Effects of raising the minimum wage Research and key lessons

Post on: 16 Март, 2015 No Comment

(Wikimedia)

The U.S. federal minimum wage was first established during the Depression, and since 1933 has risen from 25 cents to $7.25 per hour. Despite the increases, inflation has eroded its value; returning it to the value it held in 1968 would require an increase to nearly $10 per hour. In his 2013 State of the Union address, President Obama called for raising the minimum wage to $9 per hour, which in adjusted terms would put it back at its early 1980s level. According to administration estimates. this would boost the wages of some 15 million people. Supporters of these efforts note that women in particular are likely to benefit significantly.

In February 2014, the nonpartisan Congressional Budget Office issued a new report, The Effects of a Minimum-Wage Increase on Employment and Family Income, that explores two scenarios: Raising the minimum wage to $10.10 or to $9.00. The report concludes that there are distinct trade-offs. Under the $10.10 scenario, there would likely be a reduction of about 500,000 workers across the labor market, as businesses shed jobs, but about 16.5 million low-wage workers would see substantial gains in their earnings in an average week. Under the $9.00 scenario, the labor force would see a reduction of 100,000 jobs, but an estimated 7.6 million low-wage workers would see a boost in their weekly earnings.

Critics assert that the real effects of minimum-wage increases are negative: they hurt businesses, raise prices and ultimately are counterproductive for the working poor, as they can lead to unemployment. For a good sense of the partisan argument and the statistics and studies that are often cited see these position pieces from the right-leaning American Enterprise Institute and the left-leaning Center for American Progress .

At the macro level, a substantial increase in the federal minimum wage is likely to have broad effects, with some studies predicting that it could ripple across the economy, boosting the wages of nearly 30% of the American workforce .

The best starting point for understanding the debate may be a factual picture of minimum-wage earners, as there are many myths. The U.S. Bureau of Labor Statistics (BLS) illustrates this as follows:

The BLS further notes. Minimum-wage workers tend to be young. Although workers under age 25 represented only about one-fifth of hourly-paid workers, they made up about half of those paid the Federal minimum wage or less. Among employed teenagers paid by the hour, about 23% earned the minimum wage or less, compared with about 3% of workers age 25 and over.

Fundamentals and framings

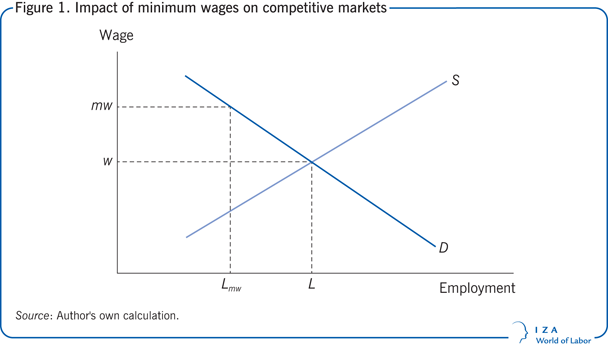

Beneath the political claims and efforts on both sides is a profound philosophical debate between neoclassical economics with its emphasis on aggregate growth and what is best for the market as a whole and progressive economics, beginning with John Maynard Keynes and the New Deal, with an emphasis on shared prosperity and fairness. In the minimum-wage debate, much depends on framing and assumptions, as well as ones interpretation of the larger patterns of increasing wage inequality in the United States. Although there is no doubt that inequality has risen significantly over the past few decades, studies can be found to support positions on both sides of the minimum-wage issue, and questions remain about the precise relationship with inequality dynamics .

Scholarly debates over the minimum wage have taken a distinct shape over the past two decades. In the 1990s, Princetons Alan Krueger now Chairman of the White House Council of Economic Advisers and his colleague David Card produced a seminal paper that has framed much of the subsequent debate. Those scholars examined the results of a New Jersey law raising the minimum wage, comparing the outcomes in the fast food industry to those in the bordering state of Pennsylvania, where wage laws remained the same. Their study called into question textbook assumptions about how labor markets might work. The findings included:

- The data indicated no evidence that the rise in New Jerseys minimum wage reduced employment at fast-food restaurants in the state.

- Further, prices of fast-food meals increased in New Jersey relative to Pennsylvania, suggesting that much of the burden of the minimum-wage rise was passed on to consumers.

That papers implication was that the neoclassical models, which suggested the opposite would happen, didn’t comport with reality data triumphed over theory. For the next decade, the economics profession saw an extended debate about whether that papers fundamental insights were right and could be extended to support policy. Krueger and Card had to defend their findings in a follow-up to the original paper. In 2000, dozens of pages of an issue of the American Economic Review were dedicated to this fight, as Timothy Taylor notes at his Conversable Economist blog .

Subsequent studies

Some subsequent studies have generally supported aspects of Krueger/Card. A 2004 study of available literature, The Effect of Minimum Wage on Prices, analyzed a wide variety of research on the impact of changes in the minimum wage. The paper, from the University of Leicester, found that firms tend to respond to minimum wage increases not by reducing production or employment, but by raising prices. Overall, price increases are modest: For example, a 10% increase in the minimum wage would increase food prices by no more than 4% and overall prices by no more than 0.4%, significantly less than the minimum-wage increase.

In a 2010 study published in Review of Economics and Statistics. scholars Arindrajit Dube, T. William Lester and Michael Reich also looked at low-wage sectors in states that raised the minimum wage and compared them with those in bordering areas where there were no mandated wage changes. They found strong earnings effects and no employment effects of minimum-wage increases.

A 2012 paper published in the Journal of Public Economics. “Optimal Minimum Wage Policy in Competitive Labor Markets,” furnishes a theoretical model that lends some support to the empirical insights of Krueger/Card. The paper, from David Lee at Princeton and Emmanuel Saez at UC-Berkeley, concludes: “The minimum wage is a useful tool if the government values redistribution toward low wage workers, and this remains true in the presence of optimal nonlinear taxes/transfers.” However, under certain labor market conditions, it may be better for the government to subsidize low-wage workers and keep the minimum wage relatively low.

Diverse outcomes

The research generally supports the idea that raising the minimum wage would have varying effects across U.S. regions and industries, even if on the whole it doesn’t produce massive negative effects.

A 2013 paper for the National Bureau of Economic Research, Revisiting the Minimum Wage-Employment Debate: Throwing the Baby Out with the Bathwater? casts doubt on some of the existing research methods and data modeling that economists have used. The papers authors, which include longtime subject experts David Neumark of the University of California at Irvine and William Wascher of the Federal Reserve Board, find that the overall evidence still shows that minimum wages pose a tradeoff of higher wages for some against job losses for others, and that policymakers need to bear this tradeoff in mind when making decisions about increasing the minimum wage. These scholars have written previously that, in the short run, minimum wage increases both help some families get out of poverty and make it more likely that previously non-poor families may fall into poverty.

At the ground level, this all suggests that a small firm in a low-wage region might, for example, respond to an increase in the minimum wage by having the owner pick up more hours herself and cut back on an employee’s overtime hours. A large firm might likewise try to squeeze more work out of its salaried managers and hire more part-time workers, to avoid benefits obligations. At the same time, because work has a social dimension and is not purely an economic endeavor many employees might keep their jobs at the higher mandated wages because of employer loyalty or trust, or the simple desire to avoid the complications of restructuring business operations to account for fewer workers. The lesson here is to distrust sweeping generalizations about what might result from a minimum-wage increase within the national labor market as a whole.

Related subsidies

Its worth keeping in mind that low wages impact more than just workers. The Earned Income Tax Credit (EITC) is, in effect, a wage subsidy, and consequently paid for by taxpayers, not private firms. A 2013 study from U.C. Berkeley and the University of Illinois at Urbana-Champaign, “Fast Food, Poverty Wages: The Public Cost of Low-wage Jobs in the Fast-Food Industry,” found that workers at McDonalds and other major restaurant chains use federal and state programs at far higher rates than other workers costs that are again picked up by society. A raise in the minimum wage might, in theory, shift some of the burden back to private companies, something that some labor economists see as being only fair.

A 2004 briefing paper from the U.C. Berkeley Labor Center, Hidden Cost of Wal-Mart Jobs, analyzes this issue through a study of the nations largest retail employer. As Washington Post columnist Ezra Klein has suggested. however, the overall cost-benefit analysis for such retailers must account for more than just wages.

The following papers provide further insights into the effects of minimum-wage laws and focus on some under-appreciated dynamics:

The Minimum Wage and the Labor Market

Rocheteau, Guillaume; Tasci, Murat. Federal Reserve Bank of Cleveland, May 2007.

Excerpt: New models of employment show that there are some cases in which a minimum wage can have positive effects on employment and social welfare. The effects depend ultimately on the prevailing market wage and the frictions in the market. Evidence to date does not support the view that raising the minimum wage will lead to positive employment effects.

The Unexpected Long-Run Impact of the Minimum Wage: An Educational Cascade

Sutch, Richard. National Bureau of Economic Research, 2010.

Abstract: Neglected, but significant, the long-run consequence of the minimum wage which was made national policy in the United States in 1938 is its stimulation of capital deepening. This took two forms. First, the engineered shortage of low-skill, low-paying jobs induced teenagers to invest in additional human capital primarily by extending their schooling in an attempt to raise their productivity to the level required to gain employment. Second, employers faced with an inability to legally hire low-wage workers, rearranged their production processes to substitute capital for low-skill labor and to innovate new technologies. This paper explores the impact of the minimum wage on enrollments between 1950 and 2003. I describe an upward ratcheting mechanism which triggers an “educational cascade.” My estimate is that the average number of years of high school enrollment would have risen to only 3.5 years, rather than 3.7 years, for men born in 1951. Thereafter, enrollment rates would have trended down to about 3.2 years for the cohort born in 1986, rather than slowly rising to around 3.9 years. The cumulative effect of the minimum wage increases beginning in 1950 was to add 0.7 years to the average high school experience of men born in 1986.

Meltzer, David O.; Chen, Zhuo. National Bureau of Economic Research, 2009.

Abstract: Growing consumption of increasingly less expensive food, and especially “fast food”, has been cited as a potential cause of increasing rate of obesity in the United States over the past several decades. Because the real minimum wage in the United States has declined by as much as half over 1968-2007 and because minimum wage labor is a major contributor to the cost of food away from home we hypothesized that changes in the minimum wage would be associated with changes in bodyweight over this period. To examine this, we use data from 1984-2006 to test whether variation in the real minimum wage was associated with changes in body mass index (BMI). We also examine whether this association varied by gender, education and income, and used quantile regression to test whether the association varied over the BMI distribution. We also estimate the fraction of the increase in BMI since 1970 attributable to minimum wage declines. We find that a $1 decrease in the real minimum wage was associated with a 0.06 increase in BMI. This relationship was significant across gender and income groups and largest among the highest percentiles of the BMI distribution. Real minimum wage decreases can explain 10% of the change in BMI since 1970. We conclude that the declining real minimum wage rates has contributed to the increasing rate of overweight and obesity in the United States. Studies to clarify the mechanism by which minimum wages may affect obesity might help determine appropriate policy responses.

Special thanks to economist Richard Parker. Lecturer in Public Policy at the Harvard Kennedy School, for his insights for this article.