Dividend Discount Valuation Model for Stocks Formula Example

Post on: 3 Май, 2015 No Comment

One of the problems that investors face in the stock market is figuring out the value of the stocks in which they are considering investing. Comparing a stocks value to its market price allows investors to determine if a share of stock is being traded at a price that is greater or less than its actual value. There are a variety of ways that investors attempt to value stocks, but one of the oldest and most basic is the dividend discount model.

The dividend discount valuation model uses future dividends to predict the value of a share of stock, and is based on the premise that investors purchase stocks for the sole purpose of receiving dividends. In theory, there is a sound basis for the model, but it relies on a lot of assumptions. Nevertheless, it is still often used as a means to value stocks.

Lets take a look at the theory behind the dividend discount model, how it works, and if and when you should use it to evaluate whether to purchase a stock.

Theory and Process Behind the Valuation Model

Rational investors invest in securities to make money. The concept behind this model is that investors will purchase a stock that will reward them with future cash payments. Future dividend payments are used to determine how much the stock is worth today.

In order to use the model, investors must accomplish a few things:

1. Approximate future dividend payments

This is not always an easy task, because companies do not offer the same dividend payouts each year. Dividends are the shares of earnings that corporations choose to redistribute to their shareholders. Corporations vary these payments, but as a rule of thumb investors usually assume that corporations redistribute a given percentage of their earnings to their shareholders. Of course, this raises the additional challenge of forecasting future income, which is usually accomplished by forecasting growth or decline in sales and expenses over future years. Then they can calculate the amount of money that is expected to be paid out in the form of dividends and divide that by the number of shares outstanding to determine the amount of dividends each investor is paid for every share they own.

2. Determine a discount rate for future payments

Determining the value of a share of stock isnt as simple as adding up all future dividend payments. Payments made in the near future are considerably more valuable than those made in later years due to the time value of money. Imagine that an investor plans to invest for a five year horizon. The payments he receives after the first year can be reinvested for four years, whereas the payments he receives after five years cannot be reinvested. Therefore, the payments he receives in one year are a lot more valuable. Investors need a method of discounting the value of these dividends. This is accomplished by determining a required rate of return for investors, which is usually assumed to be the amount of money they could earn investing in the stock market as a whole (usually approximated with the estimated return of the S&P index) or a combination of investing in stocks and bonds yielding the current rate of interest.

3. Apply the calculations for the model

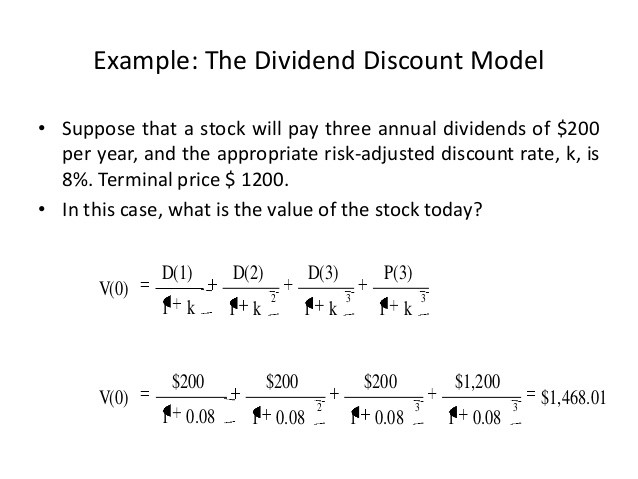

The equation for the dividend discount model is:

In this model, P represents the present day value of the stock, Div represents the dividends that are paid out to investors in a given year, and r is the required rate of return that investors expect given the risk of the investment.

In addition, the value of a company whose dividend is growing at a perpetual constant rate is shown by the following function, where g is the constant growth rate the companys dividends are expected to experience for the duration of the investment:

Using these two formulas in conjunction with one other, the dividend discount model provides for a straightforward technique to value a share of stock based on its expected future dividends.

Example of the Dividend Discount Valuation Model

ABC Corporation is paying dividends of $2 per share. Investors expect a rate of return of 8% on their investment. Dividends are expected to grow by 5% for one year and then 3% each year thereafter. Applying the discount model using the two formulas above, the value of the investment can be calculated in each period:

- Year 1. The value of the investment for this time frame is $2.00/1.08 = $1.85.

- Year 2. Dividends for this year have grown to $2.10 per share based on the 5% growth rate. The value of the investment for this period of time is expected to be worth $2.10/(1.08)^2 = $1.80

- Constant growth value. According to the constant growth equation listed above, the constant growth value of a share of stock is $2.10/(0.08-0.03)= $42.

Value of a share of ABC Corporation. The value of a share of stock is calculated by using the two formulas above to calculate the value of the dividends in each period: (2.00)/(1.08) + 2.10/(1.08)^2 + 2.10/(0.08 0.03) = $45.65 per share.

Compare to a value of a current share of stock. This is the most important part of the model. If a share of stock is trading at less than $45.65 per share, the stock is underpriced and they can profit by purchasing it. If the stock is trading at more than $45.65 per share, they may be able to profit by short selling the security .

Advantages

There are three major reasons why the dividend discount model is a popular valuation technique:

1. Simplicity of Calculations

Once investors know the variables of the model, calculating the value of a share of stock is very straightforward. It only takes a little bit of algebra to calculate the price of stock.

2. Sound and Logical Basis for the Model