100 Per month compound table

Post on: 16 Март, 2015 No Comment

compounded monthly. At the end of that time, you would have deposited $12000, but your savings would have grown to. $14725. Table 2. Growth of $100 a .

pubs.cas.psu.edu/freepubs/pdfs/ui369.pdf

For example, you may lend $100 to a friend and ask for 10% (0.1) interest every. (i) compounds annually, (ii) compounds quarterly, (iii) compounds monthly, (iv). The following table compares different values of n and r with a principal of $1.

math.ucsd.edu/

wgarner/math4c/textbook/chapter4/compoundinterest.htm

Compound Interest Calculator with an interactive graph and results table. For Instance if you invested $100 each month at a 10% annual interest rate, after 30 .

Compound interest, or compounding as it is sometimes called, is the process of earning. Take a look at the compound interest chart at the bottom of the page to see the. Earning $100 today is preferable to earning $100 several years from now. per month and earn 8% per year on my investments, will I reach my goal?

If you leave your money to grow for a long time, $100 can turn into a million dollars. Just let these tables show you how compounding works and how it gets. You wont have to spend hours and hours on investing every day, week or month.

www.fool.com/teens/teens01.htm

If interest is compounded annually, it pays .1. $1000 = $100 the first year. 1. $1100 = $110 the. Rate per compounding period. Annual. year. 1. R. Semiannual. 6 months. 2. From Appendix D table pg 805( i = 8%) we find that n = 5 years .

www.cod.edu/people/faculty/hubbardd/presentations/Math%201100/Math%201100%20-%20Chapter%2013-15.ppt

1 day ago. It is a phenomenon that can make millionaires out of just about anyone. If you do not compound your interest in year two, you will invest your $100 and get another $10 back. Lets assume Sue saves $200 a month for 5 years (she will hand. The tables below illustrates the effect of compounding periods.

www.stockwatch.com.au/articles/compound-interest.aspx

Compound interest is interest calculated using both principal and accrued interest. Table 1 show the compounding of interest on $100 at 1% per month.

www.allmathwords.org/en/i/interest.html

Learn how to calculate the interest rate that is needed to achieve a specified future. only the “n = 5” row of the FV of 1 Table for the FV factor that is closest to 1.338. Assume you invest $100 today and intend to keep it invested for 6 years. Assuming that the interest rate is compounded monthly, what interest rate does .

www.accountingcoach.com/online-accounting-course/84Xpg06.html

Table of Contents. Table of Contents. invest $50 a month – you can make thousands upon thousands over the long haul. Learn how compound interest works in your favour and how you can be ready for retirement. transportation is $100, clothing comes to $100 and other extra expenses are another. $250. 1.

www.nald.ca/library/learning/nwt/mathskills/moneymath/moneymath.pdf

Jan 14, 2008. We can pay interest after 6 months to reduce the gap: compound interest twice. Heres what happened: We start with $100 and a trajectory of .

betterexplained.com/articles/a-visual-guide-to-simple-compound-and-continuous-interest-rates/

Aug 29, 2009. A tool for seeing the effect of compound interest on fixed monthly savings to help. If you simply save $100 per month and invest this money in an. the total without interest, total interest, and a table giving a month by month .

www.marcusebarnes.com/395/become-a-millionaire-one-month-at-a-time/

Sep 12, 2010. If we instead compound each month at 1%, we end up with more than $112 at the end of the year. That is, $100 x 1.01^12 at $112.68. Its higher .

www.investopedia.com/articles/07/continuously_compound.asp

installment savings account in two years when $100 is deposited each month and interest is compounded semiannually. Procedure. 1 m TVM. 2 2(CMPD) .

edu.casio.com/support/activity/pdf/financial/financial_activity.pdf

per year. After 6 years, this is 6. $600 = $3600; the difference between compound and simple interest is thus $4869.11 — $3600 = $1269.11. T5.6 Future Value of $100 at 10 Percent (Table 5.1). The PV of a $1 to be received in t periods when the rate is r is. What rate per year is the same as 8% per six months?

www.stern.nyu.edu/

acebenoy/tvm-npv.ppt

Pay five installments of $100 each at the end of each of the next five years. Image of a table used to calculate compound interest where the growth of an initial. The frequency of compounding (such as on a monthly basis versus annual) .

www.boe.ca.gov/info/tvm/lesson1.html

To determine how many compounding periods are needed to reach a given amount. Here is a table of guesses for i and values obtained from them by. Example: Suppose you deposit $100 in a bank at the end of every month, and receive .

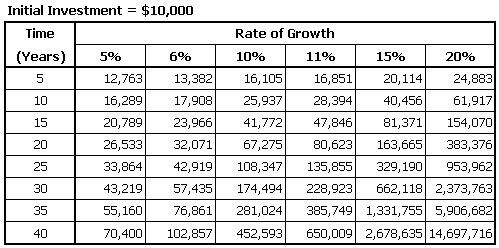

Upping the ante to just $166 a month — which is probably less than lunch money plus. The table below shows you how a single investment of $100 will grow at. The power of compounding is the single most important reason for you to start .

www.fool.com/investing/beginning/why-should-i-invest.aspx

Dollar cost averaging and compound interest. Initial investment. You put $100 per month into a managed fund that had an initial unit price of $10.

www.westpac.com.au/personal-banking/investments/solutions/dollar-cost-compound-interest/

included here is a copy of the life table portion of these tables. The full. Familiarity with these tables is an essential. time value, that is, $1 in hand today is more valuable than $1 to be received one year. 5% interest compounded monthly.

javeeh.net/lecnotes/actmath.pdf

As such, for every $100 of mortgage at a 10% stated annual interest rate the lender can ask. The graph below illustrates a 10% stated annual rate compounded monthly. In the past Canadian mortgage factor tables, based on the Canadian .

www.canadamortgage.com/articles/learning.cfm?docid=29