Unconstrained Investing Spring 2014 Quarterly Perspectives

Post on: 8 Ноябрь, 2016 No Comment

Perspectives Newsletter Q1 2014

Unconstrained investing. Chances are you’ve heard the term being bandied about in recent years. Is it a flash-in-the-pan investing trend? Should you consider it for your portfolio? Our answers: No. and yes. Here we tackle three of the big questions related to unconstrained investing strategies.

What It Is

Unconstrained, by dictionary definition, means not restricted or limited. And that’s a fair application in the investing world. Other words that would apply equally well: flexible, adaptable, go-anywhere, tactical. More practically and specifically, unconstrained is an investment approach that taps opportunities across a wide set of asset classes and markets without the limitations imposed by a broad market benchmark.

That offers several potential advantages, says Rick Rieder, Chief Investment Officer of Fundamental Fixed Income and Portfolio Manager of the unconstrained BlackRock Strategic Income Opportunities Fund. If a bond manager is constrained to a benchmark, such as the Barclays U.S. Aggregate Bond Index, it essentially forces that manager to replicate that index (with some narrow room to ‘tilt’ the portfolio), limiting the potential for returns and potentially exacerbating risks.

With an unconstrained approach, the majority of the bond world, much of it off limits to the traditional core bond investor, becomes available, Mr. Rieder explains. This includes U.S. and international high yield, non-U.S. sovereign debt, emerging market sovereign and corporate debt, bank loans and collateralized loan obligations, among many other securitized instruments.

What It Is Not

For all its merits, some wonder whether unconstrained and the absence of a foundational benchmark equates to a lack of discipline. Without a benchmark, does unconstrained investing encourage managers to take on too much risk? Peter Hayes, Head of the Municipal Bonds Group and a portfolio manager of the BlackRock Strategic Municipal Opportunities Fund. offers a confident no.

Unconstrained absolutely should not be read as undisciplined, he says. We would argue our approach is more immersed and vigilant than one that, for example, can invest only in investmen-tgrade bonds with intermediate maturities. We have to be more diligent than most in scouring the market, understanding the risk/reward that exists and tactically adjusting our allocation to take best advantage of all that’s available.

The reality is that unconstrained strategies tend to be outcome oriented rather than focused on beating a benchmark. We know investors need income, and we know the options today are limited. We are aiming to solve for that in our portfolio, Mr. Rieder says, noting that he and his team are not looking for investments that offer the biggest bang in the moment. We’re looking to construct a portfolio that can generate attractive risk-adjusted returns with less volatility over time.

Why You Need It

The markets are changing—and some traditional investment approaches that worked in the past may not any longer.

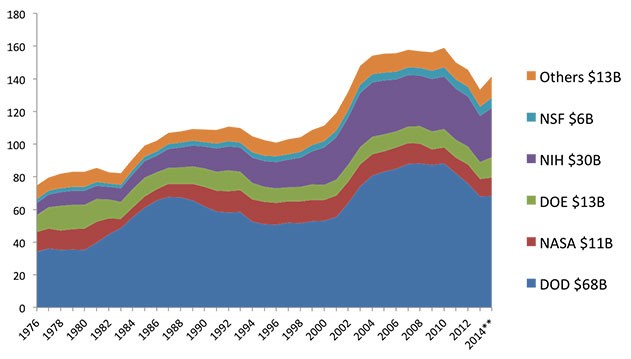

Consider today’s leading fixed income benchmark, the aforementioned Barclays U.S. Aggregate Bond Index (the Agg). By construction, the index replicates the investment-grade debt sold in the U.S. market. Hence, it is heavily weighted(roughly 75%) toward U.S. Treasuries and other government-related securities— the very investments that are most affected by changes in interest rates. This is less than ideal in an environment where the consensus is calling for interest rates to rise (which means bond prices fall). In short, investing in a traditional fixed income portfolio could mean taking on more risk than you realize.

A dynamic, unconstrained portfolio is not limited by the Agg or any other benchmark. It has the option to invest across a broad universe and to tactically adjust course as conditions warrant. This affords investors exposure to different types of risk and return opportunities, all within the context of a single professionally managed portfolio. While this type of diversification does not assure a profit or protect against loss, it has been shown to provide for more consistent results over time as the risks in some assets are offset by opportunities in others.

Michael Fredericks, Portfolio Manager of the BlackRock Multi-Asset Income Fund. agrees with his colleagues: The flexibility of a go-anywhere tactical approach means benchmark allocations are not holding the portfolio back by requiring us to invest in low-yield, high-volatility asset classes, which happen to be in large supply today. We feel strongly that a one-stop solution that carefully manages volatility can offer investors attractive income and a more consistent experience over time.

Are you ready to be unconstrained? Contact your financial professional or our Investor Service Center at 800-441-7762.

Unconstrained Investing Is…

Unconstrained Investing Is Not.