Bond Links Bonds To Hold In A Risingrate Environment 2015

Post on: 31 Март, 2015 No Comment

3A%2F%2Fwww.etftrends.com%2F?w=250 /% These new types of zero duration or negative duration ETFs hold long-term bonds, but they will short Treasuries or Treasury futures contracts to hedge against potential losses if interest rates rise – bond buffer in a rising rate environment

3A%2F%2Fwww.marketwatch.com%2F?w=250 /% David Waring is the co-founder of bond investing education web site Learn Bonds and market commentary site Bond Moves. If you’ve watched a You Tube video on technical analysis or forex trading, you have probably seen one of the over 100 videos that he

3A%2F%2Finvestorplace.com%2F?w=250 /% I categorize that as strong enough to keep stock investors happy with economic momentum, but low enough for bond investors to recessionary or deflationary environment to meaningfully change the momentum in high quality bonds. Therefore investors

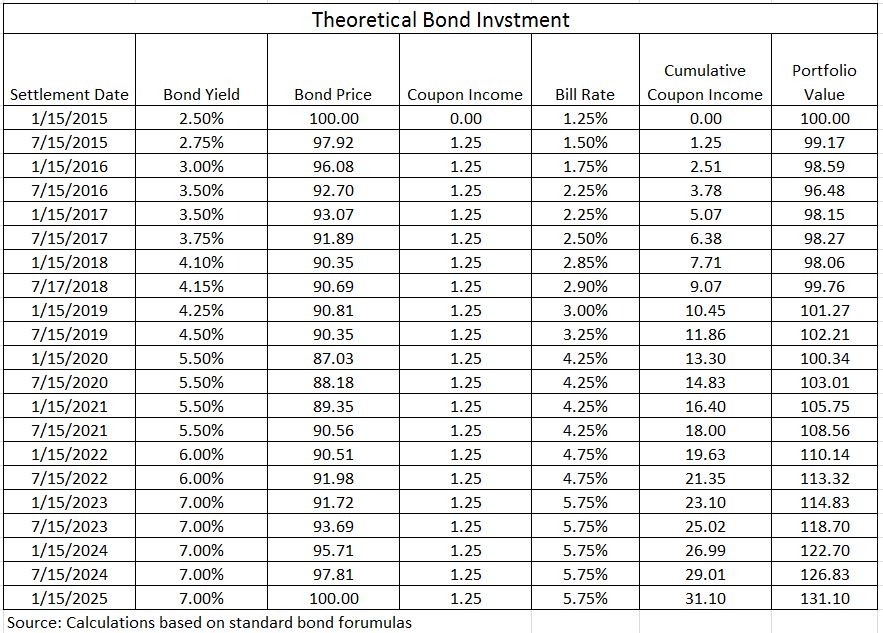

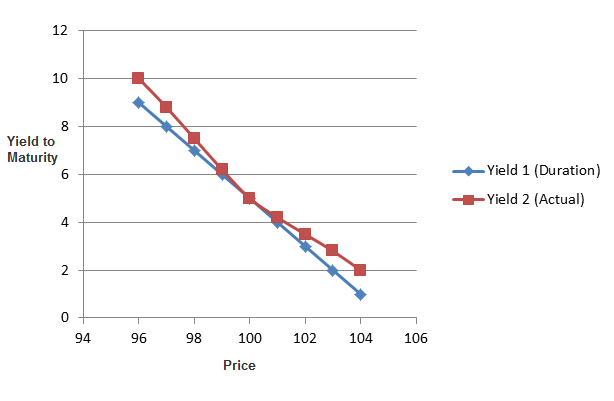

3A%2F%2Fseekingalpha.com%2F?w=250 /% seem to think that bond funds are worse than individual bonds. The thinking goes that since you can hold an individual bond until maturity, you’re insulated from the effects of rising interest rates and can avoid taking any losses. A typical bond fund

3A%2F%2Fwww.nasdaq.com%2F?w=250 /% The goal is to significantly reduce or eliminate the effect of interest rate fluctuations on the underlying basket of bonds in a rising rate environment. Conversely, these three funds would underperform a comparable un-hedged bond ETF in a falling

3A%2F%2Fmoney.usnews.com%2F?w=250 /% In the discussion on rising interest rates, the real question isn’t if they will rise, it is when. Given this reality, it is worthwhile to evaluate the risk of owning bond mutual funds versus individual bonds in a rising interest rate environment.

3A%2F%2Fwww.cnbc.com%2F?w=250 /% For the last 20 years, it didn’t particularly matter whether you owned U.S. bond funds or individual bonds swap your bond mutual funds for a portfolio of individual bonds in a rising-rate environment, then? Not necessarily, said Chris Bouffard

3A%2F%2Fwww.morningstar.com%2F?w=250 /% We hear from many investors that they are looking at individual bonds versus bond funds as a way to protect themselves in a rising-rate environment that if they just hold them to maturity they won’t feel the pain of rising interest rates.

3A%2F%2Fnews.morningstar.com%2F?w=250 /% Investors who steered a percentage of their bond money to short-term bonds or cash to protect to take a look at asset types that would hold up reasonably well—or even benefit—in a rising-interest-rate environment, even as they maintain their asset

3A%2F%2Fwww.marketintelligencecenter.com%2F?w=250 /% While investors are dumping long-duration bonds rising rate environment. Some of these are senior loan funds, floating rate funds, and zero or negative duration bond funds. Below, we have detailed one ETF from each category that investors should keep