How to Save a Million Dollars at Any Age 45 Years Old

Post on: 31 Май, 2015 No Comment

If youre 45 years old right now and working, perhaps youre starting to consider when and how youd like to retire. Kiplingers Personal Finance magazine has some suggestions if retiring with $1 million is art of that game plan. Keep in mind the role inflation plays; $1 million is a good goal, but twenty years from now, it might enough to fund an entire retirement unless you find a way to reduce your expenses. You have to start somewhere, however.

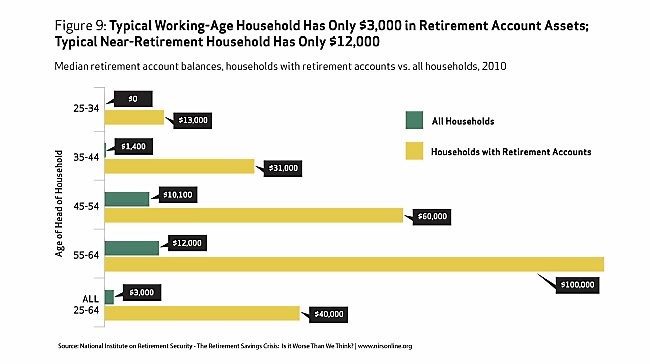

With no savings at 45. youll need to accumulate $1,698 in your portfolio every month to meet this goal. If you have $50,000 set aside for retirement, your monthly contribution will be only $1,298. With $100,000, a 45 year old can likely start retirement with $1 million by saving $861 per month.

Obviously, reaching this goal is more difficult the later you start. If anything, this series should be a wake-up call to those with half-a-century until retirement; unfortunately, thats not the target audience of this particular magazine.

Here are the strategies Kiplingers Personal Finance suggests for 35 year old, a category in which I will find myself in just a few short years:

* Contribute up to $15,500 in a 401(k). Thinking back to when I was 25, I was earning under $30,000 at a non-profit organization in New Jersey. Even if a 401(k) had been available, maximizing my contribution to the IRS limit was practically unthinkable. For a 45 year old in the middle of a career, this strategy may be more attainable. At the very least, if your company offers an employer matching contribution, take advantage of that.

A full contribution to a 401(k) requires almost $1,300 per month.

* Adjust your asset allocation to 80% stocks, 20% bonds. For my preferences, I think even at age 45 there should be less emphasis on bonds. With a large amount of time before retirement, and particularly before the end of retirement, it would be worthwhile to keep a riskier portfolio weighted heavier in stocks. Not only do your funds have to last until retirement, they have to last through retirement. While I stock market downturn towards the end of your career could derail your investments, I probably wouldnt do much to add bonds into a retirement portfolio until there are 10 years or less until retirement.

* Dont put your kids college costs ahead of retirement. Ive discovered that this is a mantra favored by most financial advisers. While you or your kids can take out loans to help fund their education, you cant take out loans to fund your retirement. Does more need to be said? Maybe. If the choice is between helping a relative fund an education they wouldnt be able to receive otherwise and my own personal retirement luxury, I may opt to assist with the education. This will always be a personal decision.

Every time Ive presented this Kiplinger series so far, with suggestions for 25 year olds and 35 year olds. commenters have pointed out the devastating effects inflation has on funds. Ive covered this many times. In fact, forget about the official core inflation data presented by the government. The price of the things youll need to spend money on as you grow older, such as health care for instance, are going to increase at a much higher rate than 3%. Forget about calculations that tell you the future value of $1,000,000 based on 3% inflation. But dont stop saving for retirement.

No, if your time horizon for retirement is decades in the future like mine, $1 million will most likely not be enough to support my necessary expenses. Aim higher if you can, but you have to start somewhere.

Updated January 16, 2010 and originally published February 6, 2008. If you enjoyed this article, subscribe to the RSS feed or receive daily emails. Follow @ConsumerismComm on Twitter and visit our Facebook page for more updates.