Muni ClosedEnd Funds Are (Still) Attractive Focus on Funds

Post on: 14 Октябрь, 2015 No Comment

By Brendan Conway

Daisy Maxey of the Wall Street Journal reviews a trend thats several months in the making: Financial advisers waking up to the steep discounts in municipal-bond closed-end funds.

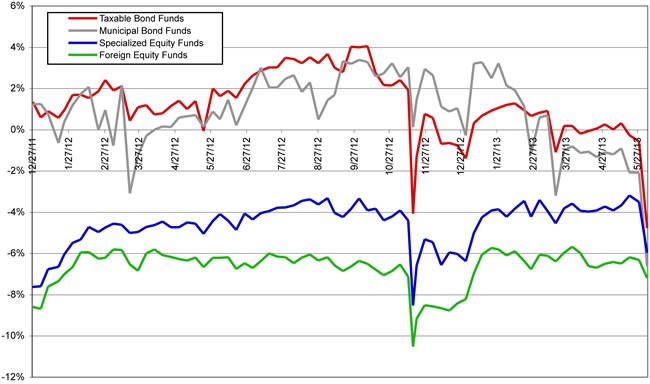

As the bond market recovers in 2014, many bond CEFs are left behind, exhibiting steep discounts to the value of their underlying portfolios. The reason: CEF investors still havent gotten over 2013s interest-rate scare. Thus, they remain eager to avoid the leverage used by these funds.

Advantage: You. If an advisers clients want munis, they might as well pay 6%-7% less via a CEF, which often use leverage in the range of 30%. As of this week, the 12 biggest muni-bond CEFs trade at discounts to net-asset value, according to CEFConnect.com .

The biggest, the $1.9 billion Nuveen Municipal Value (NUV ), trades 5% below NAV, while BlackRock Muni Target Term Trust (BTT ), Nuveen Municipal Opportunity (NIO ) and Nuveen NY AMT-Free Muni Income (NRK ) trade anywhere from 8.6% to 9.1% below NAV. The groups distributions range from 4.6% to 6.5%.

So, yes, those willing to live with the risk get to buy at a handsome discount.

From Maxey:

As of Tuesday, the average discount on municipal-bond closed-end funds was 6.81%, down from 9.91% on Dec. 13, according to Thomas J. Herzfeld Advisors Inc.. a Miami investment-advisory firm managing $186 million.

Although the funds still remain appealing considering their yields, fears of higher interest rates are damping demand, says Patrick Galley. chief investment officer at RiverNorth Capital Management LLC. a Chicago firm specializing in opportunistic investment strategies.

Despite those fears, he says, for those investors who have muni-bond exposure or other fixed-income-like exposure, this is a great time to invest in the muni-bond closed-end fund space.

Investors who own municipal bonds through an open-end mutual fund, for example, might want to consider selling and buying that same exposure at a discount through a closed-end fund, says Mr. Galley, who bought municipal-bond closed-end funds late last year and this year.

Discounts will narrow as interest rates stabilize or perhaps even as they rise, taking some air out of the fear in fixed income, he says.

Getting Income, and More, From a Fund Next

Exchange-Traded Notes: Not the New Black