Accounting rate of return (ARR) method example formula advantages and disadvantages

Post on: 31 Май, 2015 No Comment

If you have already studied other capital budgeting methods (net present value method. internal rate of return method and payback method ), you may have noticed that all these methods focus on cash flows. But accounting rate of return (ARR) method uses expected net operating income to be generated by the investment proposal rather than focusing on cash flows to evaluate an investment proposal.

Under this method, the assets expected accounting rate of return (ARR) is computed by dividing the expected incremental net operating income by the initial investment and then compared to the managements desired rate of return to accept or reject a proposal. If the assets expected accounting rate of return is greater than or equal to the managements desired rate of return, the proposal is accepted. Otherwise, it is rejected. The accounting rate of return is computed using the following formula:

Formula of accounting rate of return (ARR):

In the above formula, the incremental net operating income is equal to incremental revenues to be generated by the asset less incremental operating expenses. The incremental operating expenses also include depreciation of the asset.

The denominator in the formula is the amount of investment initially required to purchase the asset. If an old asset is replaced with a new one, the amount of initial investment would be reduced by any proceeds realized from the sale of old equipment.

Example 1:

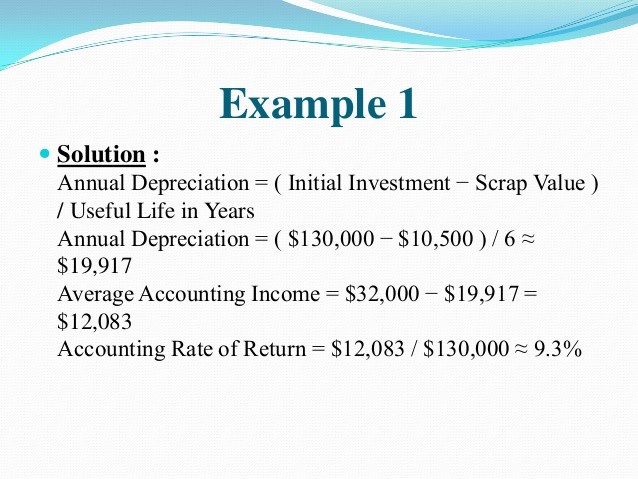

The Fine Clothing Factory wants to replace an old machine with a new one. The old machine can be sold to a small factory for $10,000. The new machine would increase annual revenue by $150,000 and annual operating expenses by $60,000. The new machine would cost $360,000. The estimated useful life of the machine is 12 years with zero salvage value.

- Compute accounting rate of return (ARR) of the machine using above information.

- Should Fine Clothing Factory purchase the machine if management wants an accounting rate of return of 15% on all capital investments?

Solution:

(1): Computation of accounting rate of return:

= $60,000 * / $350,000 **

= 17.14%

* Incremental net operating income:

Incremental revenues Incremental expenses including depreciation

$150,000 ($60,000 cash operating expenses + $30,000 depreciation)

$150,000 $90,000

** The amount of initial investment has been reduced by net realizable value of the old machine ($360,000 $10,000).

According to accounting rate of return method, the Fine Clothing Factory should purchases the machine because its estimated accounting rate of return is 17.14% which is greater than the managements desired rate of return of 15%.

Cost reduction projects:

The accounting rate of return method is equally beneficial to evaluate cost reduction projects. The accounting rate of return of the assets that are purchased with a view to reduce business costs is computed using the following formula:

Example 2:

The P & G company is considering to purchase an equipment costing $45,000 to be used in packing department. It would reduce annual labor cost by $12,000. The useful life of the equipment would be 15 years with no salvage value. The operating expenses of the equipment other than depreciation would be $3,000 per year.