Hussman Funds The Outlook Will Shift as Conditions Shift August 26 2013

Post on: 1 Май, 2015 No Comment

The Outlook Will Shift as Conditions Shift

John P. Hussman, Ph.D.

All rights reserved and actively enforced.

After a prolonged and strenuously overvalued, overbought, overbullish, rising-yield syndrome in stocks, followed by a more recent and still-unrepaired breakdown in market internals, I remain concerned about what might be called a broken speculative peak. I should note, however, that this doesn’t rule out further market highs recall that the initial deteriorations in market internals in 2000 and 2007 were both followed by subsequent recoveries to marginal new highs, creating extended market peaks over the course of several quarters before severe market losses followed.

Despite our grave concerns about market risk here, we also have to allow for the possibility that the recent bull market will carry further. Yet its critical to understand that allowing for that possibility has rarely been successfully achieved by ignoring overvalued, overbought, overbullish syndromes or deteriorating market action. Rather, the most useful opportunity to respond constructively is on an early improvement in market action, after overvalued, overbought, overbullish conditions have been cleared.

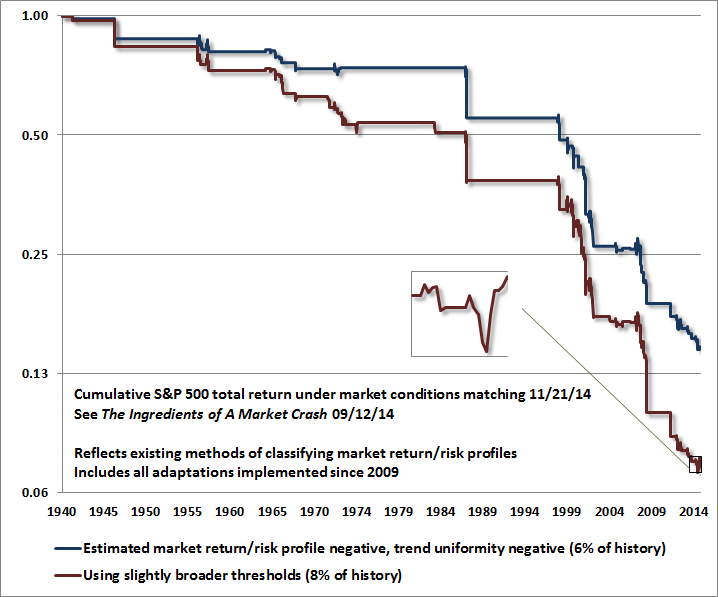

As I noted more than a year ago, this sort of constructive response to improved market action (absent overextended syndromes) has historically been beneficial even in periods where our broad return/risk estimates have been negative something that is not unique to this cycle, but can be validated in historical cycles as well. While we incorporated that refinement into our work in early 2012, the period since then has been a largely uncorrected extension of overvalued, overbought, overbullish conditions, fueled by temporarily self-fulfilling superstition about the efficacy of monetary policy in removing all risk. The advance since then has persisted despite conditions that have been violently negative historically. In my view, were probably only observing an example of delayed punishment.

Our investment outlook will shift as market conditions shift, and we will lean toward a more constructive stance when conditions support it. There are straightforward ways to do that while still remaining careful about larger cyclical risks. Present conditions simply dont provide historical evidence that investors can expect to be rewarded by accepting market risk here.

Market conditions will change, not least because the belief in some monetary put option itself is superstition (see Following the Fed to 50% Flops ), and not least because the Fed has announced in what should be no uncertain terms that it intends to taper this policy going forward. Moreover, despite the view that economic factors are the Fed’s sole consideration and that small disappointments will cause the Fed to flinch, the members of the Federal Reserve Open Market Committee have become increasingly aware of the diminishing effectiveness and growing distortions resulting from QE. This is evident in recent speeches even by dovish members. The FOMC has also noted that an ongoing evaluation of the efficacy, costs, and risks of asset purchases might well lead the Committee to taper or end its purchases before it judged that a substantial improvement in the outlook for the labor market had occurred.

Last weeks Federal Reserve monetary policy symposium at Jackson Hole certainly provided no support for the flinch expectation. Rather, the academic presentations emphasized the general futility of quantitative easing, while the presentations by policy-makers such as other central-bank heads focused largely on the mechanics of an exit:

The United States and most other advanced countries are closing on five years of all-out expansionary monetary policy that has failed in all cases to restore normal conditions of employment and output. These countries have been in liquidity traps where monetary policies that normally expand the economy by enlarging the monetary base are ineffectual. Reserves have become near-perfect substitutes for government debt, so open-market policies of funding purchases of debt with reserves have essentially no effect.

- Robert Hall, Stanford Economist & Chair of NBER Business Cycle Dating Committee, Federal Reserve Economic Policy Symposium (Jackson Hole)

The portfolio balance channel of QE works largely through narrow channels that affect the prices of purchased assets, with spillovers depending on particulars of the assets and economic conditions. It does not, as the Fed proposes, work through broad channels such as affecting the term premium on all long-term bonds. The Feds purchases of long-term US Treasury bonds significantly raised Treasury bond prices, but has had limited spillover effects for private sector bond yields, and thus limited economic benefits. Moreover, since the safety premium on Treasury bonds stem from the economic benefits they provide to investors, by reducing the supply of Treasury bonds, the economy is deprived of extremely safe and liquid assets and welfare is reduced.

- Arvind Krishnamurthy & Annette Vissing-Jorgenson, Northwestern University, Federal Reserve Economic Policy Symposium (Jackson Hole)

Note that even the benefit of significantly raised Treasury bond prices no longer exists, as 10-year Treasury yields and 30-year fixed mortgage yields are now higher than both their starting and average levels since QE2 was initiated in 2010. The interest cost of buying a home with a 30-year fixed mortgage has increased by 40% since last year. Moreover, while nobody evidently cares that the Fed is almost certainly insolvent on a mark-to-market basis here, to the extent that the Fed experiences net losses on its holdings, the overall impact on public finance is equivalent to the Treasury issuing debt at a higher interest cost than necessary.

In any event, we remain defensive here on the basis of a broad range of considerations, and our outlook will shift when the evidence shifts. Our investment horizon of interest remains the complete market cycle, even as our operational horizon of interest continues to be the present moment. In other words, we align our investment outlook with the return/risk profile that we estimate at each point in time, based on prevailing conditions, and we view our investment horizon from the perspective of a complete bull-bear market cycle.

One result of this discipline is that even though I expect that the present cycle will be completed by a market loss on the order of 40-55%, conditions can certainly emerge over the course of this cycle that could warrant a more constructive stance than we have presently, though possibly less extended than we’d like. The most likely constructive opportunity would emerge from a moderate retreat in market valuations, ideally to oversold conditions from an intermediate-term perspective, coupled with an early firming in measures of market internals. Though larger cyclical risks here will probably make some line of defense important in any event, our outlook certainly has room to be more constructive as conditions change. We would expect such opportunities regardless of whether bull or bear market outcomes unfold ahead.

The foregoing comments represent the general investment analysis and economic views of the Advisor, and are provided solely for the purpose of information, instruction and discourse. Only comments in the Fund Notes section relate specifically to the Hussman Funds and the investment positions of the Funds.

Fund Notes

Our estimates of return/risk in stocks continue to be unusually negative due to a recent deterioration in market internals (including but not limited to interest-sensitive sectors) following what we view as a strenuously overvalued, overbought, overbullish speculative episode. Strategic Growth remains fully hedged, with a staggered strike position where the index put option side of the hedge has strike prices slightly below present market levels. Strategic International remains fully hedged. Strategic Dividend Value remains hedged at about 50% of the value of its stock holdings. Strategic Total Return carries a duration of about 4 years (meaning that a 100 basis point move in interest rates would be expected to impact Fund value by about 4% on the basis of bond price fluctuations), with about 4% of assets in precious metals shares and about 4% of assets in utility shares.

In short, the Funds remain broadly defensive across all sectors. This will change, but the recent spike in our risk estimates across all asset classes suggests the potential for general illiquidity and price weakness. We are most inclined to increase exposure to Treasury securities on price weakness, as these are the closest portfolio substitutes for short-term Treasury bills yielding close to zero. We are most concerned about equities, where we estimate unusually thin risk premiums that in the context of deteriorating market internals appear likely to be pressed higher (which would be synonymous with lower prices).

Prospectuses for the Hussman Strategic Growth Fund, the Hussman Strategic Total Return Fund, the Hussman Strategic International Fund, and the Hussman Strategic Dividend Value Fund, as well as Fund reports and other information, are available by clicking The Funds menu button from any page of this website.

Estimates of prospective return and risk for equities, bonds, and other financial markets are forward-looking statements based the analysis and reasonable beliefs of Hussman Strategic Advisors. They are not a guarantee of future performance, and are not indicative of the prospective returns of any of the Hussman Funds. Actual returns may differ substantially from the estimates provided. Estimates of prospective long-term returns for the S&P 500 reflect our standard valuation methodology, focusing on the relationship between current market prices and earnings, dividends and other fundamentals, adjusted for variability over the economic cycle (see for example The Likely Range of Market Returns in the Coming Decade and Valuing the S&P 500 Using Forward Operating Earnings ).