Starting Your IRA With ETFs

Post on: 1 Июль, 2015 No Comment

By Abby Woodham

Exchange-traded funds are excellent tools for young investors, a group that has unique investment needs and circumstances. The under-30 crowd’s investable capital is relatively small, necessitating cost minimization at every opportunity. The investment goals for responsible young people are both short- and long-term: They must begin to save for retirement, even as major expenses like graduate school and home ownership lurk around the corner. Although investing within an individual retirement account may seem incompatible with these near-term needs, an IRA is in fact a logical and straightforward place for young investors to park an ETF portfolio .

IRAs allow investors to grow their assets tax-deferred or tax-free. There are two structures to choose from: a traditional IRA or a Roth IRA. Contributions to a traditional IRA may be tax-deductible and grow from year to year without accruing taxes. Investors covered by an employer-sponsored retirement plan lose the ability to deduct contributions from their taxes at certain income levels, but the real benefit to an IRA is the ability for investments to grow within the account without paying taxes on gains from year to year. Withdrawals from the IRA account during retirement are taxed at the investor’s ordinary income rate. Roth IRAs flip the tax schedule: Contributions are made after income tax has been paid, but withdrawals during retirement are not taxed and the account grows tax-free. An investor can contribute up to $5,500 to a Roth IRA every year, as long as his or her modified adjusted gross income does not exceed $125,000. Investors can buy and sell a variety of investments, including ETFs, within either type of IRA without realizing capital gains or paying tax on distributions.

Investing through an IRA allows investors to keep costs low, which is one of our important rules of thumb for the younger set. Our ETF model portfolios for young investors carefully pull together the cheapest, most diversified ETFs to preserve every last basis point of assets for compounding. When these portfolios are held in a non-IRA brokerage account, they are subject to an additional form of cost: taxation. Every year during an annual rebalance. or even when buying and selling assets during the year, a brokerage account will incur taxes on any realized gains in a portfolio. Distributions received throughout the year, such as dividends or coupons from a bond ETF, are also taxed. In an IRA, investors can buy and sell assets and receive (and reinvest) distributions tax-free. Both a traditional and a Roth IRA will help reduce tax costs and keep more assets in a portfolio to compound over time.

IRA restrictions on withdrawals are also somewhat flexible, which allows investors to withdraw cash for short-term goals, and are significantly less stringent than a 401(k)’s. If young investors put investable assets into a 401(k), they can’t retrieve their cash without paying taxes and a 10% penalty. Loans from a 401(k) may be an option, but they have pros and cons. It’s smart to utilize a 401(k) if an employer matches a percentage of contributions (it’s free money for retirement), but locking up assets until retirement won’t help a young investor when it’s time to buy a house. We also note that most 401(k) options have limited ETF availability or none at all. IRAs, on the other hand, offer a variety of exemptions that allow investors to access their assets to pay for expensive life events without incurring taxes or a penalty. The IRS waives the 10% early withdrawal penalty if the money is used to pay for higher education from an accredited institution for you, your spouse, and your children or grandchildren. Tuition, books, supplies, and fees all qualify. Certain home-related costs are also exempt: If you have not owned a house for two years, you can withdraw up to $10,000 to pay for buying, building, or renovating your house. Some other expenses are also eligible, including unreimbursed medical costs that exceed 7.5% of your adjusted gross income.

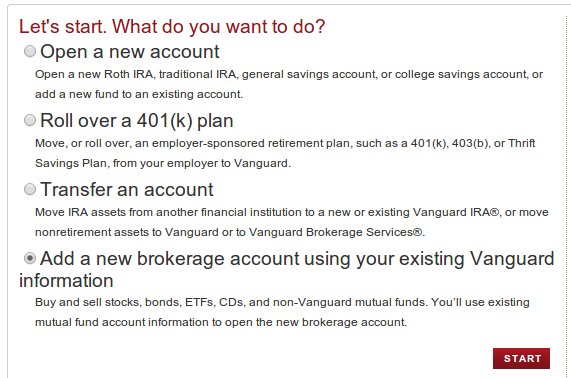

There are many platform options for IRA accounts. Most online brokerage account providers, including Vanguard, Schwab (NYSE:SCHW ), and TD Ameritrade (NYSE:AMTD ), offer IRA accounts. Any ETFs that trade commission-free in their brokerage account offerings will also trade commission-free in an IRA. The model portfolios we created for accounts at Vanguard, Schwab, and TD Ameritrade all can be executed in an IRA. Our recent guide to commission-free ETF platforms is another great resource, detailing the offerings at other firms like Merrill Lynch, Fidelity, and E*Trade.

As young investors grow their portfolios in size through continued contributions and investment returns, their assets eventually will outgrow just the IRA and necessitate the use of other accounts. When splitting asset allocation across accounts, investors should consider taxation. An IRA account is a good location for income-generating assets, such as bond and dividend ETFs. Young investors will have a relatively tiny allocation to bonds, but that amount will grow over time as they approach retirement. Dividend ETFs, which take up a 10% allocation in our ETF model portfolios, also make sense in an IRA, as tax-free compounding of reinvested dividends is a powerful force. Some assets should be kept out of an IRA altogether. but these are generally specialized investments like futures-based commodity ETFs that do not appear in our model portfolios.

Disclosure. Morningstar, Inc. licenses its indexes to institutions for a variety of reasons, including the creation of investment products and the benchmarking of existing products. When licensing indexes for the creation or benchmarking of investment products, Morningstar receives fees that are mainly based on fund assets under management. As of Sept. 30, 2012, AlphaPro Management, BlackRock Asset Management, First Asset, First Trust, Invesco, Merrill Lynch, Northern Trust, Nuveen, and Van Eck license one or more Morningstar indexes for this purpose. These investment products are not sponsored, issued, marketed, or sold by Morningstar. Morningstar does not make any representation regarding the advisability of investing in any investment product based on or benchmarked against a Morningstar index.