Five ETFs To Own During The Great Deflation

Post on: 13 Сентябрь, 2015 No Comment

Last Friday, the U.S. Labor Department reported that the consumer price index (CPI) rose 0.2% in January and climbed by 2.6% over the past 12 months. But after stripping out volatile food and energy prices, prices actually fell by 0.1% in January, marking the first time since 1982 that core CPI has declined. While the absence of any signs that runaway inflation is materializing initially soothed markets, the report also signaled that another potentially tricky economic drag, deflation, is a very real concern.

Investors have been bracing for a major uptick in prices in the wake of unprecedented liquidity injections to stimulate a stalling economy, so to many the news of sagging prices was a relief to many, especially in light of recent actions from the central bank. The recent Fed increase in the rate charged on emergency loans to banks had seemingly paved the way for a hike in other short-term interest rates. But interest rate increases are usually spurred by rising inflation, so the tame CPI numbers increases the likelihood that rates will remain near record lows, at least for the time being. There is just no inflation pressure in the U.S. so our focus has to be on growth and jobs, said William Dudley. president of the Federal Reserve Bank of New York.

But analysts note that investors should be careful what they wish for, as extended periods of deflation can cause major problems as well. When prices are continually falling, consumers tend to delay major purchases in hopes of securing desired goods later at a lower cost. And because wages are generally more sticky than most CPI components, labor-intensive businesses can see their profit margins shrink as a decline in revenue is not met with a commensurate pullback in production costs.

Deflation has been a major drag on an economic recovery in Japan, and core CPI numbers due out this week are expected to be in the range of -1.4%. Some analysts expect prices in Japan to continue their freefall until the middle of 2012. At this point, theres no reason to believe that the U.S. will necessarily slide into a period of prolonged deflation (although some investors are quite concerned ), as Fridays CPI report may prove to be an outlier.

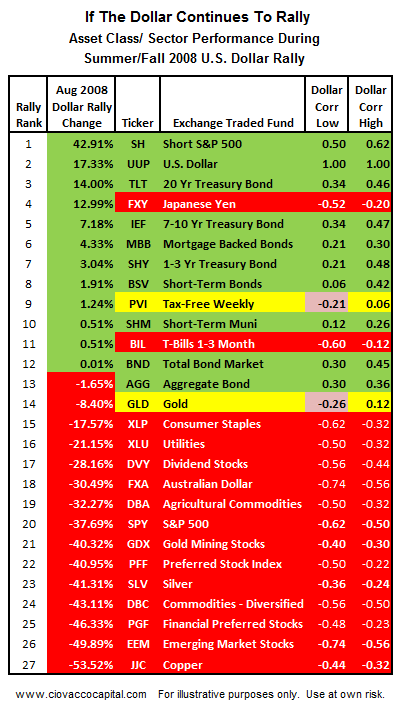

But the rarity of the event has made some investors nervous. After hunting out securities and asset classes that would perform well during periods of high inflation, theyre now scrambling to deflation-proof portfolios in case prices move in the opposite direction. Deflation is a complex phenomenon that can wreak havoc on Wall Street. But there are some ETFs that should perform relatively well if prices reverse direction and the U.S. finds itself following in Japans footsteps (see Beyond TIP: 10 ETFs To Protect Against Inflation ).

5. Barclays 20+ Year Treasury Bond Fund (TLT )

Since most bonds deliver fixed income to investors, this asset class tends to suffer during periods of high inflation as real interest rates slide. For the same reason, it is desirable to own bonds (especially long-term bonds) when deflation sets in, as the changes in prices actually enhances the real return. Moreover, deflation reduces the likelihood of rate hikes that would make prevailing yields less competitive with new issues. TLT has a weighted average maturity of more than 25 years and charges just 0.15% in expenses. This fund jumped about 0.5% on Friday following the data release.

4. Vanguard Long-Term Corporate Bond ETF (VCLT )

This ETF is to investment grade corporate debt what TLT is to Treasuries. With an average maturity of almost 25 years and average coupon of 6.7%, VCLTs current returns begin to look very attractive as prices slide. It should be noted, however, that corporate bonds may take a quality hit if deflation becomes a serious economic hindrance and threatens the ability of issuers to repay their obligations, potentially offsetting some of the benefits of owning this fund.

3. PowerShares DB Gold Short ETN (DGZ )

When CPI is on the rise, gold is one of the most popular inflation hedges available, as hard currency becomes more valuable than sovereign debt. So it makes sense that when prices are retreating, golds appeal may also decline. Again, theres a potentially mitigating factor here. Because gold also serves as a popular safe haven investment, a period of turmoilsuch as one brought on by prolonged deflationcould actually give the precious metal a boost. But in the early stages of a deflationary cycle, bullion prices should face some serious downward pressure.

DGZ is debt issued by Deutsche Bank that is designed to deliver a return inversely related to movements in gold futures prices.

2. WisdomTree Dreyfus Emerging Currency Fund (CEW )

Beccause so many factors affect relative demand for currencies, predicting exchange rates in deflationary environments is a challenging task. But the current situation doesnt bode well for the dollar, particularly as central banks around the world appear ready to begin hiking rates again.

CEW is designed to achieve returns reflective of both money market rates in selected emerging market countries available to foreign investors and changes to the value of these currencies relative to the U.S. dollar. Money market rates in some emerging markets are already around 7%, while the effective rate in the U.S. remains near zero. If the Fed gains the flexibility to delay another rate hike, these foreign returns look more and more attractive, while demand for the dollar will see a drop-off.

1. Barclays TIPS Bond Fund (TIP )

Fridays data release likely caused some inflation bugs who had been stockpiling TIP to dump part of their holdings. But before running for the exits, its important to understand how TIPS actually work. Most investors mistakenly believe that TIPS pay a floating interest rate tied to CPI. In reality, the interest rate is fixed, and the value of the principal changes twice a year with inflation.

Moreover, the principal on TIPS cant drop below its initial value. If you own TIPS with $100,000 of par value, the value of this investment wont drop below this level, regardless of how long or severe deflation is. Think of TIP as an option on inflation that provides protection on the upside, but no risk of loss on the downside, as opposed to a futures contract that has risk for both sides. Because the interest rate is fixed, the current return wont drop below this rate times the par value of the issue.

Again, one caveat here: its important to know how much the principal of the underlying TIPS have increased from their par value, as this represents the inflation premium that can be erased if prices slide.

Disclosure: No positions at time of writing.