Understanding Unconstrained Fixed Income

Post on: 26 Ноябрь, 2016 No Comment

By Priscilla Hancock, Global Fixed Income Strategist, J.P. Morgan Funds

These days, it seems that every new fixed income fund is unconstrained. What are unconstrained funds? And why are they suddenly popular?

Unconstrained investing is a style of investing; it refers to the portfolio manager’s opportunity set. Unconstrained portfolio managers are not held to a benchmark; instead they are free to pursue their best ideas, often across a variety of asset classes, security types, and sectors (what is commonly referred to as a multi-sector, or go-anywhere, approach). With the prospect of rising rates increasingly likely, that flexibility can be especially useful. Unconstrained portfolios stand in direct contrast to benchmark-aware, or indexed, strategies.

Why not mimic a benchmark? Most fixed income indices are constructed using a series of rules (ratings, domicile, currency, sector, etc.) that are applied to the existing stock of fixed income securities. As issuers issue more and more bonds that meet the rules, their securities come to dominate the respective index. In this way, fixed income benchmarks become benchmarks of adverse selection; indexed portfolios are weighted towards large debt issuers.

Benchmark concentration

Take, for example, the J.P. Morgan Emerging Market Bond Index Global (EMBIG). There are 444 issuers in the EMBIG, with an average credit rating of BBB, but almost 7% (by market value) is debt of two Venezuelan issuers (the Republic of Venezuela and Petroleos de Venezuela), most of which is rated CCC+. The weighted duration of the EMBIG is 6.84 years, and 22% of the index has duration of 10-plus years. What if you want exposure to emerging markets debt, but you don’t want to own CCC-rated issuers? What if you don’t want to have 22% of your portfolio in longer duration bonds?

Because benchmarks are comprised of outstanding bonds, they also limit the tools that a portfolio manager can use. The use of derivatives to hedge a position, or shorts to take a contrarian view, has no place in a fixed income index. Yet, given current market conditions, they may be the exact tools that are necessary for the next cycle.

Unconstrained bond funds are not risk free, however. No longer are there a set of guide rails for a portfolio manager. Benchmark risk is replaced with manager risk. As a result, investors need to conduct more thorough due diligence. Only unconstrained bond managers with experience and expertise, the appropriate resources, and rigorous investment and risk management processes can access opportunities irrespective of geography or sector, while maintaining effective portfolio diversification. Even the nature of a manager’s constraints, or the absence of those constraints, needs to be understood by investors. Unconstrained funds have limits, and some unconstrained funds are more constrained than others.

An effective manager of unconstrained funds will employ a disciplined and repeatable investment process that is able to consistently identify the most attractive security ideas generated by local bond market analysts. Just as importantly, unconstrained managers need to take a multi-dimensional approach to risk. In a benchmark aware strategy, it may be enough to measure tracking error and the impact of changes in the yield curve and spreads to risk-free Treasuries. In an unconstrained portfolio, the manager must ensure risk exposures are well-diversified across portfolios. This involves monitoring the correlation of portfolios to several risk factors and asset classes, undertaking stress testing and employing scenario analysis to better understand portfolio risks. An investment and risk management process of this caliber cannot be developed overnight.

Don’t confuse unconstrained with absolute return

Unconstrained investing should not be confused with absolute return investing. Though the terms are often used interchangeably, they are completely different. While unconstrained refers to the portfolio manager’s opportunity set, absolute return refers to one potential outcome. Absolute return managers look to deliver positive returns in all market conditions. In many ways, they are the hedge funds of fixed income, employing both long and short positions and actively hedging portfolio risk.

Similarly, unconstrained investing can be used to seek total returns, where greater risk may equal greater reward. Unconstrained total return managers can tactically allocate across asset classes to determine the best combination of risk and reward, while seeking to avoid assets with asymmetric risk profiles.

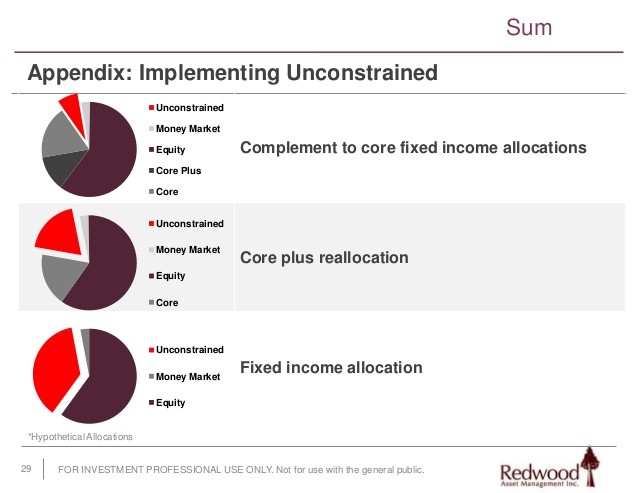

Unconstrained mandates give managers the flexibility to pursue their best ideas, weighting their portfolios towards issuers and security types that may be under-(or over-)valued or overlooked; to employ sophisticated investment products; and to manage both credit and duration risk. In today’s environment of very low yields and potentially rising rates, that flexibility is appealing.

To learn more about how to capitalize on this opportunity visit jpmorganfunds.com