Harvesting Investment Losses to Reduce Taxes

Post on: 31 Июль, 2015 No Comment

The stock market has had a good run this year, so you’ve probably made money on your stocks—at least on paper. But if you’ve sold some of your winners this year, the taxes you’ll have to pay on these gains will be all too real.

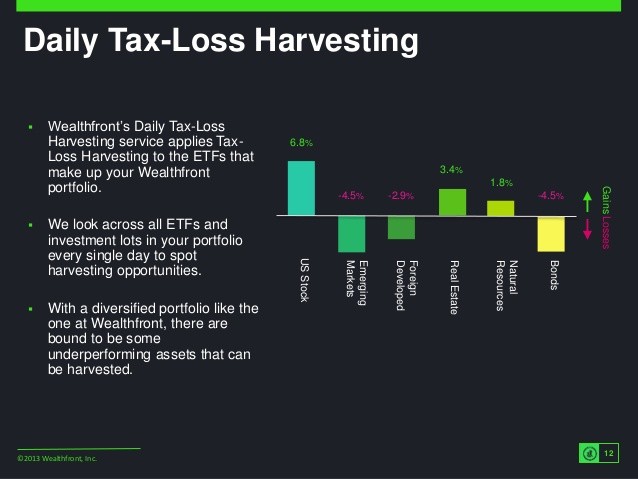

To lower your tax bill, consider taking a page out of the book of professional investors by “harvesting” your losses. Not all of your stocks have made money for you this year, right? If you sell your losers by year’s end, the losses can be used to offset your gains dollar for dollar, thus lowering your capital gains and the taxes on it. This approach isn’t limited to stocks. Just about any asset class that registers an overall average loss can be sold as part of a loss-harvesting strategy as long as that loss is realized in the same tax year.

If you just sell your losers and hang onto the money, you’ll have less money invested than before. This is a concern because you won’t be adequately positioned for gains if you have too much previously invested money sitting on the sidelines; you must be in the game to win it. In the stock market, big gains come on few days each year. The two best consecutive days since 2011 came Dec. 17 and 18, for example. It’s impossible to predict when such days will come, so the only way to benefit from them is to stay invested.

But harvesting losses is only half of the effort to strengthen your portfolio (while depriving Uncle Sam). The other half is putting that money to work.

There are some time-honored principles and practices that can help you do this effectively. The first of these is: What goes around comes around. Asset classes rise and fall continuously. What’s not hot today may be sizzling down the road, so you might want to consider today’s under-performing assets as homes for your harvest sale money. Because these assets are down today, they potentially have a lot more room to grow.

For example, small capitalization (small company) stocks did great in 2013, with an average gain of nearly 39 percent. This year, small caps didn’t do so well—registering a gain of 3 percent through Dec. 19, as measured by the S&P Small-Cap 600. But eventually, the pendulum will swing back and they’ll do better. Of course, it’s impossible to know when, but you can be assured that, unless the market reinvents itself, there’s an overwhelming likelihood that this will happen. Eventually, the swallows may not make their annual return to San Juan Capistrano—but so far, they always have.

Another key principle: The success pendulum swings back and forth regarding industries and companies of different sizes within each industry. So if you take a tax-beneficial loss on a stock in an industry that’s been out of favor, consider whether other companies in this industry may be value stocks – those that stand a good chance of coming up. These may be good homes for the cash you get from selling. (Keep in mind that you cant buy back the same shares you sell within 30 days or youll run afoul of the IRSs wash-sale rule .)

For example, oil stocks are down right now. So let’s say you took a loss in 2014 on Schlumberger (SLB), a big oil services firm with a market capitalization of $100 billion (the value of all outstanding shares). So you sell your shares of Schlumberger to harvest the loss. You then buy Helmrich & Payne (HP), a small-cap ($7 billion) company in the same industry. Helmrich & Payne’s industry and size category are both depressed, so you’re buying low.

Why stay in the same industry? First, as all sector performance is cyclical, it’s a good idea to get in while the getting is cheap. But there’s another key reason. If you’d set up your portfolio wisely and established a sensible asset allocation – your assignment of cash to different industries in different amounts — you probably built in significant diversification. You want to be in many different industries in case some tank. That way, your other stocks’ performance can buoy your overall portfolio, keeping the underperforming industries from pulling it under. By keeping your money in oil, you maintain your allocation to that industry.

To increase your chances of success with this strategy, consider screening for volatility – a stock’s tendency to go up and down. Beta is a security’s tendency to go up and down compared with the overall market. In rating stocks for beta, the financial industry assigns a value of 1 for stocks whose beta is aligned with the market as represented by the S&P 500. A stock with a beta of 1.2 is more volatile than the market, and one with a beta of .8 is less volatile than the market by the same margin.

Many highly conservative investors, still shell-shocked from the financial crisis of 2008-09, are more than willing to load up on pricey stocks because they want low beta. Sure, high-beta stocks carry more risk, but in buying them these days, you can get great earnings at a low price.

So, when you’re looking for places to spend your tax-sale cash, consider beta along company size and industry. For example, in dumping $190 billion Chevron (CVX) to buy $16 billion Marathon (MRO), this month you’d go from a beta of 1.12 to one of 1.53. Or, when taking your loss on $25 billion Hilton (HLT) to buy small-cap $3 billion Vail Resorts (MTN), there’s a jump in beta from 1.1 to 1.37.

Of course, the stocks you bought with your tax-sale money might not perform better than the ones you dumped. The point is to reinvest your tax-sale money with an eye toward value factors.

If you make a perennial practice of harvesting losses and acquire enough stocks with the sale proceeds, some of them will turn out to be winners and some, losers. There are no guarantees, but two things are certain: You won’t be paying Uncle Sam as much and you’ll remain invested, positioned for gains.

Any opinions expressed are solely those of the author and not of ABC News.

Dave Sheaff Gilreath is a founding principal of Sheaff Brock Investment Advisors LLC. He has more than 30 years of experience in the financial services industry, beginning with Bache Halsey Stuart Shields and later Morgan Stanley/Dean Witter. At Sheaff Brock, he shares responsibility for setting investment policy, asset allocation and security selection for the companys managed accounts. He also consults with the clients on portfolio construction. Gilreath received his Certified Financial Planner® (CFP) designation in 1984. He attended Miami University in Oxford, Ohio, where he earned a B.S. degree.

- Finance Personal Investing Ideas & Strategies