Present and Future Value Calculating the Time Value of Money Video Lesson Transcript

Post on: 3 Октябрь, 2015 No Comment

Instructor: Jon Nash

Jon has taught Economics and Finance and has an MBA in Finance

Because money can be invested at a given interest rate, it has a time value. Economists recognize that a dollar received today is worth more than a dollar received tomorrow. In this lesson, you’ll learn the basics of finance that serve as the foundation for understanding how bonds respond to market interest rates.

Time Value of Money

One day in the town of Ceelo, Barbara is on her way back home after a very long day of managing a small clothing store. Business is good, as evidenced by the new designer shades she bought recently. After dinner that night, she turns on the television and accidentally falls asleep. Inside Barbara’s dream, an important announcement is taking place on TV. Within a few seconds, they announce the winner of the $50 million lottery. When she looks at her hand, she sees a lottery ticket, and after reviewing the numbers on it, Barbara finds that she has won the lottery! How cool is that! When she calls the phone number on the television screen, a nice young lady by the name of Jane answers the phone and asks her a very important question: Would you rather receive a check for $50 million today or receive payments over the next 20 years totaling $60 million?

All of a sudden, Barbara wakes up from her dream and realizes that she was only dreaming, but she does remember the key question that Jane asked her and begins to ponder it carefully. If Barbara chose payments over the next 20 years, she’d get $3 million each year for 20 years in a row, totaling $60 million, which definitely sounds like more than $50 million, doesn’t it?

Assuming that she could invest $50 million today and earn a 5% interest rate on her money and assuming that there are no taxes, what should Barbara do? As she ponders this important question, she remembers an old saying that she learned as she was growing up — ‘A bird in the hand is worth two in the bush.’

Calculating the Time Value of Money

We’ll come back to this later, but I want to direct your attention to another situation taking place right now, as we speak, in the town of Ceelo.

Margie the cake baker earns a nice income. Although she spends most of the money she earns, she saves some of it in a savings account at the bank. Suppose her savings account pays 5% interest per year. The question she wants to answer is this: how much would she have to invest today if she wants her account to be worth $100 a year from now? To answer this, Margie needs to know more about the time value of money.

If Margie deposited $1 today, a savings account paying 5% interest per year would be worth $1.05 a year from now. The original $1 is what we call the principal that Margie deposited, and $0.05 is the interest that the bank pays her as a reward for holding the money there. Because the bank is willing to pay Margie interest for holding her savings at their financial institution, money has a time value. In other words, it is worth more today than it is tomorrow.

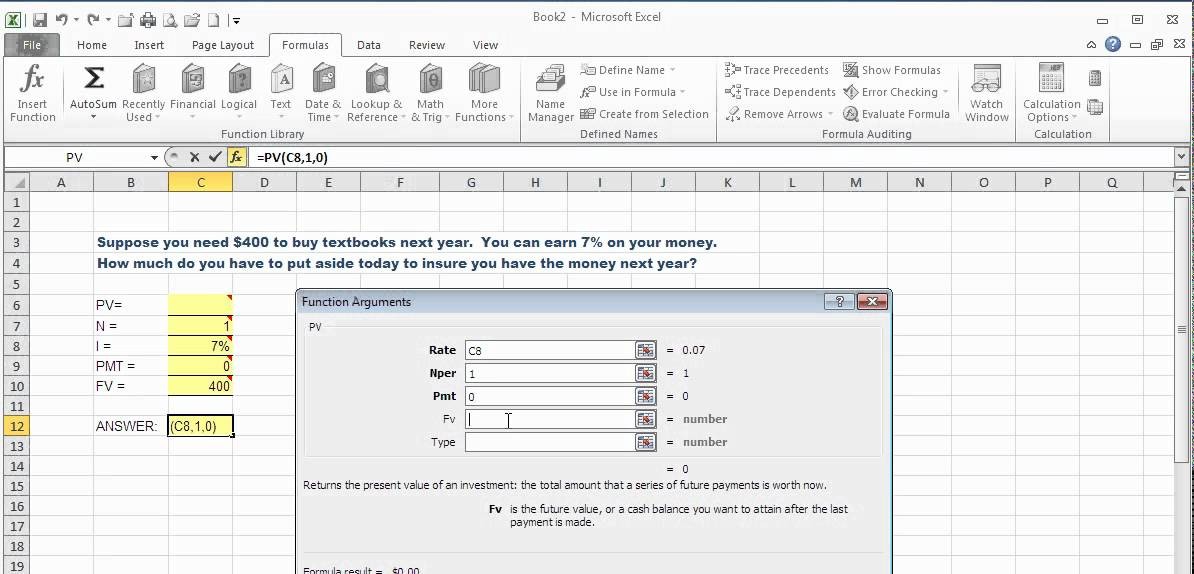

Present Value of Money

Using the formula to find the present value of money

Whenever you hear a situation that involves the choice between a payment later or a payment today, just think of the saying ‘A bird in the hand is worth two in the bush.’ I know some of you may say that this finance stuff is for the birds, and if so, I can show you that it’s real, as we take a little trip through Bird-In-Hand, Pennsylvania, which is the name of a real town, by the way.

Here’s what the time value of money means. Economists recognize that a dollar today is not the same as a dollar in the future. Why not? Because I can take a dollar today and earn a return on it, it takes more than a dollar in the future to equal a dollar today.

For example, if I can invest $1 and earn $0.05 on it over the next year, then that means that my $1 today is worth $1.05 a year from now. It also means that a dollar bill given to me one year from now would be worth less than a dollar today — specifically, about $0.95 — because I could invest this amount and earn interest so that the money I invested plus the interest equals $1 a year from today.

If Margie wants her savings account to be worth $100 a year from now, then she needs to know what this future amount is worth today, which is what economists call the present value.

Present value is the amount of money today that is equivalent to a single payment or a stream of payments earned in the future, invested at a certain interest rate. The formula for present value takes a future payment, or payments, and discounts them using the interest rate to find the worth of this money today. The higher the interest rate is, the lower the present value is today. The lower the interest rate is, the higher the present value is today.

The present value of $100 one year later is going to be worth less than $100 today. Why? Because of the 5% interest. To make things easy, Margie uses the formula for present value:

Present Value = FV / (1 + i )^n. where i is the interest rate and n is the number of time periods.

Let’s use the formula to figure out the present value of a future $100 value, assuming a 5% interest rate and a 1-year time span. FV stands for ‘future value.’ The future value that Margie wants to grow her account to is $100. i stands for interest rate, which is 5% in this case, and n is the number of periods. Margie has a 1-year time horizon, so, in this case, n = 1. Here’s what the calculation looks like that answers Margie’s question:

$100 / (1 + .05)^1 = $95.24

So, Margie would have to invest $95.24 today when the interest rate is 5% in order to grow it to $100 exactly one year from today.

Suppose the interest rate were 3% and the time horizon was 5 years instead. What would the present value of $100 be in 5 years? This is what we’d get:

$100 / (1 + .03)^5 = $86.26

Now suppose Margie wants to know how much she’d need to invest today in order to have it grow into $1 million in 20 years, if she assumes that she’ll earn a 7% interest rate per year. Here’s what this looks like, accounting for the time value of money:

$1,000,000 / (1 + .07)^20

Don’t even think of trying this in your head. You’d need a calculator, and you can split it up into two calculations. First, enter 1.07^20, which equals 3.86968446. Now divide your future value of $1,000,000 by this discount factor, and you’ll get $258,419. What does this mean? If Margie invests $258,419 today into an account earning 7% per year, then this money grows each and every year at 7% until, after 20 years of waiting, she’ll have $1 million.

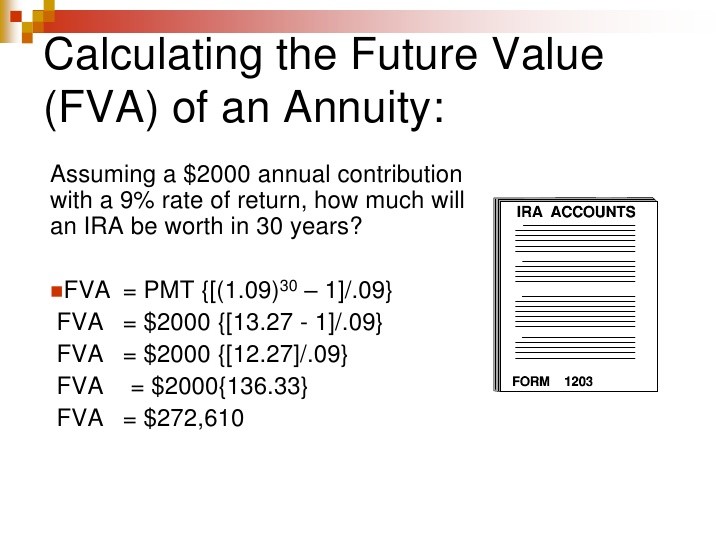

Future Value of Money

The formula for finding the future value of money

The time value of money depends on two things — the time interval between now and when you receive it, and the interest rate that money can be invested at in order to earn a return.

For example, $100 paid to you in 1 year is worth more than $100 paid to you in 5 years. The longer the time interval, the less that future money is worth to you today and the greater the return you’d expect to earn if you invested money today.

Likewise, $1 invested today at a 10% interest rate will pay you more than $1 invested at 5%. The higher the interest rate you earn on your money, the greater the time value of money. Working backwards, $1 paid to you in one year that can earn a 10% return would be worth less than $1 paid to you in 1 year at a 5% interest rate.

Now, let’s look at this concept from the opposite point of view. $100 invested today at 5% for exactly 1 year will be worth how much? To answer this, let’s use the future value.

Future value is the future worth of an amount of money invested today, paying a certain interest rate. If Margie invests $100 today in an account earning 5% per year, then 5% of $100 is $5, and in exactly 1 year, her $100 turns into $105. How do we figure that out? By using the formula for future value:

Future Value = PV * (1 + i )^n

PV stands for present value, which is $100 in this case. i is the interest rate, which we said was 5%, and n is the number of periods — in this case we’re talking about years, specifically 1 year — so n = 1. When you plug all this into the future value formula, the future value of Margie’s $100 invested at 5% is equal to $100 * (1 + .05)^1 = $105.

Calculating the Price of a Bond

The formula for present value has a very important application. One of the basic types of investments is called bonds. If you understand the concept of the time value of money, then the idea of a bond is not much of a stretch.

A bond is a promise to pay an amount back in the future that is borrowed today. Very simply, it’s a debt, or a loan. They call it a bond, which is a type of security, because it can be bought or sold in the free market, but it’s really just a loan. When the U.S. government borrows money to fund the operations of the government, it issues bonds and promises to make payments over time to pay back the money it borrows. This is a government bond that can be bought and sold in the free market, and to buy and sell something, you have to have a price. That’s where the time value of money comes in.

Since bonds pay an ongoing stream of fixed interest payments and market interest rates for new bonds go up and down regularly, the price of an existing bond goes up and down whenever the market interest rates change.