A Value Investor’s Haven Japan (Final) ValueEdge

Post on: 22 Октябрь, 2015 No Comment

Tee Leng November 9, 2014 6 comments

Having explained how I navigated the Japanese market in Part 3. in this last post of the series, I would be sharing 2 Japanese companies I found and invested in. For the following companies, I would just be writing a short summary of the investment thesis.

Co-Cos Nobuoka (3599.JP):

Est. in 1948, Co-Cos Nobuoka is a manufacturer of work clothing, operating mainly in Hiroshima. Recently, it has been expanding into sports wear, dress shirts and other forms of apparels, however, uniforms for corporate clients accounts for the bulk of the revenue. Their production line have been shifting towards Indochina including Vietnam.

- Increasing Cash & Cash Equivalents

- Increasing NAV

- Total Debt to Equity within acceptable levels of approximately 15%

- Pays dividends

- Constant buy-back of shares

- Constantly reducing debt levels

2C93 /%When discovered, Co-Cos Nobuoka was trading at ¥586, translating to a discount of 43.5% to NCAV, with a Price-to-Book ratio of 0.30x. Over the past 1.5 months, the share price has risen 34.1%, against a 4.9% rise in Nikkei 225 ETF.

Shinko Shoji Co. (8141.JP):

Est. in 1953, Shinko Shoji is one of the 3 largest traders specialising in electronic parts including semiconductors. Furthermore, they have a strength in electronic parts for industrial and game machines, such as pachinko machines. Despite its operations mainly in Japan, they have still have an overseas presence with 25% of revenue derived from sales overseas.

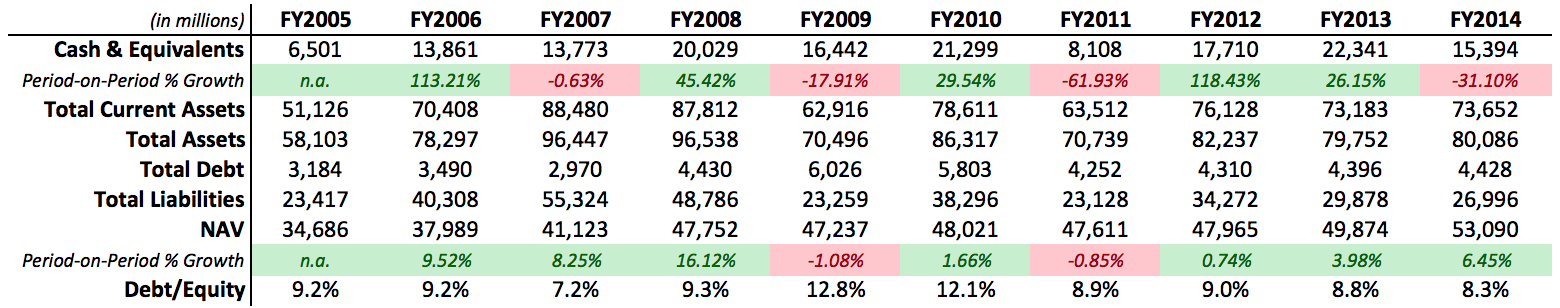

- Cash & Cash Equivalents trending upwards

- NAV trending upwards

- Total Debt to Equity within acceptable levels of approximately 9%

- Pays dividends

- Constant buy-back of shares

- Reducing debt levels; years with sharp decline in Cash & Cash Equivalents corresponds to a sharp increase in net borrowings

2C85 /% When discovered, Shinko Shoji was trading at ¥1,013, translating to a discount of 46.0% to NCAV, with a Price-to-Book ratio of 0.47x. Over the past 2 months, the share price has increased 8.7%, against a 4% increase in Nikkei 225 ETF.

With these two examples and the past 3 posts, I hope it would serve as a good starting point for other value investors thinking of entering the Japanese market. The investment thesis I have written are only snapshots of the more important reasons I wanted to highlight investing in Japan companies. Other factors have to be considered such as EBIT, Net Income and Free Cash Flow. One key takeaway with such an investment strategy would be that investors are going in somewhat blind. Going forward, there is not much reason to expect an increase in Japan companies to start publishing Annual Reports in English. Hence, this blindfold when entering the Japanese market is not going to come off anytime soon. One advice to fellow value investors would be with such an investment strategy, the main priority would be to ensure protection of capital and not outperformance. Once capital protection is achieved, outperformance would naturally come in the long term horizon.

Do feel free to email me/drop a comment if you have any queries with regards to investing in Japan as I do understand it can be rather frightening initially.

Disclaimer: The authors have vested interests in 3599.JP & 8141.JP