Consumer Alert Buy Bitcoins at Your Own Risk

Post on: 10 Октябрь, 2015 No Comment

Virtual currency is a high-risk payment option for consumers

The Office of Consumer Affairs and Business Regulation advises consumers who may consider purchasing the digital or virtual currency Bitcoin to proceed with caution because of the high-financial risks involved.

Just last week, the largest Bitcoin exchange shut down resulting in hundreds of millions dollars worth of lost bitcoins.A couple of weeks ago, a Bitcoin ATM opened up in South Station. While this operation closely resembles an ATM, the kiosk performs quite differently. It does not provide cash, but instead allows consumers to load bitcoins onto a virtual wallet either accessed by an app downloaded onto a smartphone or through a code provided on a piece of paper that is unique to each consumer.

Proponents of Bitcoin make the point that this virtual currency allows for a faster, no-fee payment system, which is attractive to both merchants and consumers. While there is a demand for a faster and more efficient commercial payment system, the question is whether bitcoins are the most appropriate and safest alternative to satisfy that demand.

Before purchasing bitcoins either online or through a kiosk, consumers are strongly advised to consider the risks.

What are bitcoins?

Bitcoins are a type of decentralized virtual currency, meaning they are not issued or backed by the United States or any other government. They are also unregulated and uninsured, which means that consumers and businesses alike have limited recourse if they have a problem. Unlike the dollar, which is legal tender, no one is required to accept bitcoins as a form of payment.

While not tangible currency, bitcoins are bought by transferring real money through an exchange or to an individual, and are stored on computers or held by the purchaser or a third party in a so-called virtual wallet. Once the bitcoins are in your virtual wallet, you can use them to purchase items from any merchant willing to accept them or sell them to someone willing to buy them.

What risks should I be worried about?

Consumers should pay particular attention to the following risks:

- You can lose your money or bitcoins on an exchange: Consumer ramifications were seen first-hand when one of the largest Bitcoin exchanges, Mt. Gox, abruptly closed down recently with no explanation. It was later revealed the exchange was hacked, and millions of dollars of bitcoins were stolen. Consumers were left hanging as to how they could recoup their lost money. Mt. Goxrecently filed for Chapter 11 bankruptcy and reorganization in the Northern District of Texas, so consumers now have a process under which they can file claims.

- Bitcoins can be stolen from your virtual wallet: Bitcoins are like cash if they are lost or stolen, they are gone for good. If your virtual wallet is hacked, your bitcoins can be stolen. Also, if you forget your private key (similar to a PIN), your bitcoins are not replaceable.

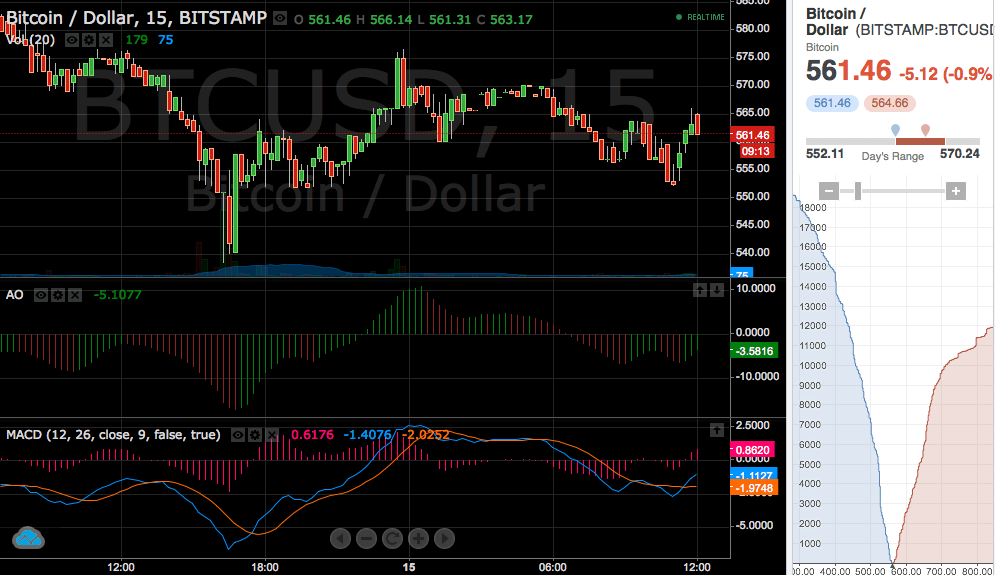

- The value of bitcoins can fluctuate rapidly: During the time it took Consumer Affairs staff to inspect the South Station kiosk, the value of the average of the four most common Bitcoin exchanges fell $20 it has since fallen hundreds of dollars. This rapid fluctuation means it is a high risk investment for consumers. The value could even drop to zero, making bitcoins worthless.

- There are no consumer protections: Bitcoins are not FDIC insured. Unlike credit cards, you have no right to reverse the charges if something goes wrong. The South Station kiosk also has no disclosures, leaving consumers without information about fees or where to go if there is a problem. The Massachusetts Division of Banks is currently revieweing the operation of this kiosk to determine if it requires licensing.

Should I buy bitcoins or should I stay away from them?

First and foremost, if you cant afford to lose the money you have, you should not buy bitcoins.

For other consumers who are thinking about buying bitcoins, you should do your due diligence, just as with making any investment and weigh all the risks. Understand how the currency works, know how much the currency is currently valued, and how (or whether) you will be able to retrieve that value at any time in the future.  After you purchase bitcoins, take proper precautions, including protecting your private key and not leaving large amounts in your virtual wallet.

How are bitcoins made?

Bitcoins are created through a sophisticated computer algorithm that requires extensive computer power. Creating new bitcoins is called mining and is something that is not available to the average consumer.

Basic Facts on Bitcoin:

- Its a high-risk currency because of the volatility in its price.

- Its not backed by any central banks worldwide and has no tangible value.

- Its an experimental concept.

- Its unregulated and does not provide protection for consumers.

- Consumer disclosure rules and regulations are limited or nonexistent.

- It is not insured or backed by any government or regulatory structure.

- No company is required to accept bitcoins as a form of payment.