Chartered Financial Analyst

Post on: 16 Март, 2015 No Comment

A2.Fresh CFAs generally begin as executive trainees in the financial sector. With experience they climb up the corporate ladder to higher executive levels. The areas where a CFA can use his skills are: financial accounting, management accounting, financial management (both as relevant to India and for the international scene), investment management, security evaluation, project planning, venture capital management and credit rating among other things. A CFA will be responsible for decisions in the above mentioned areas. His or her decisions will be based on quantitative techniques of analysis of relevant data. The training provided by the ICAFI will enable a CFA to know what to look for, where to look for it and how to analyse whatever data he or she has obtained. The work performed by a CFA can be extremely challenging and rewarding in monetary terms and in terms of professional satisfaction.

A3. In order to become a certified Chartered Financial Analyst, a person has to complete a three-year post graduate programme. This programme can be studied through correspondence. It is conducted by the Institute of Chartered Financial Analysts of India (ICFAI). And on completion of the course one can become a member of the ICFAI. The admission to this course is based on an entrance exam. This examination basically tests a candidate’s aptitude for the course. The course content delves into fine details of financial analysis. So it is essential that a person opting for this course has a natural aptitude for and the knack to grasp financial matters.

A4. The CFA course is opted for by both students and employed executives. Fresh graduates and also students in the final year of the Bachelor Degree course are eligible for the admission test. The pre qualification of a graduate degree is waived in the case of Commissioned defence personnel who have five years of experience. A financial analyst should have two traits, the first being an ability to work well with numbers and the second being the ability to convey his viewpoint in a precise and comprehensive manner. Keeping this in view, the admission test attempts to test a candidate’s verbal skills and quantitative reasoning abilities.

A5.The foundation module of the course is aimed at familiarising candidates from disciplines other that commerce, to the basic principles of finance. It includes courses in financial and management accounting, essentials of tax planning, basic guiding principles of investment, basics of corporate finance and a study of statistics as relevant to financial applications. So people with professional qualifications like MBA, CA, ICWA and M Com. are exempt from the initial foundation module of the course. The others who take the foundation course can appear for the qualifying exam of the foundation module three months after enrolment.

The preliminary level This level, also known as the second module, is divided into two groups — Group A and Group B. Financial accounting and financial management are the two papers in Group A. A candidate can take an exam in these papers six months after enrolment. There is only one paper in Group B: quantitative methods and economics. A candidate can take an exam in this paper twelve months after enrolment.

The Inter level This level, referred to as the third module, is divided into two groups: Group C and Group D. Group C has two papers — one on economic legislation and the other on management accounting. Exams for papers in this group can be taken six months after passing the preliminary level. Group D also has two papers: one on security evaluation and the other on project appraisal planning and control. Exams for this group can be taken twelve months after passing the preliminary level. The final level

The final level or the fourth module is divided into two groups: Group E and Group F. Group E has two papers — advance financial management and financial services. Exams for this group can be taken six months after passing the inter level. Group F has two papers in investment management — the Indian financial system and international financial management. Exams for the papers in this group can be taken one year after passing the inter level. Candidates at this level are also given practical training by placing them with reputed organisations.

A6. As mentioned earlier, this course is conducted through correspondence. The institute sends study material at regular intervals to the students. This is supplemented with contact programmes in the form of weekend workshops held at major metros like Bangalore, Chennai, Mumbai, Delhi, Hyderabad and Calcutta. The aim of these workshops is to handle issues like clarification of key concepts and solving any problems that the candidates might have encountered during the course of self-study. Further Study The Chartered Financial Analysts course of the ICFAI is recognised by the Indira Gandhi National Open University as an equivalent to a Post Graduate degree. So a CFA is eligible for admission to Ph.D. programmes in management. Many American Universities also recognise the programme and accept it as an eligibility criterion for the pursuit of Ph.D. studies.

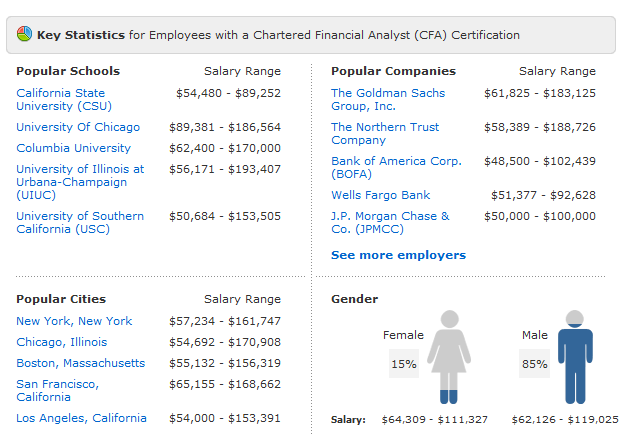

A7. Employment opportunities are a plenty in sectors like banking, insurance, the corporate sector, companies dealing in finance and leasing. The Reserve Bank of India, the International Development Bank of India (IDBI), the Industrial Finance Corporation of India (IFCI) and the Indian Railways recognise the CFA programme and employ trained CFAs. Besides these, a trained CFA can go into business as an independent business consultant or join an existing consultancy firm. A Chartered Accountancy firm or a firm specialising in cost accountancy is another option for a trained CFA.

www.icfai.org/homepage/Icfai_home_page.html