Obama defends Federal Reserve s $600 billion bid to boost economic recovery

Post on: 6 Август, 2015 No Comment

By Neil Irwin

Washington Post Staff Writer

The Fed’s moves last week have provoked sharp criticism from Germany and other major exporting nations, exposed fault lines within the central bank itself and even drawn Sarah Palin, former vice presidential nominee turned media sensation, to expound on monetary policy.

Speaking at a news conference in New Delhi with Indian Prime Minister Manmohan Singh, Obama stressed that the Fed acts independently from his administration but left little doubt that he has Chairman Ben S. Bernanke’s back.

The Fed’s mandate, my mandate, is to grow our economy. And that’s not just good for the United States, that’s good for the world as a whole, Obama said Monday. The worst thing that could happen to the world economy. is if we end up being stuck with no growth or very limited growth. And I think that’s the Fed’s concern, and that’s my concern as well.

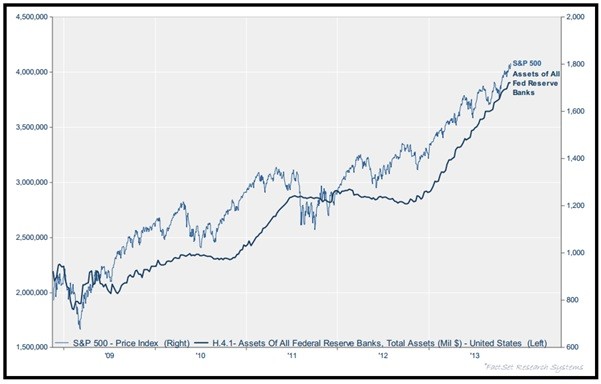

The Fed said last Wednesday that it will buy $600 billion in Treasury bonds over the next eight months in a bid to boost the sluggish recovery by expanding the money supply. The action, known as quantitative easing, is intended to lower long-term interest rates for mortgages and other loans, boost the stock market, and increase inflation to be nearer to the 2 percent level the Fed unofficially targets.

But while the policy may be a done deal, the decision is set to hang over talks between leaders of 20 major nations beginning this week in South Korea. Nations such as China, Germany and Brazil are criticizing the Fed’s action in harsh terms, suggesting it amounts to currency manipulation because it will result in a lower value for the dollar.

It’s not right when the Americans accuse China of manipulating exchange rates and then push the dollar exchange rate lower by opening up the flood gates by turning on the printing presses, the German finance minister, Wolfgang Schaeuble, told Der Spiegel magazine, according to wire reports. Late last week, he called the policy move clueless.

Responding to some of those charges, Bernanke said over the weekend that the moves were the logical policy for an economy with unemployment near 10 percent and inflation near 1 percent, well below the Fed’s unofficial target.

Given the Fed’s dual mandate from Congress, of maintaining maximum employment and price stability, Bernanke said the central bank saw the need to do something.

Back on U.S. shores, it became clear that there are divergent views among Fed policymakers.

The remedy for what ails the economy is, in my view, in the hands of the fiscal and regulatory authorities, not the Fed, said Richard Fisher, president of the Federal Reserve Bank of Dallas, in a speech in San Antonio. At last week’s meeting, I could not state with conviction that purchasing another several hundred billion dollars of Treasuries. would lead to job creation and final-demand-spurring behavior.

Kevin Warsh, a Fed governor who is a close ally of Bernanke but who has been more skeptical than the chairman of the new easing measures, stressed that while there are risks in the new Fed action, the central bank will move to contain them if problems emerge.

There are significant risks that bear careful monitoring, Warsh said in New York, citing the risks of inflation, a steep drop in the dollar and disrupting the functioning of the Treasury bond market.

Should these risks threaten to materialize, however one gauges the probabilities, Warsh said, I am confident that members of the [Fed policy committee] will have the tools and convictions to adjust policies appropriately.

And there are signs that more Republicans, particularly those aligned with the more-populist tea party, are casting a critical eye on the Fed’s latest actions. Rep. Mike Pence (R-Ind.), who has attacked the Fed’s decision, invited Kansas City Fed President Thomas Hoenig, who dissented from the action at the central bank’s policy meeting last week, to address the House Republican Conference.

And Palin, in prepared remarks reported by National Review Online, joined the chorus of conservative attacks on the Fed action.

We shouldn’t be playing around with inflation, Palin said, according to the report. We don’t want temporary, artificial economic growth bought at the expense of permanently higher inflation which will erode the value of our incomes and our savings.

irwinn@washpost.com