Accounting Goodwill Analyzing a Balance Sheet

Post on: 31 Май, 2015 No Comment

Investing Lesson 3 — Analyzing a Balance Sheet

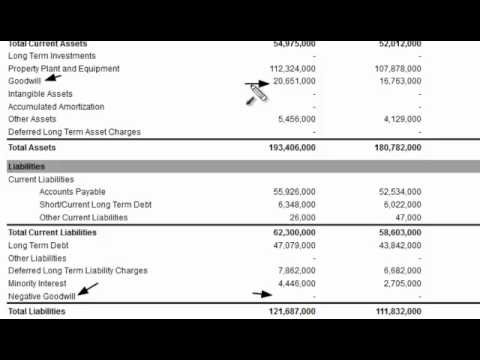

In the accounting sense, Goodwill can be thought of as a premium for buying a business. When one company buys another, the amount it pays is called the purchase price. Accountants take the purchase price and subtract it by a company’s book value. The difference is called Goodwill.

For decades, when a company bought another company, it could use one of two accounting methods: pooling of interest or purchase. When the pooling of interest method is used, the balance sheets of the two businesses are combined and no goodwill is created. When the purchase method is used, the acquiring company will put the premium they paid for the other company on their balance sheet under the Goodwill category. Accounting rules require the goodwill be amortized over the course of 40 years.

An Example of Balance Sheet Goodwill

McDonald’s

Earnings: $1,977,300,000

Shares Outstanding: 1.29 Billion

(You don’t need McDonald’s other information for this example)

Book Value: $1,082,424,000

Book Value per Share: $10.3482

Earnings: $169,648,000

Say McDonald’s decided to buy all of Wendy’s stock using the purchase method. Wendy’s has a book value of $10.3482 per share, yet is trading at $32 per share. If McDonald’s were to pay the current market price. they would spend a total of $3,347,200,000 (104.6 million shares x $36 per share). To keep this example simple, we are going to assume the shareholders of Wendy’s approved the merger for cash. McDonald’s would mail a check to the Wendy’s shareholders, paying them $32 for each share they owned.

Since the book value of Wendy’s is only $1,082,424,000, and McDonald’s paid $3,347,200,000, McDonald’s paid a premium of $2,264,776,000. This is going to go onto their balance sheet as Goodwill. It is required to be amortized against earnings for up to 40 years. This means that each year, 1/40 of the goodwill amount must be subtracted from McDonald’s earnings so that by the 40th year, there is no goodwill left on the balance sheet.

Now that McDonald’s and Wendy’s are one company, their earnings will be combined. Assuming next year’s results were identical, the company would earn $2,146,948,000, or $1.66 per share1. Remember that goodwill must be amortized, meaning 1/40 the amount must be deducted from next year’s earnings. McDonald’s must deduct $56,619,400 from earnings next year as a charge against goodwill2. Now, McDonald’s can only report earnings of $2,090,328,600, or $1.62 per share (compared to the $1.66 they would have been able to report before the goodwill charge ). Goodwill reduced earnings by 4 per share.

If the pooling of interest method had been used, no goodwill would have been created, and McDonald’s would have reported EPS (earnings per share) of $1.66. Meaning that depending on how the accounting was handled, the exact same transaction could have two vastly different impacts on earnings per share.

Goodwill on the Balance Sheet Receives New Accounting Rules

It is no wonder that managements, in order to avoid this reduction in reportable earnings, frequently opted to use the pooling of interest method when they complete a merger. Since no goodwill is created, over-eager managers are able to pay outrageous prices for acquisitions with little or no accountability on the balance sheet. Since it makes no sense to have two different ways for accounting for a merger, the FASB (the folks in charge of coming up with these accounting rules) decided they should eliminate the pooling of interest method and force all transactions to be done via the purchase method. Executives and politicians claimed this will significantly reduce the number of mergers since the new standards would cause reportable earnings to drop as soon as a company had completed an acquisition. As a concession, the FASB will no longer require goodwill to be written off unless the assets became impaired (which means it becomes clear that the goodwill isn’t worth what the company paid for it).

Pay careful attention to the mergers a company has made in the past few years. Once you are able to value a business. you will want to look at recent acquisitions to determine if they were too expensive. If you find this to be the case, you will probably want to avoid the stock (why would you want to invest in a company that was throwing your money around?).

Notes: 1.) Since McDonald’s purchased Wendy’s, the two companies’ profits will be combined. $1,977,300,000 + $169,648,000 = $2,146,948,000. To get the earnings per share, you would simply divide it by the number of shares outstanding (1.29 billion). We’re assuming McDonald’s bought Wendy’s for cash. If stock had been used, the number of shares would change, but for simplicity sake, we are going to assume this not to be the case. 2.) Take the premium $2,264,776,000 and divide it by 40 years = this is the charge against earnings each year 3.) Companies purchased before 1970 are not required to be amortized off the balance sheet. They can stay there forever.

This page is part of Investing Lesson 3 — Understanding the Balance Sheet. To go back to the beginning, see the Table of Contents . If you have already read this lesson, you can skip directly to the Balance Sheet Quiz .