European Sovereign Debt

Post on: 2 Сентябрь, 2015 No Comment

April 2011

Institutional investors may want to consider including European sovereign debt to capture higher yields.

David Blake

director of global fixed income, Northern Trust ASSET MANAGEMENT

Despite the negative headlines surrounding the economies of European Union (EU) countries in recent months, institutional investors may want to consider European sovereign debt as part of their portfolios. The very issues that cast European debt into the spotlight have also served to dramatically increase the spreads among EU bond issues.

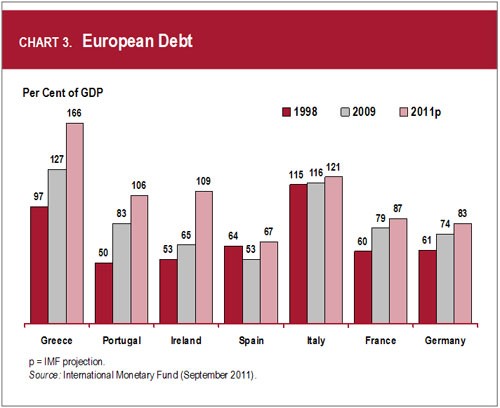

When Greeces credit seemed highly questionable last spring, the premium the country had to pay on its bonds compared to Germanys debt issues rose dramatically from 2% at the beginning of 2010 to nearly 10% in the midst of the crisis in May. Spreads on bonds issued by Portugal, Ireland and Spain also showed sizable increases, a scenario that was repeated in September, and again in November, when anxiety mounted once again regarding the financial stability of the European periphery.

To be sure, greater yields entail greater risk, as evidenced by the wave of rating downgrades affecting the periphery. Moreover, a comprehensive rescue package worth nearly $1 trillion that the European Commission and the International Monetary Fund co-sponsored has not completely steadied market nerves.

Continued utilization of the rescue package facilities or a restructuring of outstanding government debt remains a high probability event for peripheral Europe, where underlying economic growth and subsequent tax revenue may not support or sustain the maturity profile and absolute amount of current outstandings.

Nonetheless, sovereign debt with a made-in-Europe label can still provide a potentially attractive return. The question is at what price and under what strategy.

Tactical Approach

If not an integral portion of an asset allocation strategy today then investing in European sovereign debt at this point may be a very tactical approach, advises Wayne Bowers, chief executive officer, Northern Trust Asset Management, London. Although explicit evidence of such investment is difficult to assess at the moment, it would not surprise me, especially because some of the peripheral EU countries, such as Spain and Italy, have seen spread compression in recent weeks.

Bowers says the recent narrowing in spreads is a sign that overseas investors are still comfortable with taking on or increasing positions in the less creditworthy countries. Explicit public comments by Chinese Premier Wen Jiabao on buying and holding Greek government debt is a case in point.

For David Blake, director of global fixed income for Northern Trust, investing in EU sovereign debt is a prospect that needs to be framed in the context of investor risk appetite.

There are undoubtedly opportunities in the current spread environment, Blake explains. The dynamics within Eurozone debt markets have created the potential opportunity for well-informed managers to add value above and beyond more traditional rate considerations.

Blake adds that the spreads within the Eurozone are at historic wides and that such divergence is long overdue.

We welcome the return of risk pricing to sovereign debt markets, a component that was largely ignored circa 1999 to 2007, he says. As fundamental managers, we are firm believers in risk premia and would argue that the current situation is much more reflective of the relative strengths and weaknesses of individual sovereigns than was previously the case.

Yields Were Artificially Narrow

Blake is far from alone in welcoming a wider spread in interest rates within the EU. Many observers, including foreign exchange maven George Soros, have complained that EU bond yields were artificially narrowed following the introduction of the Euro as a common currency in 1999.

John Jay, senior analyst for the Boston-based consulting firm Aite Group, points out that sovereign debt has historically undergone a periodic reappraisal.

Everybody got into a real dither with the Euro periphery, so there is a mad rush to devalue the sovereign debt, and in that scenario, the bet on U.S. Treasuries is the safest, Jay says. This is not a new consideration. Every five to 10 years there is a revisiting of sovereign debt depending on the current crisis.

Still, Jay advises caution. Such diversification does not come for free, he notes. In the end, an investor has to look at the entire portfolio from a total return standpoint, weighing the proportional risks against the rewards.

Due Diligence Required

Bowers agrees, and says investors need to research sovereign- debt issuers just as they would if they were buying high-yield or investment-grade bonds, rather than relying on the rating agencies to grade a debt issuer.

Bowers points out that despite having triple-A ratings, the various countries could well be at different points in their economic cycle with regard to monetary and fiscal policy.

You do need to understand the political risk, the fiscal policy stance, the monetary policy and the economic growth fundamentals to gauge a debt issue, and its risk, return and default probability, Bowers says. All of this goes into the opinion of whether interest payments can be made on time and the bond matures at par.

Blake cites Ireland as an example of the need to delve deeper into EU debt issuers.

In September, Ireland canceled its remaining bond auctions for 2010, he points out. It was able to do so because it has pre-funded itself through mid-2011 with longer-term debt issues. Greece, on the other hand, never had the option to sit it out. Would-be investors must pay attention to such details.

Another important detail is the investor base, according to Blake. Spanish banks, he notes, are natural buyers of Spanish government bonds, but Ireland has no natural buyers of its debt and is thus more reliant on growth, subsequent tax receipts and eventually external support packages.

Diversification as Risk Management

For those investors who do seek to broaden their portfolios with higher income-producing assets, there are a number of measures they can take to manage their risk, such as diversification.