Calculating Goodwill

Post on: 31 Май, 2015 No Comment

In the bad old days we South Africans (well the white ones) became very adept at sanctions busting, finding workarounds a boer maak a plan type of stuff. We became more and more isolated, but very good at making a plan.

One of the things which developed in the small business sector at the time was a variation of the concept of goodwill. Not that goodwill was in any way unique to South Africa, it was just that we seemed to develop our own definition. It was usually calculated at some multiple of some element of the income statement. So for instance 20 times the net profit or three times the sales turnover.

Then in addition, the seller would want the stock added to the goodwill, and then to add more gutzpa to the mix, the value (replacement value no less) of the fixed assets must also be added to the price. Needless to say, it was only the really green buyers who fell for this. Still, many buyers have fallen for it But not at a level of any significance. Today, businesses which have been around for a while are becoming quite significant in value, and buyers are a lot more clued up than before.

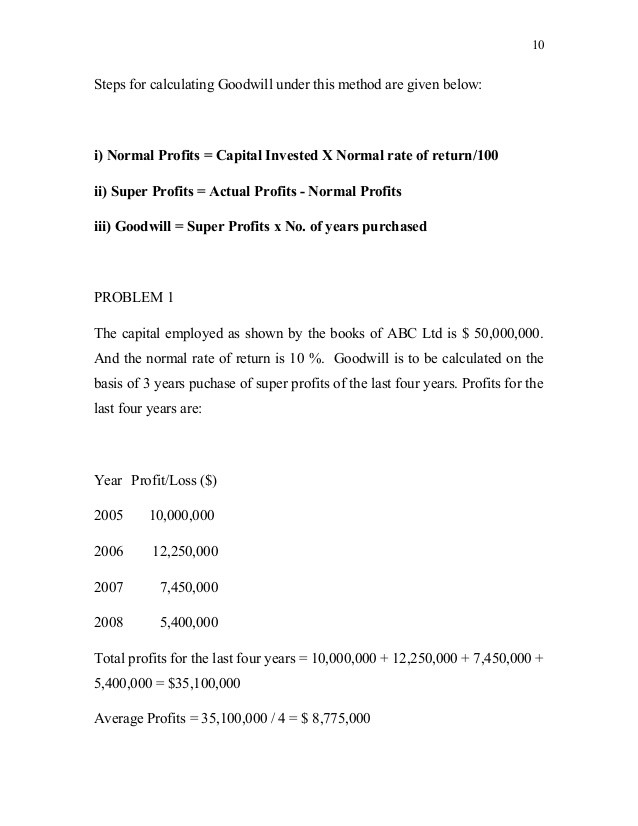

For the sake of clarity, the international definition of goodwill is published in hundreds of places as unequivocally being:

The difference between the selling price of the business and the net asset value:

- Guide to Analysing Companies by Bob Vause Goodwill is defined as the amount paid by one company for another over and above the fair value of the net assets appearing in its balance sheet.

- Corporate Valuation: An easy guide to measuring value by David Frykman and Jakob Tolleryd The investment in goodwill represents the cost of acquiring assets or other companies in excess of their book value.

- Buying and Selling a Business by Jo Haigh Goodwill: The difference between the price which is paid for a business and the value of its assets.

- How to Buy, Sell & Evaluate a Business by Samuel Tutle Goodwill, also know as excess over basis is the difference between the market value of a firm and the market value of its net tangible assets.

- How to Buy and/or Sell a Small Business for Maximum Profit Goodwill is the difference between the asking price and the actual asset-value price. [I have an issue here because that definition is incomplete in its outcome. Until one has a buyer willing to pay the asking the price the good will is pie in the sky. In such a scenario I have often heard the prospective buyer saying so you’re looking for goodwill of. Invariably the seller is left floundering at this point, unable to justify his asking price. In my opinion, stick to real market value.]

So clearly from the above, goodwill is an intangible item arising from the reputation of the company, its staff members, owners, location, agreements, products, services, ability to deal with crises, freedom from large proportion customers and suppliers, barrier to entry for new competitors, exclusivity, growth, cash flow and so on.

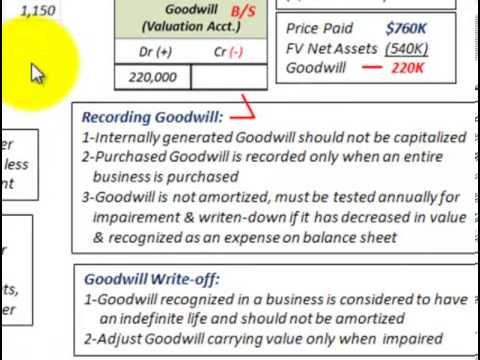

Also from the above; a price is agreed on in a sale of a business, and this price is made up of assets and goodwill. The value of the assets is easily identifiable from the balance sheet, and the difference is goodwill. If you happen to have more than R3M (say) in stale old stock which has not sold in the last ten years, you are going to be hard pressed to dump that on an unsuspecting business purchaser in addition to the selling price.

However, a sale does give an opportunity for both buyer and seller to set the levels of assets and goodwill. These levels are required to be set down in the agreement of sale. So typically, the appropriate clause will read something along the lines of the Selling Price is made of R1M in Fixed Assets, and the balance to Goodwill. Only it will say it over about fifteen pages.

Why do sellers want to sell goodwill? Simply because it gives more money in the pocket, and the tax implications are better. For the buyer, he will want the entire selling price to reflect assets because he can then depreciate his purchase. If the seller falls into that trap, he finds himself paying recoupment tax.

So, for heavens sake; dont blabber on in your negotiations constantly telling the purchaser what a good deal he is getting because the assets are worth more than the asking price. You may be held to this in the agreement of sale and pay dearly when SARS catches up with you.

Posted on December 20th, 2013 by Mark Corke No Comments