EMA and MACD Trading Strategy

Post on: 16 Март, 2015 No Comment

Entry Signals

The signals are classified into 5 sentiments for the indicators

i. Bullish

ii. Bearish

iii. Consolidation

iv. Bullish Consolidation

v. Bearish Consolidation

Which means that the moving averages and the MACD can give signals based on any of the 5 sentiments. Although, we have four Exponential moving average indicators but, I will classify them as two different indicators i.e, 5, 10 and 15 as one and then 65 as another indicator for our signals.

Now we have:

Indicator 1 EMA (5, 10, 15)

Indicator 2 EMA (65)

Indicator 3 MACD with Red and Dark Turquoise colors.

SIGNALS FOR EACH INDICATOR

Indicator 1: Whenever there is a crossover of the three EMA (5, 10, 15), then wait until they split distinctively according to the periods or colors as shown on the chart, then a BUY or SELL is confirmed depending on the direction at that point in time (Bullish or Bearish). If they are all together, that means consolidation.

Indicator 2: Check the angle of the 65 EMA

Upward angle: Bullish (BUY)

Downward angle: Bearish (SELL)

Flat: Consolidation (NO TRADE)

Indicator 3: MACD

Red line is the MACD signal line

Dark Turquoise bars are the MACD cloud

Zero level (0.00) separates BUY/SELL regions

If the Red line is above the zero level (0.00), that means BUY (Bullish) but if it is below the zero line it means SELL (Bearish).

If the Dark Turquoise bars are above/below the zero line, that means BUY (Bullish)/SELL (Bearish).

If the MACD signal line (Red line) is inside the MACD cloud (Dark Turquoise), above/below the zero (0.00) line, that means BUY(Bullish)/SELL(Bearish).

If the MACD signal line (Red line) comes out from the MACD cloud (Dark Turquoise) above/below the zero (0.00) line, that means Bullish consolidation/Bearish consolidation.

Now, let me bring everything together. You must make sure that you consider these five

sentiments before taking a trade:

i. Check the three EMA (5, 10, 15).

ii. Is the market trading above or below the white line (65 EMA)?

iii. Check the angle of the white line (65 EMA).

iv. Check if the MACD signal line (Red line) is above/below the zero(0) level

v. Check if the MACD signal line (Red line) inside the MACD cloud.

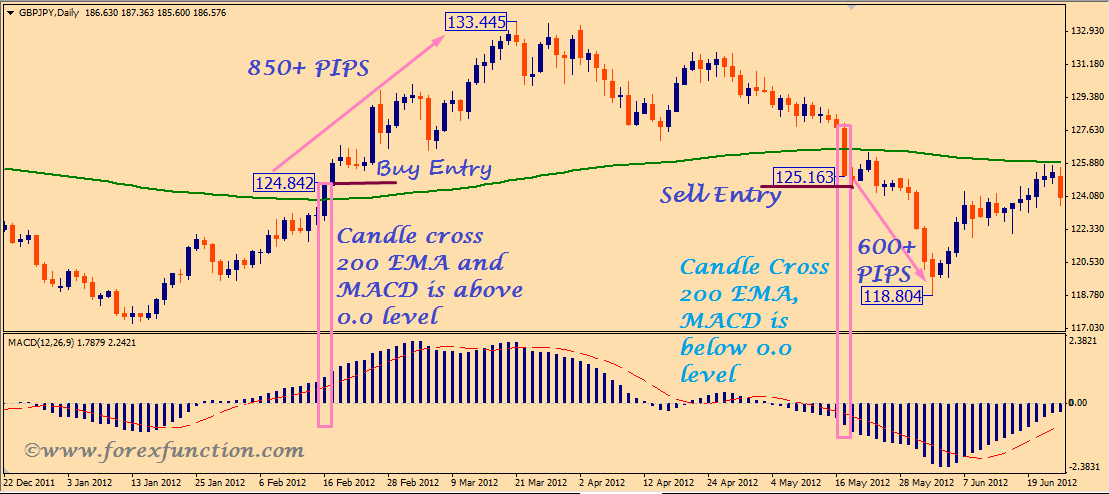

Let’s apply all the rules on the market and see:

As you can see on the chart above, the 3 EMA (5, 10, 15) separated (SELL) and the candles are below the white line (SELL). The white line (65 EMA) was angling down (SELL) and at the same time the MACD signal line (Red line) was below the zero level (0.00) (SELL) and entering the MACD cloud (Dark Turquoise) (SELL).

For every signal, make sure the five sentiments shows BUY/SELL before you take a trade .

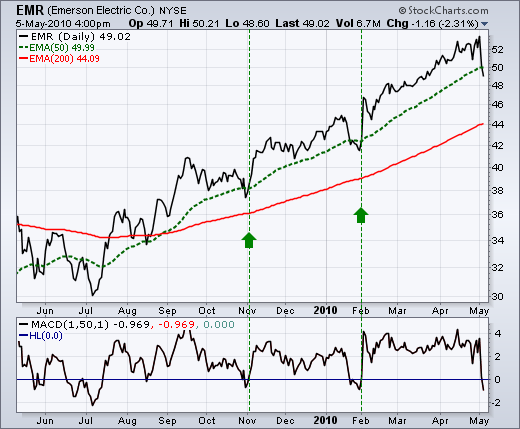

Exit Signals

You can pullout from a trade when the MACD signal line (Red line) comes out of the MACD cloud for short time traders or when the signal line crosses above/below the zero level (0.00) in an opposite direction of our trade for position traders. Look at the chart below:

Collection Source: Obaseki O. A.