Trading FAQs Order Types

Post on: 6 Май, 2016 No Comment

General order types

A market order instructs Fidelity to buy or sell securities for your account at the next available price. It remains in effect only for the day, and usually results in the prompt purchase or sale of all the shares of stock, options contracts, or bonds in question, as long as the security is actively traded and market conditions permit.

Note: In order to maintain a fair and orderly market, most market centers generally do not accept cancellation requests after 9:28 a.m. ET for market orders eligible for execution at 9:30 a.m. ET, when the market opens. Acceptance of a cancellation request by Fidelity between 9:28 and 9:30 a.m. ET does not guarantee an order cancellation. All requests to cancel an order are processed on a best-efforts basis.

When you place a limit order to buy, the stock is eligible to be purchased at or below your limit price, but never above it.

You may place limit orders either for the day on which they are entered (a day order), or for a period that ends when it is executed or when you cancel (an open order or good ’til canceled (GTC) order).

Note: All open GTC orders will expire 180 calendar days after they are placed. If the 180th day falls on a weekend or holiday, those orders will expire on the first business day following the expiration day. This policy does not apply to options.

Orders at each price level are filled in a sequence that is determined by the rules of the various market centers; therefore, there can be no assurance that all orders at a particular price limit (including yours) will be filled when that price is reached. Such orders are also subject to the existence of a market for that security. Thus, the fact that your price limit was reached does not guarantee an execution.

Limit orders for more than 100 shares or for multiple round lots (200, 300, 400, etc.) may be filled completely or in part until completed. It may take more than one trading day to completely fill a multiple round lot or mixed-lot order unless the order is designated as one of the following types:

- All or none (fill the whole order or no part of it). When you place an all-or-none designation on your order, it is considered restricted. The stock can trade at or below your price on a buy, or at or above on a sell, without the right to execution, unless the entire amount of your order is executable.

- Immediate or cancel (fill the whole order or any part immediately, and cancel any unfilled balance).

- Fill or kill (fill the entire order immediately or cancel it).

Note: Good ’til canceled time in force is not available for short sales, unlisted corporate bonds and treasuries, mortgage-backed and agency bonds, and collateralized mortgage obligations (CMOs). We do not accept limit orders for municipal bonds, commercial paper, unit investment trusts (UITs), certificates of deposit (CDs), or mutual funds.

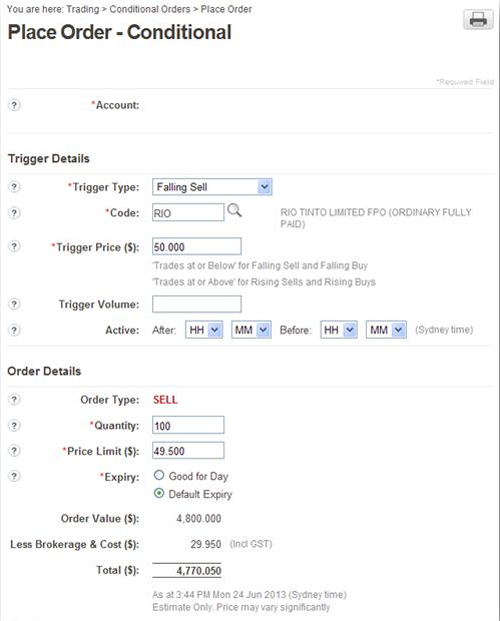

Stop orders are generally used to protect a profit or to prevent further loss if the price of a security moves against you. They can also be used to establish a position in a security if it reaches a certain price threshold or to close a short position.

The specialists on the various exchanges and market makers have the right to refuse stop orders under certain market conditions. Not all securities or trading sessions (pre- and post-market) are eligible for stop orders.

This type of order automatically becomes a market order when the stop price is reached. Therefore, there is no guarantee that your order will be executed at the stop price. It is important for investors to understand that company news or market conditions can have a significant impact on the price of a security. This could result in a stop loss order being executed at a price that is dramatically different than what your stop loss price indicates. Stop limit

This type of order automatically becomes a limit order when the stop price is reached. Like any limit order, a stop limit order may be filled in whole, in part, or not at all, depending on the number of shares available for sale or purchase at the time. Note: Buy stop loss and buy stop limit orders must be entered at a price which is above the current market price. Sell stop loss and sell stop limit orders must be entered at a price which is below the current market price.

How stop orders are triggered

- Stocks

Equity stop orders placed with Fidelity are triggered off of a round lot transaction of 100 shares or greater, or a print in the security. The market centers to which National Financial Services (NFS) routes Fidelity stop loss orders and stop limit orders may impose price limits such as price bands around the National Best Bid or Offer (NBBO) in order to prevent stop loss orders and stop limit orders from being triggered by potentially erroneous trades. These price limits may vary by market center. If you are interested in placing an order which triggers off of a bid quote or ask quote, please see Trailing Stop Orders and Contingent Orders. Options

Generally a stop order to buy becomes a market order when the bid price is at or above the stop price, or the option trades at or above the stop price. A stop order to sell becomes a market order when the ask price is at or below the stop price, or when the option trades at or below the stop price. The options stop election is based on the exchange’s best bid or offer (BBO) where the stop order resides.

You place a time limitation on a stock trade order by selecting one of the following time-in-force types:

A time-in-force limitation on the execution of an order. This limitation has a default order expiration time of 4:00 p.m. ET. You may select your own order expiration time between 10:00 a.m. ET and 4:00 p.m. ET in thirty minute increments (i.e. 10:00 a.m. 10:30 a.m. 11:00 a.m. etc). If all or part of your order is not executed by the time you’ve selected for expiration, your order will be canceled. You may view the status of your order, including order expiration date and/or time, on the Orders page.

Good ’til canceled

A time-in-force limitation that can be placed on a stock or ETF order. This limitation has a default order expiration date of 180 calendar days from the order entry date at 4:00 p.m. ET. You may select your own order expiration date and/or time, up to 180 calendar days from the order entry date. If all or part of your order is not executed by the date and/or time you’ve selected for expiration, any open portions of your order will be canceled. You may view the status of your order, including order expiration date and/or time on the Orders page.

Fill or kill

A time-in-force limitation that can be placed on the execution of an order. This limitation requires that the order is immediately completed in its entirety or canceled.

Orders with the fill or kill limitation:

- are for 100 shares or more

- are only placed during market hours

- are good only for the current day

- are not allowed for use with stop loss. stop limit. or sell short orders

Note: Fill or kill is only used under very special circumstances. If you do not fully understand how to use fill or kill, talk to a Fidelity representative before placing this limitation of an order.