hard-pressed to enact a set of policies that are more destructive to farmers, taxpayers, and consumers than the current farm policies. For these and other reasons, organizations representing taxpayers, consumers, environmentalists, international trade, Third World countries, and even farmers themselves have united around the shared conclusion that the current farm subsidy system is failing and in dire need of reform during this year’s reauthorization.

A Solution Seeking a Problem

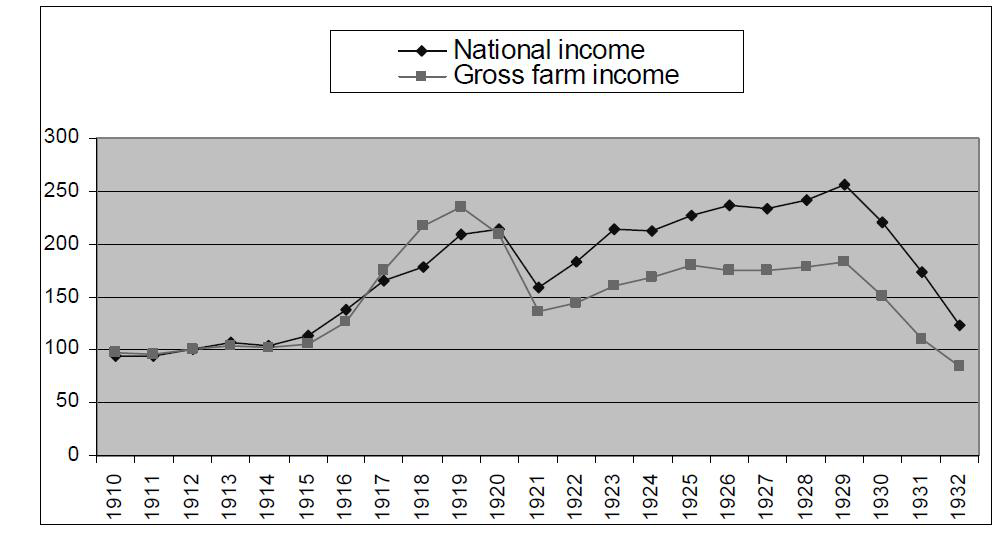

Before delving into the minutiae of farm policy, lawmakers should first determine what subsidies are intended to accomplish. When President Franklin D. Roosevelt introduced farm subsidies in the 1930s, Secretary of agriculture Henry Wallace called them a temporary solution to deal with an emergency.[1] That emergency was the collapsing farm incomes that afflicted the 25 percent of the population living on farms.

Today, farmers account for just 1 percent of the population, and farm household incomes are well above the national average, making the original justification irrelevant. What modern market failure or social problem is solved by farm programs today? Subsidy advocates offer five flawed justifications.

Myth #1: Farmer poverty.

This is the most common-and provably incorrect-justification. The average farm household earns $81,420 annually (29 percent above the national average); has a net worth of $838,875 (more than eight times the national average); and is located in a rural area with a low cost of living.[2] The farm industry’s current 11.4 percent debt-to-asset ratio is the lowest ever measured and helps to explain why farms fail at only one-sixth the rate of non-farm businesses.[3]

Overall, net farm income totaled $279 billion between 2003 and 2006-the highest four-year total ever.[4] The farm economy is thriving, and farmer incomes are soaring.

Furthermore, farm subsidy formulas are designed to benefit large agribusinesses rather than family farmers. Most farm subsidies are distributed to commercial farmers, who have an average income of $199,975 and an average net worth of just under $2 million.[5] If farm subsidies were really about alleviating farmer poverty, lawmakers could guarantee every full-time farmer an income of 185 percent of the federal level ($38,203 for a family of four) for just over $4 billion annually-one-sixth of the current cost of farm subsidies.[6]

Myth #2: Crop disaster compensation.

While farming can be very profitable, farmers are always one weather disaster away from losing their crops, but this risk can be handled with basic crop insurance rather than with expensive annual government subsidies. Washington does not address homeowners’ risks by writing each family an annual check regardless of whether or not their homes have been damaged.

Giving farmers $25 billion in annual subsidies regardless of whether or not their crops have been damaged is no more logical. Crop insurance markets, as well as futures and options markets, can balance good and bad years in a way that is cost-neutral over the long run.

Myth #3: Maintaining a cheap and stable food supply.

Some contend that food markets would fluctuate wildly without farm subsidies. In reality, food prices of both subsidized and unsubsidized crops are relatively stable. Given that the percentage of family budgets spent on food has dropped from 25 percent to 10 percent since 1933, any potential price instability would have an increasingly small impact on family budgets.[7] Even if price stabilization was necessary, price support programs have largely been replaced by commodity subsidies that stimulate overproduction rather than stabilize prices.

Nor do farm subsidies contribute to lower food costs. Two-thirds of food production is unsubsidized and thus relatively unaffected by subsidies. Of the remaining one-third, price reductions caused by crop subsidies are balanced by conservation programs that raise prices. Furthermore, food prices are based not only on crop prices, but also on food processing, transportation, and marketing costs. Bruce Babcock, professor of economics at Iowa State University, has calculated that eliminating farm subsidies would have virtually no effect on food prices.[8]

Myth #4: National security.

Proponents contend that without subsidies, American farm products would be replaced by imports, leaving the United States dangerously dependent on foreigners for food. However, the United States currently grows more food than it needs to feed itself and exports a quarter of its production.[9] The lack of subsidies has not driven all beef, poultry, pork, fruit, and vegetable production out of America, nor would it drive away production of currently subsidized crops.

Myth #5: Other countries’ agricultural policies.

Europe and Japan’s farm subsidies bring American consumers food at below-market prices. Rather than enact trade barriers to prevent this, Americans should welcome the cheap imports and allow farmers to focus on producing the crops in which the United States has a comparative advantage. Responding with U.S. subsidies and trade barriers has the net effect of raising prices for American consumers and thereby limiting any progress in free-trade negotiations. Australia largely eliminated its farm subsidies in the 1970s, and after a brief adjustment, its farm economy flourished. New Zealand implemented a similar policy in the 1980s with the same result.[10]

Two-thirds of all farm production-including fruit, vegetables, beef, and poultry-thrives despite being ineligible for farm subsidies.[11] If any of the five justifications were valid, these farmers would be impoverished, near bankruptcy, or replaced by imports, and both the supplies and prices of fruit, vegetables, beef, and poultry would fluctuate wildly. Clearly, this has not happened. In this controlled experiment comparing subsidized and unsubsidized crops, the doomsday scenarios described above have not occurred for unsubsidized crops.

The most logical explanation for the persistence of farm subsidies is simple politics. Eliminating a government program is nearly impossible because recipients form interest groups that relentlessly defend their handouts. The public paying the costs is too busy going about their lives to challenge each wasteful program. Furthermore, supporters of farm subsidies often repeat the five justifications, especially the myth that these policies aid struggling family farmers. The difference between perception and reality in farm policy is large.

How Farm Subsidies Lack Economic Sense

Farm subsidies serve no legitimate public purpose. Worse, they harm the farm economy. This section explains both how farm subsidies work and the economic incoherence embedded in U.S. farm policy. (See also the accompanying text box, How Farm Subsidies Are Calculated.)

The Main Commodity Programs. Farm policy is extraordinarily complex. This complexity conveniently insulates the farm policymaking process within a small group of lawmakers and interest groups who specialize in the details.

Subsidy eligibility is based on the crop. More than 90 percent of all subsidies go to just five crops-wheat, cotton, corn, soybeans, and rice- while the vast majority of crops are ineligible for subsidies. Once eligibility is established, subsidies are paid per amount of the crop produced, so the largest farms automatically receive the largest checks.

Subsidies are also quite duplicative. The names of the three different commodity subsidies do not adequately describe their purposes:

- Marketing loan program. Despite being called a loan, this program has the net effect of reimbursing farmers for the difference between a crop’s market price and the minimum level that Congress sets every five to six years.[12]

For farmers who grow the subsidized crop, these policies have the net effect of subsidizing them up from their crop’s market price to its countercyclical price rate, or even higher when the market price is above the countercyclical rate and they receive fixed payments.

Remedying Low Prices with Lower Prices. Farm policy is supposed to help farmers recover income lost because of low crop prices. However, farmers can increase their subsidies by planting additional acres, which increases production and drives prices down further, thereby spurring demands for even greater subsidies. In other words, subsidies merely lower prices. This is the policy equivalent of trying to use gasoline to extinguish a fire.

When the 1996 farm bill increased the marketing loan rate of soybeans from $4.92 to $5.26 per bushel (which meant larger subsidies), farmers responded by planting an additional 8 million acres of soybeans, which contributed to the 33 percent decline in soybean prices over the next two years.[13] Instead of alleviating low soybean prices, the new subsidies accelerated their fall at considerable taxpayer expense. Even the U.S. Department of Agriculture (USDA) admits that subsidy increases have induced farmers to plant millions of new acres of wheat, soybeans, cotton, and corn.[14]

In a free market, low prices serve as an important signal that supply has exceeded consumer demand and that production should shift accordingly. By shielding farmers from low market prices, farm subsidies induce farmers to grow whatever government will subsidize, not what consumers really want. Stephen Houston Jr. a Georgia cotton farmer, recently told The Atlanta Journal-Constitution. We’re just playing a game. [Market] prices don’t have anything to do with what we’re doing. We’re just looking at the government payments.[15]

Contradictory Policies. After handing out commodity subsidies that pay farmers to plant more crops, Washington then turns around and pays other farmers not to farm 40 million acres of cropland each year-the equivalent of idling every farm in Wisconsin, Michigan, Indiana, and Ohio. The Conservation Reserve Program, which pays farmers to sign 10-year contracts pledging not to farm their land, is often promoted as supporting environmental stewardship. In reality, removing farmland to raise crop prices has been the program’s central long-term justification. Paying some farmers to plant more crops and others to plant fewer crops simply makes no sense.

Ignoring Yields. The illogic does not end there. Businesses calculate their revenues by multiplying the product’s price by the quantity sold. Similarly, farmers calculate per-acre revenues by multiplying the crop price by the yield (crop volume per acre). However, farm subsidy formulas focus only on crop prices and simply plug in a historical yield measure for the quantity.

This makes little sense. Revenues depend as much on the quantity sold as on the price, and these two variables often move in opposite directions. In agriculture, this leads to one of two common scenarios:

- Surging yields flood the market with crops and cause prices to drop. Total revenues may increase, yet farmers still receive large subsidies simply because the price fell.

These scenarios are not merely theoretical. The American Farmland Trust has observed that a large drought in 2002 cut many Midwest corn farmers’ yields in half, but many farmers did not receive subsidies because prices did not fall. The opposite situation occurred in 2005 when very large corn yields flooded the market, driving down corn prices and inducing large corn subsidies despite healthy farm revenues.[16] Consequently, Washington often wastes taxpayer dollars by subsidizing farmers when they need it the least.

Subsidizing Both Crop Insurance and Disaster Aid. In 2000, Washington tripled crop insurance subsidies in an effort to eliminate the need for farm disaster payments. The budget-busting 2002 farm bill was also promoted as being large enough to reduce the need for disaster payments.

Yet even with generous farm programs and subsidized crop insurance, Congress has passed a disaster aid bill every year since 2000 at a total cost of $40 billion.[17] Congress has even drafted legislation offering disaster aid to farmers who refuse to purchase crop insurance at taxpayer-financed discounts. With Congress continuing to pass large disaster aid packages, what crop insurance subsidies are really funding is unclear.

The federal crop insurance program currently subsidizes 60 percent of all premiums for the 242 million acres that farmers have enrolled in the program. It is run by 16 private firms that accept federal subsidies but must charge the prices set by Washington. Recently, an insurer that dared to offer farmers a discount was upbraided at a congressional hearing, and Representative Jack Kingston (R-GA) successfully authored legislation to prohibit federal subsidies for that plan.[18]

The program seems to have been designed to aid insurance companies and harm taxpayers. Insurers are allowed to pass high-risk policies on to the government while keeping for themselves the low-risk policies that are likely to be profitable. Consequently, since 1998, the participating companies have earned $3.1 billion in profits, while Washington has lost $1.5 billion. Additionally, since 1998, Washington has paid nearly $20 billion in premium subsidies and more than $6 billion to cover the insurance companies’ administrative costs.

All in all, the crop insurance program spends $3.34 for every $1 in paid claims-and it still has not prevented $40 billion in disaster aid.[19]

Driving Small Farmers out of Business. Farm subsidies are promoted as assistance to family farmers. In reality, they finance the demise of family farms and prevent young people from entering farming. Economists estimate that subsidies inflate the value of farmland by 30 percent. High farmland prices make starting a farm prohibitively expensive for younger people, who would also have other expenses, including buying expensive equipment, seeds, and pesticides. With young farmers unable to enter the industry, the average age of farmers has increased to 55.[20]

Because agribusinesses are already the most profitable, they often use their enormous farm subsidies to buy out smaller family farms. In what has been called the plantation effect, family farms with less than 100 acres are being bought out by larger agribusinesses, which then convert them into tenant farms. Three-quarters of rice farms have already become tenant farms, and other types of farms are trending in that same direction.[21] Since 1945, the number of farms has dropped by two-thirds, and the average farm size has more than doubled to 441 acres.[22]

This consolidation is not necessarily harmful and may improve efficiency. Large agribusinesses are not villainous. They often succeed because they can produce large quantities of food at low prices. Furthermore, the blame for the tilted distribution of farm subsidies lies with Congress, which writes the laws, rather than with the agribusinesses that cash the checks that they receive because of those laws.

Nevertheless, taxpayers should not be required to finance this consolidation through farm subsidies. By raising land values and financing consolidation, farm subsidies drive out existing small farmers and prevent new farmers from entering the industry.

The Scandalous Distribution of Farm Subsidies

One can imagine the result if Washington tried to solve poverty by creating a welfare program that applied only to workers in the fast food, cleaning, and retail industries. Everyone in those occupations would receive a government check, with the richest executives receiving the largest checks and the poorest workers receiving the smallest. Workers in other industries would receive nothing, no matter how poor they were.

Obviously, such a policy would be nonsense, yet this exemplifies how farm subsidies are distributed. The government’s solution to alleged farmer poverty is to subsidize growers of wheat, cotton, corn, soybeans, and rice while giving no subsidies to producers of fruit, vegetables, beef, poultry, and livestock. Because subsidies are paid per acre, the largest and most profitable farms receive the largest subsidies, while family farms receive next to nothing.

Thus, a large, profitable rice corporation can receive millions while a family vegetable farmer receives nothing. Overall, farm subsidies are distributed with little regard to merit or need.

Corporate Welfare. Farm subsidies are promoted as helping struggling farmers, but Washington could guarantee every full-time farmer an income of nearly $40,000 for just $4 billion annually. Instead, farm policy is designed to aid corporate agribusinesses. Among farmers eligible for subsidies, just 10 percent of recipients collect 73 percent of the subsidies-an average of $91,000 per farm. (See Chart 3.) By contrast, the average subsidy granted to the bottom 80 percent of recipients is less than $3,000 annually.[23]

According to the USDA, the majority of farm subsidies are distributed to commercial farms, which have an average household income of $199,975 and a net worth of just under $2 million.[24] Commercial farms are also among those that need subsidies the least because they are the most efficient. Former U.S. Farm Bureau President Dean Kleckner writes that the top quarter of corn farmers (usually agribusinesses with economies of scale) can produce a bushel of corn 68 percent cheaper than the bottom quarter of farms can.[25]

Multiplying this larger profit margin by their substantially larger production volume shows how large agribusinesses can be enormously profitable. Yet these agribusinesses, not small family farms, receive most of the subsidies, making farm subsidies America’s largest corporate welfare program. (See Table 1.)

That is not all. Farm subsidies over the past decade have also been distributed to:

- Fortune 500 companies, such as John Hancock Life Insurance ($2,849,799); International Paper ($1,183,893); Westvaco ($534,210); and ChevronTexaco ($446,914).

Payment limits do exist on paper. Subsidies are restricted to farmers with incomes below $2.5 million, and an individual’s subsidy may not exceed $180,000 per farm or $360,000 for up to three farms. However, an entire industry of lawyers exploits loopholes, rendering these limits meaningless.

Farmers can simply divide their farms into numerous separate entities and then collect subsidies for each farm. For example, Tyler Farms in Arkansas has collected $37 million in farm subsidies since 1996 by dividing itself into 66 legally separate corporations to maximize its farm subsidies.[27] Other farmers evade payment limits by signing up family members, such as the Georgia farmer who reportedly collected thousands in additional subsidies by signing up his two-year-old daughter as an additional farmer, making her eligible for up to $180,000. As Chuck Hassebrook of the Center for Rural Affairs has concluded, We have no [payment] limits today.[28]

Eligibility Restricted to a Few Crops. Only one-third of the $240 billion in annual farm production is eligible for farm subsidies. Five crops-wheat, cotton, corn, soybeans, and rice-receive more than 90 percent of all farm subsidies. Fruits, vegetables, livestock, and poultry, which comprise two-thirds of all farm production, are generally not subsidized at all.[29] This is important for two reasons.

First, those who assert that the absence of farm subsidies would cause massive poverty, rapid price fluctuations, and the eventual demise of the agricultural industry have not persuasively explained why the two-thirds of the industry that operates without subsidies has experienced none of these problems.

Second, those who assert that farm subsidies are necessary to alleviate farmer poverty have not explained why Washington should favor one crop over another.

Farm Subsidies for Suburban Backyards. In 1996, lawmakers noticed that farm subsidies were only encouraging more planting and thereby further lowering prices, so they created a fixed payments subsidy that would pay farmers based on what had been grown on the land historically without obligating them to continue planting that crop. While designed with positive intentions to reduce market distortions, these fixed payments have ended up subsidizing land that is no longer used for farming. In fact, some homeowners are now collecting subsidies for the grass in their backyards.

A recent Washington Post investigation discovered 75 acres of Texas farmland that had been converted into a housing development. Today, the homeowners on these properties (which are worth well over $300,000 each) are eligible for fixed payments for the lawn in their backyards because of its historical rice production. Residents never asked for these subsidies and have even stated that as non-farmers they do not want the government mailing them checks.[30] Over the past 25 years, rice plantings in Texas have plummeted from 600,000 acres to 200,000, in part because people can now collect generous rice subsidies without planting rice. If Washington insists on subsidizing farming, subsidizing actual farmland rather than residential neighborhoods that were once farmland would make more sense.

Compensation Not Based on Actual Sale Prices. As explained in the text box, the marketing loan program (despite the loan misnomer) effectively pays farmers whenever crop prices fall below a government-set minimum. Amazingly, farmers are not compensated for the actual price at which they sell their crops. Instead, they can pick the market price on any day of the year and, even if they do not sell their crops at that market price, receive a subsidy based on it.

For example, in 2005, the marketing loan rate for corn in DeKalb County, Illinois, was $1.98 per bushel. In September, the market price fell to $1.52 per bushel, and local farmers walked into the local USDA field office and received a payment of $0.46 per bushel. The following January, when they finally sold their corn, the price had risen to $2.60 per bushel, well above the government-set minimum. The federal policy allowed farmers to keep the subsidies as compensation for a low market price at which they never actually sold their crops. The amounts can be substantial: DeKalb County farmer Roger Richardson received an extra $75,000 subsidy for crops that grossed $500,000.[31]

These are not isolated incidents. In 2006, national corn prices were only $0.05 below the $1.95 marketing loan rate. Nonetheless, corn farmers received an average marketing loan subsidy of $0.44 per bushel.[32] President Bush has proposed addressing this loophole by requiring that monthly average crop prices-rather than daily prices- become the basis for determining marketing loan subsidies. This would prevent a one-day drop in crop prices from causing a year-long surge in farm subsidies. Unless Congress acts, farmers will continue to be compensated for low prices that never affect them.

Aid for Questionable Disasters. Lawmakers often supplement generous farm subsidies and subsidized crop insurance with annual disaster assistance packages. The Washington Post discovered that the USDA encourages disaster declarations for counties without disasters and distributes disaster aid to farmers without requiring proof of any disaster.

Specifically, when the Livestock Compensation Program operated in 2002 and 2003 to compensate farmers for a drought, the majority of payments went to farmers in areas with either moderate drought or none at all. The USDA reportedly urged state and county officials to find anything that could be interpreted as a disaster and use it to qualify the county’s farmers for disaster aid. Consequently, more than 2,000 of the nation’s 3,141 counties were declared agriculture disasters, including:

- Whatcom County, Washington, for a distant earthquake that registered only 3 on the local Richter scale and caused no reported damage.

Nor were the individual farmers required to prove any losses. Washington simply sent them disaster assistance checks based on the number of livestock that they owned. In other words, disaster aid was almost completely disconnected from actual disasters.[33]

Livestock disaster assistance is not the only example of misdirected disaster aid. When sweet potatoes became eligible for crop insurance, planting quadrupled, but crop failures surged. Farmers were purposely growing sweet potato crops on unsuited land and skimping on all production costs simply to collect generous crop insurance and disaster aid-a practice known as farming your insurance. Accordingly, the sweet potato insurance program was paying out $16 in insurance claims for every $1 paid in premiums before Congress fixed it in 2005.[34] It is reasonable to assume that this practice continues to some degree in other crops.

The Overall Impact of Farm Policy

Although farm policies serve no legitimate purpose, they have profoundly negative effects on taxpayers, consumers, and small farmers, including:

- Higher prices. James Bovard once wrote, For almost every farm program, there is another equal but opposite farm program or provision.[35] Commodity subsidies encourage overproduction and therefore lower prices. The Conservation Reserve Program encourages underproduction and thereby raises prices. Tariffs raise import prices. Export subsidies lower export prices. Price supports triple the price of sugar and raise the price of milk. Calculating the net effect of these contradictory programs, the Organisation for Economic Co-operation and Development estimates that U.S. farm policy raises food prices enough to cost consumers an extra $12 billion annually-in effect, an average annual food tax of $104 per household.[36]

Conclusion

If Congress takes the path of least resistance and extends current farm policies for another five years, it will have surrendered an enormous opportunity for reform. Most debates over federal programs force lawmakers to balance a program’s social benefits with the costs of financing it, but current U.S. farm policies serve no legitimate purpose. They burden American families with higher taxes and higher food prices. They harm small farmers by excluding them from subsidies, raising land prices, and financing farm consolidation. They increase trade barriers that reduce incomes in America and in lesser-developed countries. They are falsely promoted as saving the family farm and protecting the food supply. In reality, they are America’s largest corporate welfare program.

This year’s farm bill debate will test whether Congress is serious about reform or will continue business as usual by pandering to special-interest groups that are working to protect their federal largesse. Congress and President Bush should take a more sensible approach to farm policy this year. Instead of rubberstamping the status quo, they should return to the market-based approach embodied in the 1996 Freedom to Farm Act.

Brian M. Riedl is Grover M. Hermann Fellow in Federal Budgetary Affairs in the Thomas A. Roe Institute for Economic Policy Studies at The Heritage Foundation. Ian Hinsdale, a former Heritage Foundation intern, contributed to this paper.