How to Choose a Bond Mutual Fund

Post on: 1 Июнь, 2015 No Comment

Please refer to our privacy policy for contact information.

Choosing a Bond Mutual Fund

For most individual investors, mutual funds are the best way to invest in bonds. Mututal funds provide the benefit of both professional management and a high level of diversification with a single investment – both of which would be very difficult for an individual to achieve on his or her own.

However, the decision to invest via bond mutual funds is just the beginning of the process. Investors must also determine the best fund, or funds, for their particular objectives and risk tolerance. This process can be fairly straightforward providing that you follow a few important steps.

Determine Your Investment Goals

The fixed-income investment you choose should be based on your particular situation. For example, are you looking to take on higher risk in exchange for higher income, or are you focused on preserving your capital. Perhaps you are simply looking for a way to diversify a portfolio that is heavily tilted toward stocks. Ultimately, the bond fund you choose should be determined not by short-term considerations or the latest headlines, but by your longer-term goals.

Assess Your Risk Tolerance

Once you have determined your goals, think about how much risk you are willing to take to achieve a higher return. A conservative investor would typically favor lower-risk investments that offer modest yields but only a small chance of significant principal loss. The lowest-risk bond funds are typically those that invest in short-term bonds. which tend to be more stable than their longer-term counterparts. Conversely, higher-risk bond funds — such as those that invest in high-yield or emerging market bonds — carry the potential for higher yield and greater capital appreciation, but also a larger risk of loss.

You can learn more about the risk spectrum of bond funds here .

Determine the Best Approach Given Your Tax Situation

There are two broad categories of bond funds, taxable and tax exempt. With the former, you will pay taxes at both the federal and state levels, providing your state has an income tax. With the latter, you can avoid federal taxes and, if you invest in a fund that invests only in bonds issued by entities within your state, you may be able to avoid state taxes as well.

While the tax-exempt bonds may sound like an excellent idea, they aren’t for everybody. If your tax rate is low, the higher yields that are typically available in taxable bond funds will typically allow you to come out ahead compared to an investment in a tax-free fund.

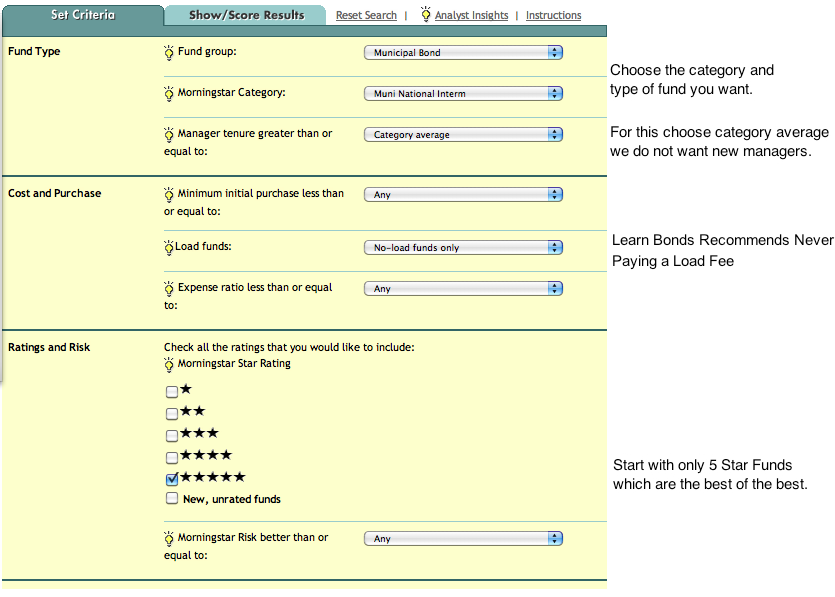

Choosing a Bond Fund

Once you have completed these three steps, it’s time to begin search for a fund. At this stage, there are a few key considerations:

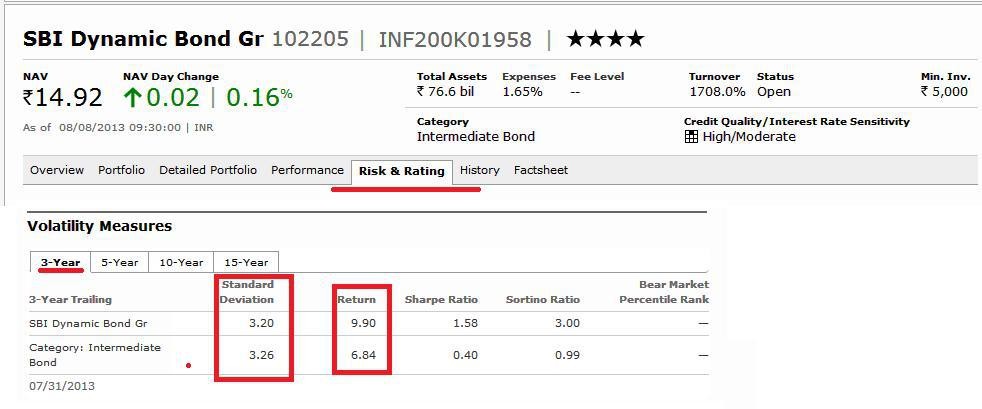

- Look at a fund’s past performance, but don’t make that the only consideration. Even if a fund has a good track record, it may not necessarily continue to perform well in the future. It’s far more important to pick a fund that meets your objective rather than simply picking funds from the top of the performance charts.

- Along the same line, avoid the temptation to select the fund with the highest yield. A higher yield generally means higher risk, and this may not be appropriate for your situation.

- Stay as diversified as possible. Choose bond funds that invest in different areas of the bond market (providing this fits with your goals and risk tolerance), or look for a single, highly-diversified fund. Picking three funds that invest in the same area of the market may seem like diversification, but it isn’t.

- Focus your efforts on funds with lower expense ratios. Over time, fees can take a big bite out of your returns – all else being equal, your odds of success are better if you don’t give up too much off the top in the form of fees. Also, emphasize no-load funds that don’t charge an up-front fee to invest.

And above else, make sure you do your research. Check with third-party fund evaluation services, such as Morningstar, to determine how risky a fund is and how it has performed against its peers over time. Morningstar can be found online, and the hard copy version is typically available at the reference desk of your local library.