Reasons Rates Could Stay Low What This Means for Portfolios

Post on: 30 Сентябрь, 2015 No Comment

Asset Class ETFs News:

If you are in or near retirement, you know it’s been hard earning income on your investments in recent years. Unfortunately, I don’t see it getting much easier in the next few years.

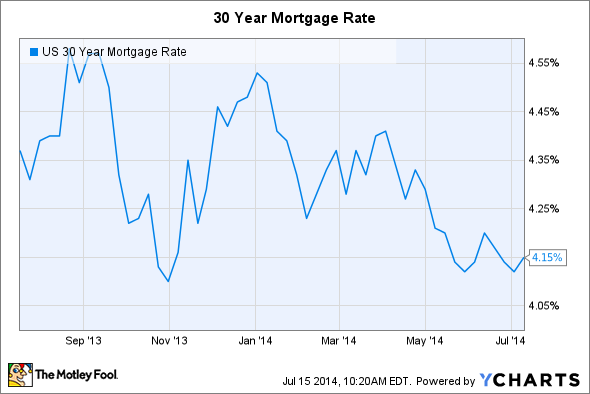

I expect the 10-year Treasury yield to finish the year between 2.5% and 2.75% and to trend higher to 3% over the intermediate term. However, while I do expect long-term rates in the United States to climb modestly in the near future, interest rates are likely to remain historically low for an extended period of time.

In my latest Market Perspectives paper, Under Pressure: Why Interest Rates Could Stay Low for a Long Time . I examine three reasons that play into this conundrum.

Slow growth and no inflation. Long-term rates tend to correlate with nominal growth (inflation plus real growth) which has been below trend since 2000. I believe that the deceleration in nominal growth has mostly been driven by secular factors, including slower growth in the labor force due to changing demographics and slowing productivity. And these factors are likely to remain in place in the coming years. To the extent that both real growth and inflation in the United States remain suppressed, both nominal growth and interest rates are likely to remain below the post-World War II norm.

Changing demographics. Changes in demographics have an impact on rates beyond slower growth. Older individuals tend to borrow less and exhibit a preference for fixed income. This helps both lower the supply and increase the demand for bonds, in the process, placing more downward pressure on rates.

Supply and demand. Other forces constraining the supply of bonds as well as increasing demand are also helping to keep yields low and bond prices high. U.S. consumer borrowing remains well below its pre-crisis pace and, despite low real and nominal yields, and institutional investors are displaying a strong appetite for bonds.

To be sure, there are other factors behind why rates are likely to remain low for long. For instance, in a recent post, my colleague Rick Rieder writes about how technological change is one reason why Federal Reserve (Fed) rate hikes are likely to lead to lower rates than in previous rate normalization cycles.

As for what this rate backdrop means for investors, a sustained environment of low yields has significant repercussions, particularly at a time when, as the baby boom retires, more and more investors are looking for income. At the very least, it suggests that investors will still need to consider sourcing income from alternative sources. This includes accepting more risk and looking at more esoteric parts of the bond market—emerging market debt, for example—as well as other asset classes, from equities to alternatives.

Like most trends, this one will eventually end, although the sluggish nature of the recovery and deflationary forces suggest it may last into the end of the decade. In the meantime, there are benefits to this environment to keep in mind too, including support for equity multiples as well as the potential for higher corporate profit margins.

Source: BlackRock research

Russ Koesterich, CFA, is the Chief Investment Strategist for BlackRock and iShares Chief Global Investment Strategist. He is a regular contributor to The Blog and you can find more of his posts here .