8 SGX Rules Every Investor Must Know

Post on: 30 Июнь, 2015 No Comment

There are 7 Rulebooks issued by SGX and the one that is most relevant to retail investors is the Listing Mainboard Rules.

It is very intimidating to read and understand the Rulebooks but as an investor, there are some basics we ought to know. In fact, some are shareholders rights that you must know!

Some of these rules are truncated so that I can keep the article short. Also, SGX may amend the rules in the future. Hence, please head to the SGX Rulebook for the updated details.

1. Annual Report and Annual General Meeting Schedule

707

(1) The time between the end of an issuers financial year and the date of its annual general meeting (if any) must not exceed four months.

(2) An issuer must issue its annual report to shareholders and the Exchange at least 14 days before the date of its annual general meeting.

This rule also means that you should receive the annual report within 3.5 months from the financial year end of the company. Usually an unaudited version will be published earlier. It will take some time for the audit to be completed before the actual annual report is compiled and published.

712

(3) A change in auditing firm must be specifically approved by shareholders in a general meeting.

3. Minimum Percentage of Shares in Public Hands

723

An issuer must ensure that at least 10% of the total number of issued shares excluding treasury shares (excluding preference shares and convertible equity securities) in a class that is listed is at all times held by the public.

The percentage of shares held by public is also known as free float or public float. It is a requirement for all SGX listings to maintain at least 10% free float. Else, the following will happen:

724

(1) If the percentage of securities held in public hands falls below 10%: —

(a) The issuer must, as soon as practicable, announce that fact; and

(b) The Exchange may suspend trading of the class, or all the securities of the issuer.

(2) The Exchange may allow the issuer a period of 3 months, or such longer period as the Exchange may agree, to raise the percentage of securities in public hands to at least 10%. The issuer may be delisted if it fails to restore the percentage of securities in public hands to at least 10% after the period.

Hence, delisting may happen if the company failed to restore the float to 10% or more after the 3 months grace from SGX. In this case, the company is still expected to make a reasonable offer to the shareholders for the exit.

The information about the company free float is reported under shareholder statistics in the annual report. This section is usually found in the last few pages of the annual report, just before the AGM information.

4. AGM To Be Held In Singapore Unless Prohibited

730A (effective till 31 Jul 15)

(1) An issuer primary-listed on the Exchange shall hold all its general meetings in Singapore, unless prohibited by relevant laws and regulations in the jurisdiction of its incorporation.

730A (effective from 1 Aug 15)

(1) An issuer shall hold all its general meetings in Singapore, unless prohibited by relevant laws and regulations in the jurisdiction of its incorporation.

(2) All resolutions at general meetings shall be voted by poll.

(3) At least one scrutineer shall be appointed for each general meeting. The appointed scrutineer(s) shall be independent of the persons undertaking the polling process. Where the appointed scrutineer is interested in the resolution(s) to be passed at the general meeting, it shall refrain from acting as the scrutineer for such resolution(s).

This rule is new and I hope to see more companies hold their AGM in Singapore, especially those companies registered in faraway land like Bermuda. I also understand that companies are supposed to do video conferencing of the AGM proceedings if they are held overseas.

The appointment of the scrutineer would also be a new sight at AGMs from Aug 15 onwards!

5. Company Share Buy-Back Has a Limit

881

An issuer may purchase its own shares (share buy-back) if it has obtained the prior specific approval of shareholders in general meeting.

882

A share buy-back may only be made by way of on-market purchases transacted through the Exchanges trading system or on another stock exchange on which the issuers equity securities are listed (market acquisition) or by way of an off-market acquisition in accordance with an equal access scheme as defined in Section 76C of the Companies Act. Unless a lower limit is prescribed under the issuers law of incorporation, such share buy-back shall not exceed 10 per cent of the total number of issued ordinary shares in the capital of the issuer as at the date of the resolution passed by shareholders for the share buy-back.

During each AGM, most if not all companies, would want to seek shareholders approval for share buy-back permission. Although most companies do not conduct share buy-backs, they still prefer to have the flexibility to do so as and when appropriate within the year. It is also important to note that share buy-back cannot exceed 10 percent of the total number of shares.

The following rule states that the company cannot buy back the shares higher than 5 percent of the average closing market price, otherwise the share price can get pushed up manipulatively.

884

An issuer may only purchase shares by way of a market acquisition at a price which is not more than 5% above the average closing market price. For this purpose, the average closing market price is:—

(1) the average of the closing market prices of the shares over the last 5 market days, on which transactions in the share were recorded, before the day on which the purchases are made; and

(2) deemed to be adjusted for any corporate action that occurs after the relevant 5-day period.

6. Listed Companies Must Have Business Operations

1018

(1) If the assets of an issuer consist wholly or substantially of cash or short-dated securities, its securities will normally be suspended. The suspension will remain in force until the issuer has a business which is able to satisfy the Exchanges requirements for a new listing, and all relevant information has been announced

(2) The Exchange will proceed to remove an issuer from the Official List if it is unable to meet the requirements for a new listing within 12 months from the time it becomes a cash company. The issuer may apply to the Exchange for a maximum 6-month extension to the 12-month period if it has already signed a definitive agreement for the acquisition of a new business, of which the acquisition must be completed in the 6-month extension period. The extension is subject to the issuer providing information to investors on its progress in meeting key milestones in the transaction. In the event the issuer is unable to meet its milestones or complete the relevant acquisition despite the time extension granted, no further extension will be granted and the issuer will be required to delist and a cash exit offer in accordance with Rule 1309 be made to the issuers shareholders within 6 months.

Some companies have sold their businesses and held a lot of cash. I remembered Elite KSB, a chicken slaughtering supplier, sold its entire business at a price higher than the stock price. The company distributed dividends higher than what investors paid for the stocks and still able to keep some cash for acquisition. However, the company could not find any suitable operations to acquire and eventually delist.

Just last year, Jaya Holdings also sold their business to Mermaid Maritime and the former has to report their asset valuation and cash utilisation every month, while the management look for an operating business to acquire.

7. Delisting Requirements

1307

The Exchange may agree to an application by an issuer to delist from the Exchange if:—

(1) the issuer convenes a general meeting to obtain shareholder approval for the delisting;

(2) the resolution to delist the issuer has been approved by a majority of at least 75% of the total number of issued shares excluding treasury shares held by the shareholders present and voting, on a poll, either in person or by proxy at the meeting (the issuers directors and controlling shareholder need not abstain from voting on the resolution); and

(3) the resolution has not been voted against by 10% or more of the total number of issued shares excluding treasury shares held by the shareholders present and voting, on a poll, either in person or by proxy at the meeting.

The point 2 and 3 are most important. It is common that the issuer would collect enough shares through voluntary cash offer prior to a delist offer. This is because they want to be confident they can achieve the 75% approval for delisting, and minimise the chances of having 10% to vote against them.

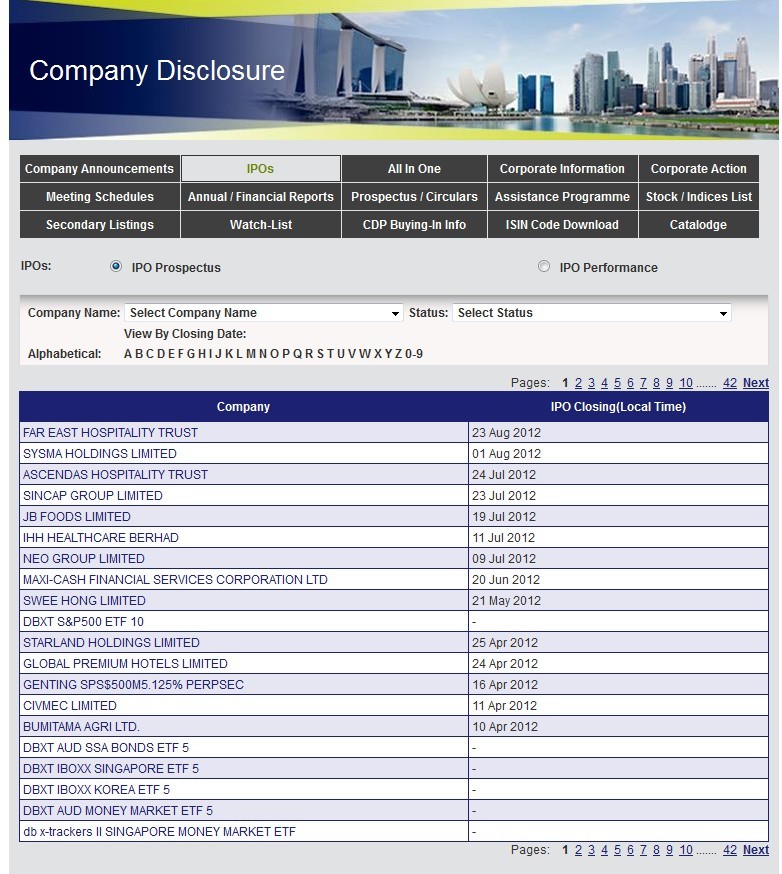

8. SGX Watchlist

1311

The Exchange will place an issuer on the watch-list, if it records:—

(1) pre-tax losses for the three (3) most recently completed consecutive financial years (based on the latest announced full year consolidated accounts, excluding exceptional or non-recurrent income and extraordinary items); and

(2) an average daily market capitalisation of less than $40 million over the last 120 market days on which trading was not suspended or halted. For the purpose of this rule, trading is deemed to be suspended or halted if trading is ceased for a full market day.

You can access the SGX Watchlist here. It is wise to check whether the stocks you intend to invest are on this list!

>>> Warren Buffett’s secrets to investing is buying a great company at a fair price. Now you can use this simple yet powerful spreadsheet to determine the intrinsic value of a stock. You can download it here for FREE.

DO YOU KNOW: Blue chips stocks are expensive to buy and slow to profit. Discover the uncommon approach to stock gains. Find off radar stocks for profits (Hint: They often give triple-digit returns). Simple method you wished you knew in our 1-day content packed course. Click here to register

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D80&r=G /%