Hedge funds

Post on: 3 Март, 2016 No Comment

The business media is awash with financial jargon, perpetuating the myth that the stockmarket is hideously complex and therefore best left to the professionals.

Instead, successful investing requires a basic understanding of the financial markets and the application of core investment principles.

Stock Market Terminology

What is a Share? Also known as Equities or Stocks, they represent part-ownership of a company. As a shareholder, you have a right to say in the decision making (through annual meetings) and are entitled to a share of the profits through the payments of dividends.

Board of Directors A group of elected or appointed members who run the day-to-day affairs of that company. They are elected by the shareholders to represent their interest.

Initial Public Offering When a company raises money by issuing shares to the public for the first time. Also referred to as Flotation or coming to the market.

Rights Issue When a company issues new shares to existing shareholders in order to raise money.

Market Makers Individuals or stock brokers who guarantee to buy and sell shares in a particular company, in order to maintain liquidity. They create markets in illiquid shares, ensuring theres always a buyer and seller.

Bid-ask spread This is the difference between the purchase price and the sales price, it is maintained by the market maker.

Liquidity The number of buyers and sellers in a particular market. It impacts the degree to which an asset can be sold quickly and easily, with little or no change in asset value. Property is an example of an illiquid asset.

The Big Bang (October 27, 1986) - The day in which the London Stock Market was deregulated. Changes included a shift from open outcry to an electronic system and the abolition of fixed commissions.

Short-Selling The practise of betting that a share price will decrease. It is the act of selling a borrowed asset with the intention of buying it back at a lower price and returning it back to the owner, pocketing the difference.

Moral Hazard The incentive to take greater risks, because someone else will bear the costs if things turn badly.

Securities – The general name given to shares, bonds and similar investments that are often traded on the stock exchange

Blue chip s These are large, nationally recognized and well-established businesses. Examples include Royal Dutch Shell and Vodafone Group.

FTSE 100 An index composed of the 100 largest companies listed on the LSE (London Stock Exchange). It measures the value of the top 100 companies and acts as a barometer of the British economy. Although most of the FTSE 100s revenue are now derived internationally (more than 70%).

AIM (Alternative Investment Market) - Its the London Stock Exchanges market for small, high-growth companies wishing to raise finance without the onerous regulations of the main market.

S & P 500 - The Standard and Poor 500 is a stockmarket index made up of 500 of the largest and most widely held companies on the NYSE (New York Stock Exchange).

Both the FTSE 100 and S & P 500 are weighted by the market capitalization of each stock, meaning larger companies account for a greater portion of the index.

Bear Market A prolonged period of declining asset prices, fuelled by investor pessimism and lack of confidence. It is characterised by stockmarket declines of 20% or more. Stock market corrections are historical norms, they happen roughly once a year in the 10% range and two to three times a decade within the 20% range.

By contrast, bull markets occur when financial markets have appreciated by at least 20%.

J.P. Morgan table of Bear and Bull markets.

Beta - This measures the sensitivity of a stocks price relative to the overall market. If a stock has a beta of 1, it indicates a level of volatility equal to the stock market.

Volatility - Indicates the speed and amount by which an investment changes in value. For example established blue-chip stocks tend to have a stable prices, making them less volatility.

Core Tier 1 capital - A measure of a banks financial strength. This consists of shareholder equity (capital directly invested by shareholders) and retained earnings (profits not paid out as dividends).

Opportunity cost Defined by investopedia as What a person sacrifices when they choose one option over another. In other words, its the benefits you could have received by taking an alternative action

Example The opportunity cost of going to university is the money you could have earned from working instead.

Economies of scale Are the cost advantages that a business can exploit by expanding their scale of production (definition from Tutor2u). As as their production output increases, they can achieve lower costs per unit.

Financial Conduct Authority (FCA)

The body which regulates the financial services industry within the UK. Their aim is to protect consumers, ensure the industry remains stable and promote healthy competition.

Financial Services Compensation Scheme ( FSCS)

The FSCS is the UKs compensation fund of last resort for customers of authorised financial services firms. They pay compensation if a firm has stopped trading or being declared default.

The scheme protect depositors up to £85,000 per person, per firm and awards up to £50,000 for customers of investment businesses .

Peer-To-Peer Lending (also known as Crowd-Funding)

It is the practise of financing a business venture, by raising small amounts of money from a large number of people. This is done through internet platforms such as Zopa, Ratesetter and Funding Circle, which bring together borrowers and lenders. As a caveat, Peer-to-peer lending is not covered by the financial services compensation scheme.

What is Bitcoin?

Bitcoin is a digital currency which allows individuals to buy goods and services, without the need of third parties (i.e. banks). The users can store and send bitcoins via a bitcoin wallet, which is stored on your mobile or computer device. And details of every single transaction are stored on a block chain, a public record of all financial transactions.

Drawbacks

Each transaction is completely anonymous, there are fears this will fuel illegal operations (drugs and firearms).

In addition, the supposedly clever design feature means there will only ever be 21 million bitcoins in circulation. This finite supply has turned bitcoin into a speculative investment, rather than a means of payment.

Financial Statements

Income Statement

Also known as the Profit and Loss account, it shows the revenues less expenses over a given period.

Balance Sheet

This summarises the assets and liabilities of a business at a particular point in time financial year end. Assets could include cash, property or machinery. And liabilities include everything the company owes.

This records the cash entering and leaving the company. A key difference between the income and balance sheet is that it doesnt include the amount of future incoming and outgoing cash that has been recorded on credit (arrangement to pay later).

Investment Management Terminology

Actively Managed Funds The investment manager will actively try to beat the market by using his judgement, experience and forecasts in making investment decisions.

Passive Funds - A fund which mimics the market index, rather than trying to beat it.

Closet-Index funds An investment fund which more or less tracks a benchmark, although it claims to be actively managed. Closet indexing exists because fund managers believe it is safer to track benchmark indices.

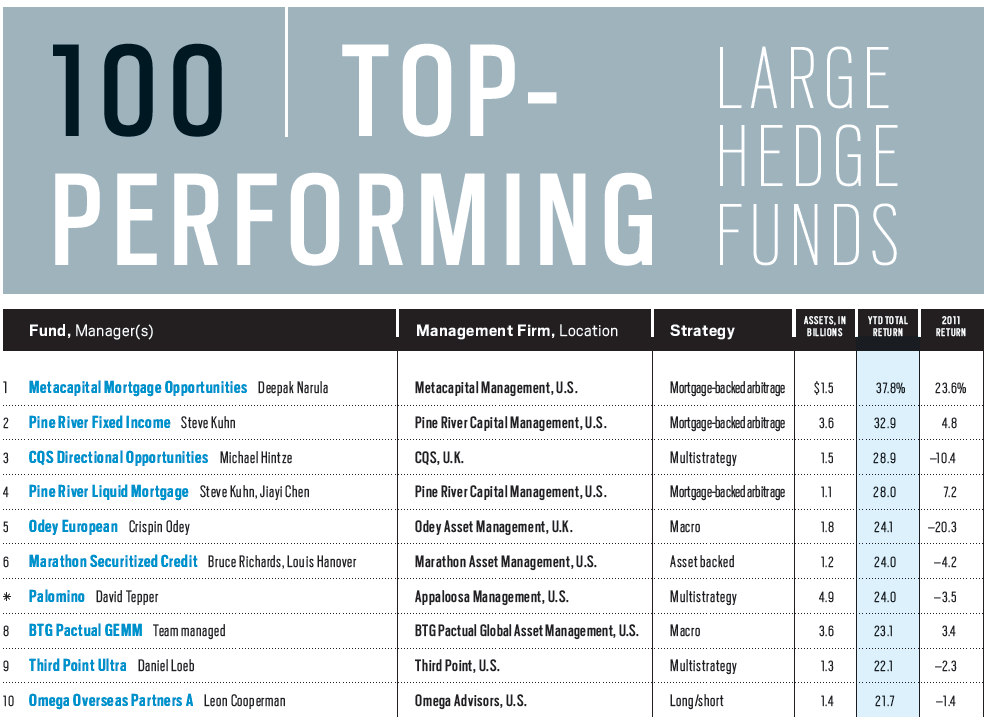

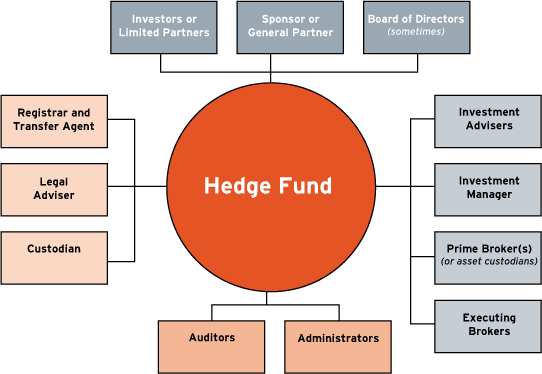

Hedge Fund A pooled investment vehicle available to wealthy and sophisticated investors. They are aggressively managed, and use leverage (borrowed money), derivatives, longs and shorts to generate superior returns.

Exchange Traded Funds Investment funds traded on stock exchanges, which track the performance of a particular market or index such as the FTSE 100.

Options - A contract which gives the buyer the right, but not the obligation to buy or sell the underlying asset, at a specified price on or before a certain date. This is a type of derivative, and they are used to speculate and hedge risk.

Financial Instability Hypothesis - American economist Hyman Minksy believed that Stability begets instability. This is because long periods of economic stability encourages financial institutions and firms to become complacent. As a result they take on greater risks and more leverage sowing the seeds of the next crisis.

Minksy Moment - The moment when the financial system moves from stability to instability. Over-indebted borrowers begin to sell assets in order to meet debt repayments, triggering sharp falls in asset values and a loss of confidence. At this point, the whole house of cards falls down.

www.investopedia.com/video/