LPL Financial s Kleintop Yes Bonds Can Lose Money

Post on: 22 Октябрь, 2015 No Comment

Jeffrey Kleintop, chief market strategist of LPL Financial, asserts that conditions are ripe for stocks to again reward investors in 2014, and he put together a list of the top 10 lessons from the past year to guide investors in the months ahead.

1. Bonds can lose money, Kleintop says in a late-year market commentary . He notes that bond prices fell in 2013 for the first time in 13 years.

2. Sentiment can matter more than fundamentals. Price-earnings ratios have risen as enthusiastic investors have bought stocks.

3. Time heals all wounds. Money has started flowing back into stock mutual funds after a five-year hiatus.

4. Defensive stocks can lead the market higher. That’s exactly what happened in the first four months of the year, although cyclical stocks did the best overall.

5. Annual returns are rarely average. The Standard & Poor’s 500 Index has returned 31.8 percent so far this year; Kleintop says the average is closer to 5 percent.

The second five lessons may have to be unlearned next year, Kleintop says, because 2013 was an atypical year in many ways.

6. Diversification is worthless. Indeed, the strategy didn’t help portfolios much this year, as a concentration in stocks paid off handsomely.

7. Risks are never realized. Many investor worries, such as government default recession, and a European financial meltdown, weren’t realized in 2013. Risks may not always be as well behaved, Kleintop says.

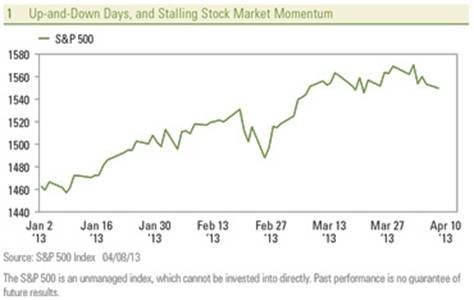

8. Stocks go up in a straight line. The market had only one sizable pullback (5-plus percent) this year.

9. Dividends do not matter. That was true for much of 2013, but in an income-hungry market, dividends are likely to be attractive to many investors in the years ahead, Kleintop says.

10. Policy is all that matters. Government policy was often king for the market this year. Next year, Kleintop predicts, the economy and markets will likely be more independent of policymakers as growth accelerates and high stakes fiscal battles are avoided.

Whatever lessons investors have learned in 2013, Wall Street’s performance in December indicates that they remain bullish on stocks. The beginning of withdrawal of monetary stimulus has added visibility for investors, who can now focus on a strengthening economic recovery, Jacques Porta, a fund manager at Ofi Gestion Privee in Paris, told Bloomberg . The U.S. economy is very strong, its a good surprise.

Related Articles:

- Short-Seller Jim Chanos Licks His Lips as Stocks Soar

- Roubini Doesn’t See Bubble in US Stocks, Bonds

2015 Newsmax Finance. All rights reserved.