Low Interest Rates Are Killing Money Market Funds

Post on: 1 Май, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

After the European Central Bank cut interest rates last week, both JP Morgan and Goldman Sachs announced they were closing some of their european money market funds. With the Fed looking increasingly likely to cut rates, money market investors should start looking at alternative ways to capture yield now.

Interest rates at some major U.S. money market mutual funds have averaged less than 0.10% for the past 3 years. At that rate, $1 million earns just $1,000 a year in interest. It’s hard to believe that savers may soon have to accept even less.

On Saturday’s Investment Masters Roundtable, Eugene Groysman and I discussed an intriguing alternative. Eugene runs a Marketocracy portfolio that currently has a dividend yield of 13%. Over the past year, many of the stocks in this portfolio have returned more than 13% because they have appreciated as interest rates have fallen. Could this portfolio be a good alternative to a money market fund?

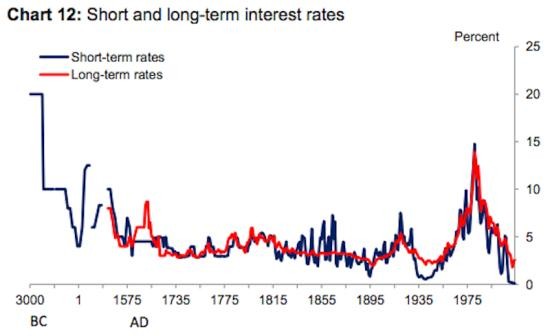

Ken: I’m not ashamed to admit that I am old enough to remember when money market mutual funds paid double digit interest rates.

Eugene: I wasn’t old enough to remember, but I was alive when that happened.

Ken: I’m shocked at what some of the largest money market funds are yielding these days. Schwab, Vanguard, and Fidelity are all paying between 0.01% and 0.04% a year. There are some places where you can still get 0.10%, but even that is nothing to write home about. At these rates, it doesn’t seem like it’s worth the effort to maintain records and file tax returns on a money market account any more.

Eugene: It’s a horrendous situation for people. With inflation at 2%, they are losing 1.99% of the value of their money each year, albeit safely.

Ken: Of course, safety is the main reason investors keep their money in these funds. With these money market funds, you won’t lose any money, but you can most definitely lose purchasing power.

Eugene: Exactly. The Federal Reserve has said that they are not going to raise interest rates for at least the next 2 years, in fact, they are likely to reduce rates further. If the yields fall any further, you will start to see some of money market funds closing simply because the rates are too low for them to stay in business.

Ken: Lets take a look at some of the stocks you’ve got in your high yield portfolio. Tell us what these companies do and how you selected them?

Eugene: All of these companies invest in mortgage backed securities that are one way or another guaranteed by an agency of the U.S. government.

Ken: This would be the same U.S. government that guarantees the Treasury bills and bonds in which money market funds invest?

Eugene: That’s right, the securities these companies buy are guaranteed by the U.S. government, just like the securities that money market funds buy. The difference is that these companies are buying longer term securities whereas money market funds are typically very short term.