Biotech bubble loses some air after a surge in stock prices and hiring slows down

Post on: 21 Октябрь, 2015 No Comment

By DON SEIFFERT

Anna Protopapas remembers watching as biotech stocks soared to unimaginable heights with a mix of excitement and disbelief in early 2000.

I think there was a sense of, Is this really real? says Protopapas, who is now president of Millennium Pharmaceuticals in Cambridge. There were many people walking around, saying this is the new economy. that traditional market valuations have changed.

By the second half of that year, the biotech bubble began to burst, and stock prices came crashing back down in the next two years to a level where they stayed for most of the next decade until now.

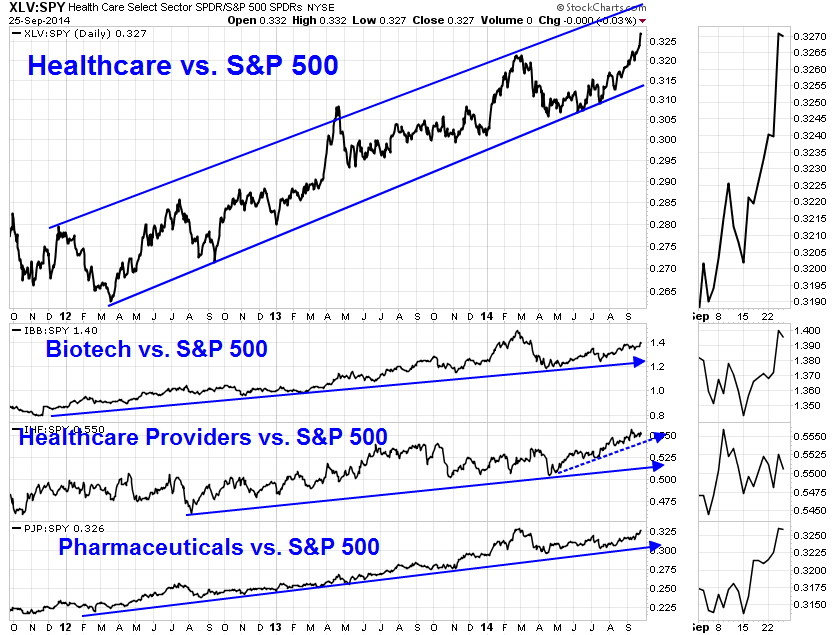

During the last two years, the Nasdaq Biotech index has grown by 120 percent as investors have poured money into early-stage drug companies at an unprecedented rate. Over the same two-year period, the Standard & Poors 500 index has risen 43 percent. Its the first time since 2000 that the two stock indexes have diverged so sharply, and thats given rise to speculation that we could be in the midst of another biotech stock bubble.

Its a sensitive topic among investors. Theres a financial incentive to maintain high values for biotechs. And theres no agreed-upon definition of an investment bubble they are only obvious in hindsight. But theres mounting evidence ranging from slowing employment growth among local biotechs to broader economic indications from just the past few weeks strongly suggesting there has been an investment bubble at work, and that its already starting to deflate.

The financial metrics are out of whack, says Dennis Goldberg, a longtime biotech executive and partner at the recently-launched Benu BioVentures in Natick. Not only does he believe there is a biotech bubble, but it is very big, he says.

One need only look at the recent IPOs and biotech valuations relative to earnings and projected revenues, Goldberg says.

Similarly, Morningstar analyst Karen Anderson says she sees plenty of overvaluation in the market, especially among smaller, newer biotechs. Not only are these not very established (companies), but we havent seen the data to support that theyre going to have strong drugs, she says.

Local biotechs have benefited immensely from the surge in investment, with the 10 largest Massachusetts-based biotechs now claiming $88 billion in combined market capitalization. Thats more than triple the market value of those same companies in January 2011. That spike in investor confidence has helped fuel job growth at those companies: Today, those 10 companies have 11,400 employees, 34 percent more than they did in the beginning of 2011.

But that employment growth appears to be leveling off. As of mid-November, those companies have added fewer than a third of the number of new jobs that they added last year. The rate of job growth among them will be slower this year than in any of the past three years. While local companies are still adding jobs overall, the slowdown reflects events at Ariad Pharmaceuticals and Vertex Pharmaceuticals, in which hundreds of workers have been cut after the drugs they were developing hit snags.

There are also signs that the unprecedented biotech IPO market is slowing. There have been 49 IPOs at early-stage life sciences companies this year as of the end of November, according to a Dec. 2 report by Burrill & Co. Thats more than any year in the past decade, with about a fifth of those at companies here in the Bay State.

But while four life sciences firms went public last month nationwide, seven postponed those plans, and one withdrew its IPO plan entirely. The bulk of this years life sciences IPOs occurred during the summer. (Massachusetts has had 10 so far this year.) Also, the IPOs since October have seen a smaller first-day jump in prices than in the IPOs over the summer, which the Burrill report attributes to investors looking for a quick return.

Another analysis, by investment firm Credit Suisse, finds that those biotechs that have gone public this year havent kept up with the pace of the market as a whole. The firm tracked the biotechs in the IPO class of 2013 as of mid-November, and found them to be under-performing not only the rest of the biotech sector, but the rest of the market as a whole. Until October, the average stock price of those firms rose at the same rate as the Nasdaq Biotech index. But in just the past two months, shares at the most recently-public companies took a nose dive. The average stock increase of those 38 biotechs as of the end of November was 20 percent for the year. Thats much less than the Nasdaq Biotech Index, which was up 65 percent at the end of November, and even below the Standard & Poors 500 index, which was up 25 percent at the same time.

Anderson, the Morningstar analyst, contends that there are real advancements at the larger drug companies fueling biotech stocks: Biogen Idecs blockbuster multiple sclerosis drug, Tecfidera; Gileads promising new all-oral, interferon free hepatitis C treatment; and Roches advancements with biologic drugs, to name a few. That investor confidence has spilled over into smaller, unproven biotechs.

I dont see this being a bubble that just bursts, she says.

Rather, she predicts that companies will be weeded out over the next two to three years, with investors becoming more selective as a result.

Benu BioVentures Goldberg doesnt hesitate to use the word bubble to describe the current situation for early-stage drug companies.

Goldberg says the biotech industry as a whole performs poorly if you look at actual revenue, compared to other industries with similar levels of investments. That has never been an accepted marker for biotech success, and has been both a cause and symptom of the problem, he says.

Still, even he doesnt expect a sudden crash like in 2000, at least not in the Cambridge area. The area never fully rebounded from the last bubble, he says, and companies are smaller and leaner. Also, he says local biotechs are supported by a large percentage of corporate investment from big pharma firms, which are more willing to wait for promising drug candidates to emerge than venture capitalists, who need to turn a profit more quickly.

Other venture capitalists in the Cambridge area are much more optimistic. Kevin Starr, co-founder of Third Rock Ventures, says you cant judge the biotech market in the short term. Rather, he sees a bigger picture in which the strong investment this year is making up for a shortage of biotechs as well as new drugs for the past decade. Venture capitalists, he says, have largely abandoned early-stage life science companies, while big pharma companies have cut back on research, creating a pent-up demand for new drugs.

The prices that pharma has been willing to pay for really important new products is incredible, Starr says. Pharma is paying more and more and more for access to fewer and fewer products.

Starr says some of the recent irrational exuberance in the market surrounding biotechs is from fund managers with more cash at their disposal looking to increase their holdings in the biotech sector. He says that same exuberance is responsible for the big losses seen at Ariad and other companies after their drugs ran into problems, as investors who arent focused on biotechs tend to flee at the first sign of risk.

But he says the trends underlying the increased investment are still strong.

I think, fundamentally, we are in a renaissance period for life sciences, he says. Long-term, innovation is now being rewarded in M&A (deals) and (stock) market increases.

Noubar Afeyan, founder and CEO of Flagship Ventures in Cambridge, says he sees the recent gains as part of a cycle, following years of a drought in biotech IPOs. He expects a majority of the recently-public biotechs will be acquired, but is confident in their ability to survive any downturns in the market.

I think there will be a reduction in value at some of these companies maybe all of these companies if the whole sector slows down, he says. Then they will grow again.