Investing The impact of low interest rates

Post on: 30 Сентябрь, 2015 No Comment

The impact of low interest rates

Add this article to your reading list by clicking this button

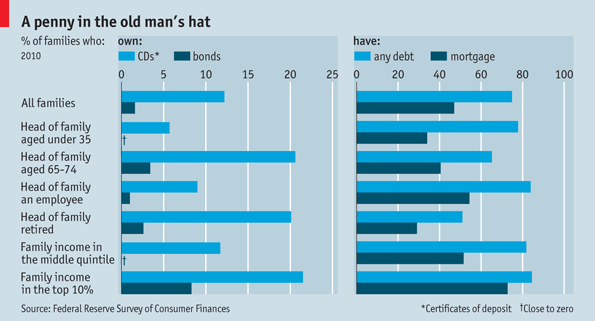

INTEREST rates are very low around the developed world; near-zero in nominal terms and negative in real terms. This is part of a deliberate policy by central banks to discourage saving and encourage borrowing. It has also been seen as a way of boosting the stockmarket and thus as creating a wealth effect for individuals, and boosting confidence.

How might low real rates boost the equity market? There are two theoretical explanations. The first relates to the fact that equities should be priced as the value of future cashflows, discounted to the current day by an interest rate.* Lower that discount rate and you raise the present value of shares. I have argued that this rationale is flawed; if rates are now because economic growth is slow (and it has been), then one needs to lower the estimate of future cashflows. The effects cancel each other out. The second reason is simple asset switching; low rates on bonds and cash make investors seek out the greater attractions of equities; this may well be the driving force behind 2013’s equity rally.

That’s enough of theory, how about practice? Back in October, I wrote a column showing that periods with the lowest real rates on T-bills had been very bad for equities. My analysis was only over one year periods and just for the US but the much smarter professors at London Business School (Elroy Dimson, Paul Marsh and Mike Staunton) have worked the numbers out for 20 countries over more than a century. In this year’s Credit Suisse Global Investment Returns Yearbook (of which more later in the week), they show the following results.

Starting real rates Real equity returns

over next 5 years

Lowest 5% -1.2%

Next 15% 3%

Next 15% 3.6%

Next 15% 3.9%

Next 15% 4.9%

Next 15% 7.3%

Next 15% 9.3%

Highest 5% 11.3%

As you can see, the slope is perfect. Low real rates are associated with low future returns on equities; high real rates are associated with high future returns. This counters one potential objection to the data I used; that low rates occurred at the worst moment of the crisis and that equities might be temporarily depressed. The optimists would say that low rates are central banks’ device for engineering a recovery; if so, that recovery does not show up in equity markets over as long a period as five years.

The professors’ analysis chimes with my recent posts (here and here ) on the likelihood of low future returns. They think that the historically achieved risk premium of equities over bills (4.1% at the global level) was artificially inflated by valuation effects and greater-than-expected real dividend growth. A risk premium of 3.2% a year going forward (over bills and cash) seems more reasonable. Since they expect the real return on cash to be negative, that means low real returns on equities as well.

* Actually, the risk-free rate plus a risk premium. Working out this premium is the tricky bit. But at times when real rates are low, the economic outlook is likely to be cloudier so the premium should go up, offsetting the fall in the risk-free rate.