Gov’t rejects all treasury bill bids

Post on: 31 Август, 2015 No Comment

January 5, 2015

Banks sought high rates during this years first auction of Treasury bills (Tbills), preventing the government from raising in the amount it had scheduled to borrow this week.

At yesterdays auction of short-dated government debt, the Bureau of Treasury rejected all bids for the three-, six-month and one-year notes.

Treasury bills (Courtesy of treasury.gov.ph)

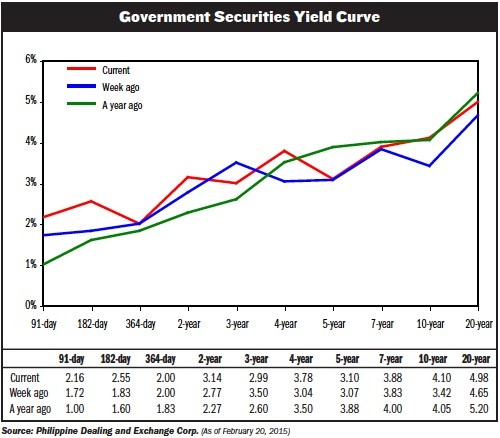

The average offered rate for the 91-day T-bill, which banks use as a benchmark in pricing loans, was 2.309 percent, compared with 1.416 percent at the auction on December 1 last year.

At yesterday’s auction, the six-month T-bill rate would have risen to 1.824 percent from 1.771 percent, while the yield on the 364-day T-bills would have gone up to 2.059 percent from 1.836 percent, the auction committee said.

The government had planned to borrow P20 billion in short-dated notes yesterday.

“They [investors] are really way way above where they should be. Theres no need for rates to increase drastically considering we still have a very low inflation rate,” National Treasurer Rosalia B. De Leon told reporters following the auction.

Despite the rejection of bids for T-bills, the governments cash position will remain strong, De Leon said.

“We have a very safe buffer of cash,” the treasurer assured.

Meanwhile, De Leon said the government has no definite plan yet regarding the planned commercial borrowing for this year.

Last November, she said the government was looking at tapping the offshore debt market early in 2015 for its deficit funding requirements, or a possible issue bonds for liability management purposes.

The government’s global bond sale of up to $750 million was been approved by the Bangko Sentral ng Pilipinas (BSP) in principle in November, according to a government source who requested not to be named as he is not authorized to speak about the deal.

The approval paves the way for the country’s return to the overseas debt market early this year.

The central bank has also given nod to a government plan to exchange up to $1.25 billion worth of foreign-currency denominated bonds for longer-dated securities to help it manage its obligations, the same source said.

The Philippines has a history of issuing sovereign bonds early in the year to get favorable borrowing terms and raise the bulk of its foreign debt needs before the markets become more volatile.

It wants to cut its dependence on foreign borrowing by pursuing debt buy-backs and swaps, and innovative deals such as global bonds denominated in local currency, a move praised by credit rating agencies.

Last month, Moody’s Investors Service raised the Philippines’ credit rating to two notches above investment grade – matching Standard & Poor’s rating – saying favorable prospects for strong economic growth remained.