Dividend Growth The Case Of Technology Dividend ETFs

Post on: 1 Август, 2015 No Comment

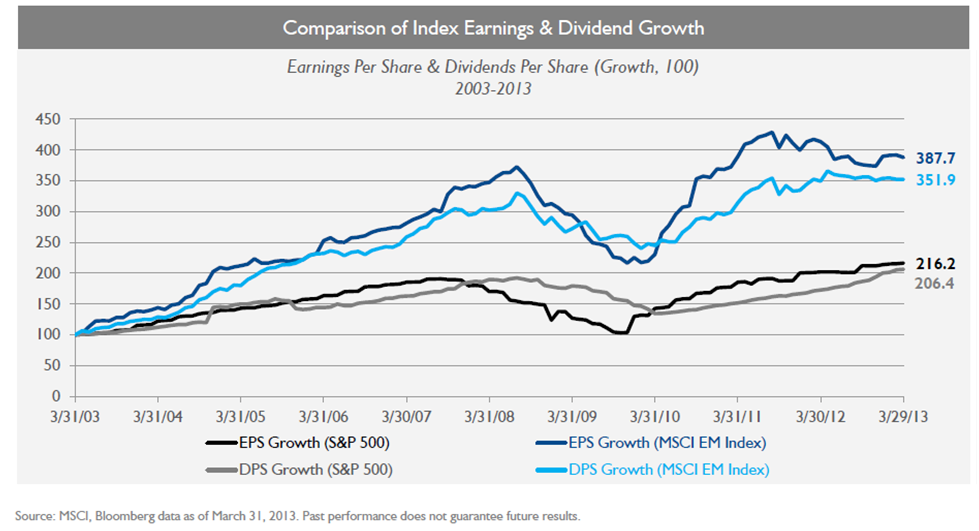

Technology companies are paying record-high dividends as part of a strategy that seeks to bolster shareholder value at a time when growth opportunities are scarce. According to WisdomTree and Bloomberg, Technology firms have been the greatest contributors to dividend growth over the past five years — accounting for more than 54% of the increase in dividends from November 30, 2007, to June 30, 2013. Moreover, NASDAQ OMX research found that the tech sector realized the fastest annualized rate of dividend growth, which averaged 24.27% over the decade that ended December 31, 2012. The rapid dividend growth continues unabated. According to FactSet, the S&P 500 technology sector’s dividend growth has run at double-digit rates for ten consecutive quarters. In the second-quarter 2013, the trailing twelve-month dividend payout, on a per-share basis, of the S&P 500 technology firms was 62% higher than a year ago.

The appeal of the tech sector’s dividend growth is evident, as is the attractiveness of the sector’s dividend-paying stocks to value investors. Dividend investors have plenty of options to pursue tech stocks that offer attractive dividends. However, while investing in single stocks can have both its advantages and disadvantages, the safer path to benefit from the rapid dividend growth in the tech sector appears to be through dividend-paying technology-focused exchange-traded funds (ETFs). A clear frontrunner among the tech-sector dividend ETFs is the First Trust NASDAQ Technology Dividend ETF (NASDAQ:TDIV ). Other dividend ETFs offering exposure to the sector include Technology Select Sector SPDR® Fund (NYSEARCA:XLK ) and iShares U.S. Technology ETF (NYSEARCA:IYW ). For investors focused primarily on dividend growth, there is also WisdomTree U.S. Dividend Growth Fund (NASDAQ:DGRW ), a forward-looking, dividend-growth focused, broad-sector ETF with a large exposure in technology firms.

First Trust NASDAQ Technology Dividend ETF invests at least 90% of its net assets into holdings of the NASDAQ Technology Dividend Index, seeking to approximate the index’s investment results. Its main holdings are technology and telecommunications companies, with the former given a collective index weight of 80% and the later given a collective index weight of 20%. Caps are imposed to prevent excessive concentrations among larger stocks. Only liquid stocks with market capitalization of at least $500 million are included, carrying the minimum yield of 0.5% and having no dividend cuts over the past year. The index, and thus the EFT, is based on a modified dividend value weighting methodology.

TDIV’s largest exposure is in semiconductors and semiconductor equipment stocks (24.3% of the Fund’s net assets), the sector which is highly cyclical. The ETF’s three largest holdings include the tech bellwethers Intel (NASDAQ:INTC ), Microsoft (NASDAQ:MSFT ), and Apple (NASDAQ:AAPL ). TDIV assesses a total annual fund operating expense of 0.50%. It has a dividend yield of 2.56%, exceeding that of the S&P 500 index. In terms of performance, on an after-tax sold basis (post liquidation), this ETF has returned 9.92%, year-to-date through the end of September 2013. The fund has a portfolio turnover rate of 18% of the average value of its portfolio.

The second choice for tech-focused dividend investors could be either Technology Select Sector SPDR® Fund, with 73 holdings, or iShares U.S. Technology ETF, with 144 holdings. The former ETF mimics the S&P Information Technology Select Sector Index, seeking the effective representation of the S&P 500’s IT sector. The latter ETF seeks to approximate returns of the technology sector of the U.S. equity market, and is thus a subset of the Dow Jones U.S. Index. Both indices are capitalization weighted, which then results in a different portfolio composition or weights when compared to ETFs applying a different weighting methodology, such as the modified dividend value weighted methodology of TDIV. Both XLK and IYW have Apple, Microsoft, Google (NASDAQ:GOOG ), and IBM (NYSE:IBM ) as their top four holdings. The structure of the remaining holdings differs between the funds.

While both these tech-centered ETFs pay dividend yields lower than that of the TDIV -XLK pays a dividend yield of 1.8% and IYW pays a dividend yield of only 1.1%- they both have a lower cost structure than TDIV. In fact, XLK’s total annual fund operating expense is only 0.18%, while IYW assesses 0.46% in total annual fund operating expenses. These are lower than TDIV’s total annual fund operating expenses. Nevertheless, in terms of performance, on a one-year basis through the end of September 2013, using after-tax sold (post-liquidation) values, XLK has returned 3.53%, annualized, while IYW has returned 3.00%, annualized, well below the achieved returns of TDIV. Yet, it should be noted that both XLK and IYW have portfolio turnover rates of about 5.00% of the average portfolio values, well below TDIV’s portfolio turnover rate.

Finally, dividend growth investors seeking a broad sector exposure, but with an aim to tap the tech sector’s huge potential for continued robust dividend growth, have at their disposal WisdomTree U.S. Dividend Growth Fund. This ETF is not exclusively tech-focused, but it currently allocates a slightly more than 20% weight to technology stocks. The ETF tracks WisdomTree U.S. Dividend Growth Index, with a unique weighting methodology, which thus makes its structure somewhat different from the other indices and ETFs mentioned here. The ETF is based on a fundamentally-weighted index comprised of dividend-paying stocks with growth characteristics. The ETF includes 294 companies from the WisdomTree Dividend Index with the best combined rank of growth and quality factors. According to its issuer, the index is dividend-weighted annually to reflect the proportionate share of the aggregate cash dividends each component company is projected to pay in the coming year, based on the most recently declared dividend per share. This ETF assesses 0.28% in total annual operating expenses. Its dividend yield is 1.76% and its 30-day SEC yield is 2.03%. DGRW’s inception date was May 22, 2013; therefore, no comparable one-year annualized post-liquidation returns are currently available.

With large hoards of cash, technology companies have ample room to boost dividends robustly in the future. That trend should support the appeal of both technology stocks and the dividend-paying, technology-focused ETFs. Investors should closely evaluate their investment objectives and should scrutinize available dividend ETF in the technology sector in a search of investment vehicles that have a potential to maximize their income and capital growth.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.