Advisors Turning To Alternative Investments

Post on: 16 Март, 2015 No Comment

While they’re still poorly understood, more and more advisors are using alternative investments.

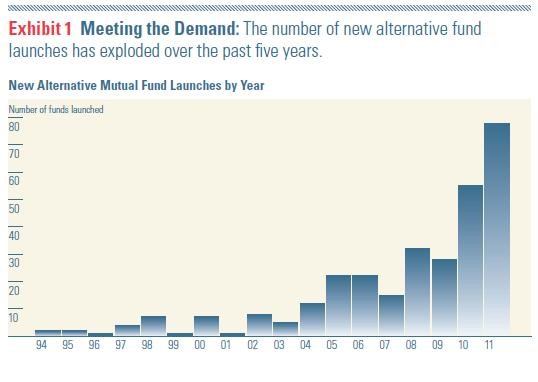

Alternative investments, including hedge fund strategies, are becoming more popular, as many advisors turn to off-the-beaten-path vehicles for everything from portfolio diversification to risk management to generate returns, a study from Cambridge, Mass.-based Cogent Research showed.

While ETFs have not been the vehicle of choice to access alternative asset classes, that’s quickly changing for advisors, according to the 2011 Advisor Brandscape report, which was compiled by the market research firm. The study found that more advisors expect to increase their use of alternatives and ETFs in the next year.

To date, nearly 80 percent of all retail advisors interviewed in the survey rely on alternative strategies within client portfolios, allocating on average 11 percent of their book to such strategies. Apart from hedge funds, alternative investment strategies include venture capital, private equity, limited partnerships and structured products and notes.

Of all those making use of alternative investment strategies, more than 40 percent of them will increase their use of ETFs in the next 12 months. Comparative data weren’t available, as this is the first time Cogent addressed the use of alternatives.

“It was somewhat surprising to us to see such broad and consistent use of alternatives, not only across channels, but also based on assets under management,” John Meunier, a Cogent principal, said in a press release about the report.

The study was based on interviews of 1,643 retail advisors.

“Clearly, advisors of all stripes and tenure have embraced the notion that managing client portfolios in today’s environment requires the tools to provide greater asset-class diversification and better risk management strategies,” he added.

Alternatives have been mostly heralded for their ability to diversify a basket of investments. Some 83 percent of those who use such strategies in their books said they do so to diversify the mix. Managing risk is a close second, as 80 percent of advisors who use alternatives do so to mitigate risk exposure.

More than half of those who make use of alternatives do so to achieve absolute returns, while some confessed to seeking to beat a benchmark with the instruments. Tax management was cited as a reason to use alternatives by nearly 20 percent of the advisors who said they use them.

Information Deficit

Still, word about alternative investments is still getting out.

Among the 22 percent of advisors who don’t currently use alternatives, nearly half said that’s because they lack knowledge about the strategies and how they work.

That lack of knowledge is also said to be holding back clients and preventing advisors who are keen on using such instruments from expanding their allocation to them, the report found.

More education and customer support coming from providers will be key in promoting product acceptance, Meunier said.

“These figures represent a huge opportunity for mutual fund and ETF providers to satisfy a growing demand among retail advisors for institutional-quality alternative investment strategies that are both scalable within their practices and palatable to skeptical investors,” Meunier said.