Dividends V Repurchases

Post on: 1 Август, 2015 No Comment

Are share repurchases good or bad? The answer, as might be expected, is a bit gray.

Assuming the company has a certain amount of cash they wish to return to shareholders, the two ways they can do it are through dividends and share repurchases. Share repurchases (also referred to as a share buyback or a stock buyback) are typically more flexible for the company, while dividends are more flexible for the shareholder.

Overview

The basic answer is that share repurchases are great when the share price is undervalued, and not-so-great when the share price is overvalued. To put it into a more useful context, if you would otherwise reinvest your dividends or invest new capital into the company at current stock prices, then share repurchases are useful to you because the company basically does it for you. The alternative is that the company could pay you a higher dividend, but youd be taxed on that dividend and reinvest it into the company anyway. On the other hand, if you would not reinvest dividends or invest new capital into the company at current prices, then share repurchases are not in alignment with your current outlook, and it would be better for you to receive a higher dividend.

Something else to be considered is that when a company uses money for share repurchases when it could be paying a higher dividend instead, the companys management is limiting your control and increasing theirs. As a shareholder in a company that makes uses of share repurchases, you have to rely on managements ability to judge whether its an appropriate time to repurchase shares, whereas with your dividend, you have complete control over that choice. The flexibility of dividends for shareholders is great, because if allows you to direct your flow of income to where you think the best investment opportunities are at any given time. Share repurchases lack that flexibility.

Three Examples

Perhaps the best way to illustrate this is with some examples of companies that return cash to shareholders.

Chubb Corporation (CB)

Chubb Corporation currently has fairly static business operations, pays a dividend, and has a very stock valuation and P/B ratio. This is common among property and casualty insurance companies right now.

Chubb, like many other insurers, is using its low P/E to its advantage by repurchasing many of its own shares. In fact, its spending 2 or 3 times as much money on share repurchases as it is on dividends, and this fuels their impressive dividend growth. With a low P/E ratio, this dividend aristocrat is getting a great value for its cash, and I consider this an example of a smart share repurchase plan. The majority of investor returns will be due to dividends and share repurchases. In fact, between 2004 and 2012, Chubb gave its investors approximately 10% annualized returns (thereby doubling their money), despite having less than 1% annualized revenue growth. This was possible because the valuation was low and all of the capital was given to investors in the form of dividends or share repurchases.

Costco Wholesale (COST)

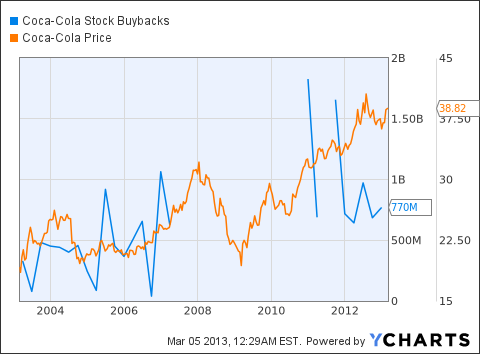

Costco Wholesale has also repurchased a lot of shares, and spent more money on that then they have on dividends. Unfortunately, with a higher P/E, theyre not getting a very good value on their shares. In addition, out of the last few years, they repurchased the least shares in 2009 when their stock price was the cheapest. So theyre doing the exact opposite of what would be most beneficial to shareholders. In this case, doubling their dividend and reducing share repurchases would be the better option.

Costco is an important example, because Costco management is otherwise excellent. This is not an example of bad management making bad decisions, but instead an example of good management making mediocre decisions. The company has performed very well since it was founded, treats its employees and customers well, and in general is very admired for how it does business. But a great business leader does not necessarily make a great chief investment officer. Buying back stock at bad prices is not exactly the end of the world; it still improves shareholder returns. But the opportunity cost is big, as that money could have been put to better use.

The last thing to consider is the conflict of interest company executives have with the share price of their stock. If a CEO states that his companys stock is overvalued, is that in his best interest and in the best interest of his shareholders? Much of this may even be a subconscious effect, as Id wager most company management sees their company in quite an optimistic way. So this can be a factor as to why even good managers may repurchase shares at the wrong time.

National Presto Industries (NPK)

National Presto is an interesting example. Each year, NPK pays a small regular dividend and a huge special dividend. The special dividend they pay depends on the financial performance of that year.

American blue-chip companies, such as the dividend aristocrats, have a habit of paying quarterly dividends that increase each and every year like clockwork. This is great for many reasons, because it provides an excellent psychological reason to buy-and-hold, and keeps management exceptionally disciplined. Some of the best long-term returns available in the market have been from these slow and steady dividend growers. For this reason, lists are created, showing which companies have paid consecutively increasing dividends for a given number of years. Management certainly doesnt want to ruin a 10, 20, or even 50 year streak of increasing dividends due to one bad year, if at all possible. So they stay sharp.

The downside of this is that sometimes their dividend payout ratios become a bit too high, because theyre growing their dividend through a recession. Or sometimes their payout ratios become a bit too low, because theyre not growing their dividend as quickly as they could be during a strong market. Basically, this American approach sacrifices dividend flexibility for great intangible benefits like a long-term dividend-growth outlook and psychological benefits of knowing your income stream is going to increase each year.

These blue chip companies often repurchase shares in addition to paying dividends. This keeps their shareholder returns flexible even though theyre paying a larger and larger dividend each year. They have a habit, like Costco, of buying back the most stock when business is great and their stock price is high.

NPK is not doing this. They are not repurchasing shares, and instead theyre keeping their shareholder returns flexible by paying a large annual special dividend.

Companies that pay a regular dividend each quarter, and increase that dividend each year, would do well to consider an annual special dividend. They could forgo some or all of their share repurchases and instead send that money to investors with a year-end special dividend based on the years performance, while keeping their regular dividend growing each and every year.

Conclusion

In conclusion, share repurchases are fine when the company is currently priced at a level you would buy shares at, and suboptimal otherwise. Even when this first criteria is met, however, its appropriate to be a bit wary about share repurchases because it takes some control away from you, the shareholder, and gives it to company management. So over the long-term, through high prices and low prices, you have to hope they make smart reinvestment decisions (and many companies do not).

American companies would do well to consider making annual special dividends more commonplace. Its a nice compromise between regular dividends and share repurchases, because it returns more direct value to shareholders while also keeping the yearly dividend flexible and allows them to continue building their long records of continually increasing regular dividends.

The idealized scenario is for a company to pay regular quarterly dividends that increase each year, and then to either repurchase shares or pay a special dividend depending on the market conditions of their stock. Unfortunately, I almost always have to settle for one or the other. Luckily, the popular model that combines dividends with share repurchases is a fairly good compromise due to its mixture of flexibility, tax treatment, and intangible benefits. Large shareholder yields are generally a great thing for value investors.

Share Repurchases

-Better tax treatment than dividends

-Share repurchases are more flexible than regular dividends for the company

Regular Dividends

-Important for those seeking current income

-Dividends are more flexible than share repurchases for the shareholder

-Provides a psychological edge and discipline to both shareholders and company management